Discover how to check, claim and request a student loan overpayment refund in 2025. Learn repayment options and your rights in the UK.

Getting a student loan to fund higher education is typical for most British students. Your employer begins to deduct repayments via the Pay As You Earn system once you graduate and start earning above the earnings threshold. It is also automatic, which is convenient. Yet, automation also indicates errors can occur. A Freedom of Information request in 2023 revealed that more than a million people had overpaid for their student loans. Put another way, thousands of borrowers were inadvertently paying back excess, even on debts they had not completed due to sickness, or incomplete studies, which would not help anyone’s financial position, especially if you are already battling the cost‑of‑living crisis.

This guide takes a look at overpayments on student loans, looking at explanations for why they happen and how you might be able to claim back your student loan overpayment refund.

What is a Student Loan Overpayment?

In simple terms, a student loan overpayment occurs when you pay back more than you should. The Student Loans Company (SLC) classifies overpayments in two main ways. First, you might get more money than you’re entitled to, for example, if you withdraw from your course or your personal circumstances change. In that case, you owe the extra money back. The second, and more common, scenario is when your employer deducts repayments when you shouldn’t be paying anything at all. That can happen if you earn below the annual threshold, if your employer uses the wrong plan type or if deductions continue after your loan has been cleared. Each of these situations results in overpayments that you have the right to reclaim.

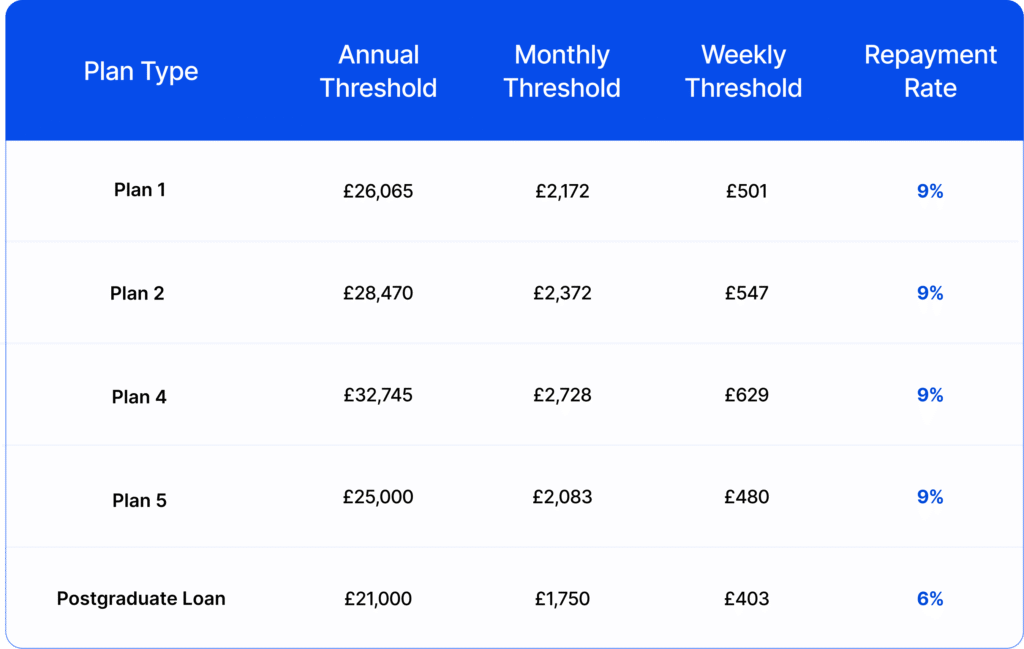

The income thresholds for repayment depend on the plan type

Important Notes:

- You repay 9% of income above the threshold for Plans 1, 2, 4, and 5

- You repay 6% of income above the threshold for Postgraduate Loans

- Repayments may be deducted if you exceed weekly or monthly thresholds due to overtime or bonuses, even if your annual income is below the yearly limit

- You can request a refund from HMRC at the end of the tax year if your annual income is below the yearly threshold

- Payroll system errors can result in unnecessary overpayments over time

Overpaid Student Loans UK: Common Reasons

Student loan overpayments can be caused by several factors. Understanding them helps you prevent mistakes and check whether you are due money back:

- You earn less than the repayment threshold. You only have to repay your loan if your annual income is above the threshold for your plan. If you receive a bonus or overtime that takes you above the monthly limit, your employer will start deducting repayments even if your total yearly income falls below the threshold. You can only request a refund after the end of the tax year.

- You are on the wrong repayment plan. Employers are told to assume Plan 1 by default unless told otherwise. If you have a Plan 2 or Plan 4 loan but your employer uses the wrong code, you could overpay. Equally, being put on Plan 1 instead of Plan 5 can mean deductions start too early.

- You repay even though your loan is fully cleared. In your final year of repayments, the SLC recommends switching to Direct Debit to avoid continued payroll deductions. If you don’t respond to their letter because you have moved house or missed the message, your employer may keep deducting money.

- You start repaying too early. Repayments aren’t due until the April after you finish or withdraw from your course. Some graduates are incorrectly enrolled into repayment during their studies because of errors on their P45 forms.

- You receive a grant or loan overpayment. Student Finance England sometimes reassesses your eligibility during term time. If your income goes up, you change course or withdraw, you may be paid more than you were entitled to and will have to repay the excess separately.

Those are the main reasons why student loan overpayments happen. Regularly checking your payslips and online loan account can help you spot problems early.

Recovering Student Loan Overpayments

If you suspect you’ve overpaid, don’t panic; you have options. The SLC and HMRC work together to identify overpayments. For cases where your loan has been cleared but deductions continue, HMRC instructs your employer to stop taking repayments. In addition, the SLC will try to contact you or issue automatic refunds if it spots an overpayment. Unfortunately, they don’t always have up‑to‑date contact details. It’s worth checking your online account to see whether money has been refunded automatically; it will appear as “SLC Receipts” on your bank statement.

If no refund appears and you believe you are owed money, you should request a refund. Before contacting the SLC, gather evidence such as payslips, P60 forms and your loan statement. StepChange, a UK debt charity, recommends checking your payment history carefully and having your payroll reference number to hand. The SLC will ask for these details to confirm your claim. Keep records of all communications to ensure there is a paper trail.

Student Loan Refunds Explained: How to Address an Overpayment

The process for obtaining a student loan refund varies depending on why you overpaid:

Income below the threshold – Sign into your online student loan repayment account and request a refund for the tax year in question. HMRC must first confirm your annual income, so refunds are usually processed after the end of the tax year. You can only claim for tax years that have ended.

Loan fully repaid – If you have finished paying off your loan but payments are still being taken, the SLC should contact you automatically. You can switch to Direct Debit in your final year to avoid overpaying. Otherwise, contact the SLC with evidence of your cleared balance.

Wrong repayment plan – Check your plan type in your online account and compare it with your employer’s payslip. If the plans don’t match, ask your employer to update the code and contact the SLC for a refund.

Started paying too early – Notify the SLC as soon as you notice deductions before your grace period ends. You’ll need your PAYE reference and past pay slips to prove you weren’t due to repay.

Grant or loan overpayment – Student Finance will write to you if you have been paid more than you’re entitled to. Repayment is separate from your standard loan deductions. You may have to repay as a lump sum or through instalments during your course.

In each case, acting quickly can prevent the debt from being passed to a collection agency. According to Debt Advisory Services, ignoring an overpayment notice can result in debt collectors, legal action and even wage garnishment.

Repayment Options

Once an overpayment is confirmed, you need to arrange repayment in a way that suits your financial situation. For borrowers who are still receiving student loan funding, Student Finance can deduct the overpayment from future instalments. Automatic deductions mean you don’t have to make separate payments, but they reduce your support. Alternatively, you can request a separate repayment plan to spread the cost.

If you’ve already left university, you may need to repay via a lump sum or monthly instalments. Debt Advisory Services notes that some people prefer to clear the debt quickly, while others negotiate an affordable instalment plan. Discuss your budget honestly with the SLC – there is no minimum income limit for overpayment repayments, so even low earners must contribute something. The SLC often offers flexible repayment schedules, so it’s worth negotiating.

When exploring repayment options, remember that the interest rate applied to student loans is currently 4.3 % for Plans 1, 4 and 5 and 7.3 % for Plan 2 while you are studying. Overpayments attract the same rate, and interest is refunded at that rate if you overpay. Switching to Direct Debit in your final year can reduce the risk of paying interest.

Consequences of Not Repaying

Ignoring a repayment of an overpayment of a student loan will cause you serious problems. Student Finance has a legal obligation to collect the money, even if you had no idea it was an overpayment in the first place. If you do not respond to requests for repayment, they might use a debt collection agency, with additional fees, who may contact you via phone on a persistent basis.

An unpaid debt can also be reported to credit reference agencies, lowering your credit score and making it more difficult to obtain a mortgage or any other type of credit. In extreme cases, legal processes can be issued which can lead to court orders or deductions directly from your wages. You can also lose tax repayments to unpaid over-payments, and the consequences of unpaid debts may also affect your eligibility for future student fees or professional licences.

Rights When Dealing with Debt Collectors

If your case is passed to a debt collection agency, it’s important to know your rights. Debt collectors can contact you via phone or mail and negotiate payment plans. They cannot harass you, use threats, misrepresent the amount owed or pretend to be legal professionals. Always ask for written confirmation of the debt and keep copies of all communications. If you believe the debt is incorrect or the collector’s behaviour is unfair, you can complain to the Financial Ombudsman Service.

Importance of Staying in Touch with Student Finance

Staying in contact with Student Finance is the simplest way to avoid overpayment issues. The SLC recommends keeping your personal details, including address and bank information, up to date in your online account. If they can’t reach you, automatic refunds might be delayed or impossible to process. By proactively updating your details and responding to SLC communications, you reduce the risk of missing important notices about repayments, eligibility or refund opportunities. Regularly logging into your online account allows you to check your current balance, verify the plan type and request refunds when necessary.

What if You Can’t Pay the Debt?

Financial difficulties can make repayment feel impossible. If you’re struggling, contact Student Finance as soon as possible. They may agree to a lower instalment, deferment or other arrangement based on your circumstances. For grant overpayments, you might be allowed to repay after your course ends. If you still can’t afford the repayments, independent debt advice services like StepChange or Citizens Advice can help you explore formal solutions such as Debt Management Plans, Individual Voluntary Arrangements or Debt Relief Orders. These measures can provide breathing space but have long‑term consequences, so always seek professional guidance.

What Should You Do if You Believe You Have Overpaid?

Here’s a quick checklist to follow if you suspect you’ve overpaid your student loan:

- Check your online account. Log in to your student loan account to see your current balance, repayment plan and any automatic refunds. Compare your payslips with the deductions shown.

- Gather documentation. Collect payslips, P60 forms and loan statements to evidence your repayments. Having detailed records will make it easier to prove your case.

- Contact the SLC. Use the online refund request if your income was below the threshold, or phone the SLC if repayments were taken too early, on the wrong plan or after your loan was cleared. Be ready with your customer reference number and payroll details.

- Keep records. Write down the date and time of each conversation, the name of the person you spoke to and any instructions they provide. Save copies of letters and emails.

- Act quickly. Don’t ignore communications. Prompt action minimises the risk of your case being passed to debt collectors.

Why Use CaseCraft.AI for Student Loan Overpayment Disputes?

If the SLC refuses your student loan refund, you might need to take further action. CaseCraft.AI is a UK platform that simplifies small claims up to £10,000. Their automated system generates court forms, organises evidence and guides you step‑by‑step through the process. The platform charges a fixed £15 set‑up fee and a 10% success fee if your claim succeeds. Because most overpayments are well under the £10,000 small claims limit, CaseCraft.AI can help you seek a fair resolution without hiring a solicitor, should you need to pursue the matter further.

By understanding why student loan overpayments happen and how to request a refund, you can ensure you only pay what you owe. Stay informed, keep track of your repayments and act quickly if you spot a problem. It’s your money, make sure you get it back.

FAQ: 2025 Guide to Student Loan Overpayments

Why do student loan overpayments happen?

Overpayments occur when your employer starts deductions even though your annual income is below the threshold, you’re on the wrong repayment plan, your loan is already paid off, or you begin paying before you’re due. Administrative errors and changes in your personal circumstances can also cause overpayments.

How do I know if I’ve overpaid?

Check your payslips and online loan statement. If you see payments deducted when your annual income is below the threshold or after your balance is cleared, you may have overpaid. The SLC may contact you, but you should still check your account regularly.

How long does a student loan refund take?

Once the SLC confirms your refund request, payments are usually processed within about 28 days. Requests for tax‑year refunds are processed after HMRC confirms your income.

Can I get a refund for voluntary overpayments?

No. Voluntary extra repayments are not refunded unless they become overpayments after your loan is fully repaid.