Discover key options when buying a house with a partner in the UK. Learn about joint ownership, rights, mortgages, and smart alternatives.

Buying a home together can feel like a rite of passage. You and your partner may have saved for years, sacrificed nights out and holidays and now feel ready to make what is often the biggest purchase of your lives. It is an exciting prospect, but it is also a legal and financial commitment. When things go well, nobody wants to think about worst‑case scenarios, yet research shows that many couples still don’t understand how UK property law works. Understanding the different ownership options, how deposits are protected and what happens if a relationship ends will help you feel more confident in your decision. Below, we explore your options, common pitfalls and the role of small‑claims technology like CaseCraft.AI, which can help resolve certain disputes when things do go wrong.

Options for Buying a House with a Partner

The way you hold a property jointly determines what happens if one of you dies or if the relationship ends. Under English property law, there are two main ways to own a home jointly: joint tenancy and tenancy in common. Some couples also consider holding the property in one name with an express trust or cohabitation agreement. The choice affects everything from inheritance rights to the ease of selling or refinancing the property, so you should agree on the structure before you exchange contracts.

What Does “Joint Tenancy” Mean?

Under a joint tenancy, you each own the whole property rather than a distinct share. This has several implications:

- You have equal rights and obligations. It doesn’t matter who contributed the deposit or pays more of the mortgage; you both own 100% of the house.

- If one of you dies, the property automatically passes to the surviving owner. This “right of survivorship” means you cannot leave your half to someone else in your will.

- All decisions about the home must be made together. You cannot mortgage or sell your share without your partner’s consent.

Joint tenancy works well where both partners are contributing equally or where you want the survivor to inherit the whole home automatically. However, it offers no way to reflect unequal deposits or protect parental gifts, and dissolving the joint tenancy later can be complicated.

What Does “Tenancy in Common” Mean?

Tenancy in common allows each of you to own a defined share of the property. Your shares do not have to be equal; you could agree on a 70/30 split to reflect different deposits or incomes. The key points are:

- Each co‑owner has a separate, identifiable share.

- Your share can be passed on in your will because there is no automatic right of survivorship.

- Although “in theory” you could mortgage your share, lenders often refuse because they can’t enforce a sale against just your portion.

Tenancy in common suits partners who contribute different amounts or want their estate to go to children or other relatives. To avoid later disputes, you should draw up a Deed of Trust (also called a declaration of trust) setting out each share and what happens if you sell or if one partner wants to leave.

Can Tenants in Common Take Out a Joint Mortgage?

Yes. Most lenders will allow up to four applicants on a single mortgage. While the mortgage may be joint, the ownership shares can still be different. Remember that each borrower remains jointly and severally liable: if one person stops paying, the lender can pursue any or all of you for the arrears.

Can One Person Pay a Joint Mortgage?

There is nothing to stop one partner paying the mortgage from their own income, for example, where one earns more or takes parental leave. From the lender’s perspective, the mortgage is a joint liability, so both of you must meet any shortfall. Unequal payments could alter the beneficial ownership, so consider recording contributions in a Deed of Trust.

Transfer of Ownership Into Joint Names

If you already own a home and later add your partner’s name, you are effectively transferring equity. The simplest way to do this is to gift part of the property to your partner, adding them to the title deed. No money changes hands, and there is usually no stamp duty. Alternatively, your partner can buy a share of the property by paying you part of its value, but they may pay stamp duty on that sum if it exceeds £125,000. A solicitor will need to handle the paperwork and register the change.

Transferring equity can trigger a new mortgage or changes to your current mortgage. Speak to your lender beforehand and ensure you both understand the tax implications.

Will My Partner Gain a Claim on My House if They Move In?

You might ask: “I own my house and my boyfriend is moving in – will he have a claim on the property?” The answer is that cohabitation does not automatically create property rights. In law, there is no such thing as a “common‑law marriage”, no matter how long you have lived together. Your partner will only have a claim if they can prove they contributed to the deposit, mortgage payments or major home improvements with an understanding that they would acquire a share. Without such evidence, the registered owner keeps 100% of the property.

This is why many cohabiting couples take legal advice before moving in. A cohabitation agreement or declaration of trust records contributions and how equity should be divided if you split. Litigation over property ownership can be expensive and stressful. For smaller disputes about deposits or damage worth under the small claims threshold (£10,000 in England and Wales, £5,000 in Scotland and Northern Ireland), the small claims court may be a more proportionate route. Digital platforms like CaseCraft.AI make these claims easier by helping you gather evidence, prepare court‑compliant documents and track deadlines. For example, you can upload receipts and correspondence to the secure platform, file the claim online and receive real‑time updates. CaseCraft.AI even checks eligibility and automates paperwork, reducing the risk of mistakes.

If You Own Half a House, What Are Your Rights in the UK?

If you are joint tenants (sometimes called beneficial joint tenants), you and your partner each own the whole property; you cannot sell or gift “your half”, and the house will go entirely to your partner when you die. If you are tenants in common, you own a specific share, can pass it on in your will and may sell your share, subject to any co‑ownership agreement. Your rights depend on the type of ownership recorded at the Land Registry; check the TR1 transfer form or your title register if you are unsure.

What Is a Deed of Trust?

A Deed of Trust (sometimes called a declaration of trust) is a legally binding document drafted by joint property owners. It records each person’s share of the beneficial interest and sets out how the property will be sold and how expenses and proceeds are divided. Such deeds are particularly useful for unmarried couples buying as tenants in common because they protect unequal deposits. According to a Zoopla study, 27% of separating homeowners felt that the proceeds of sale were divided unfairly, and only 15% had a deed of trust in place. A deed can also specify who pays the mortgage, how to resolve disputes and what happens if one partner wants to sell

Without a deed, you will rely on complex legal doctrines like resulting or constructive trusts, which can be costly to prove in court and sometimes cost tens of thousands of pounds. Drafting the deed during conveyancing or shortly afterwards is recommended. Be wary of DIY templates; a solicitor will ensure the deed reflects your intentions and register the appropriate restriction at the Land Registry.

Feeling Anxious About Buying a House With a Partner? Here’s What to Consider

Feeling anxious is natural. You may worry about affordability, legal pitfalls or whether the relationship will last. Rather than ignoring those feelings, try to understand what is causing them. Are you worried about taking on too much mortgage debt? Do you fear losing a parental gift? Or perhaps you don’t yet trust your partner’s spending habits? Talk openly with your partner and consider seeking impartial advice. The law can seem unforgiving to unmarried couples, but proactive planning can minimise risks. Using tools like CaseCraft.AI to document deposit contributions, emails, and agreements can also offer peace of mind. If a small dispute arises later, the platform can help file a claim quickly and accurately, using AI to automate documents and ensure compliance with small‑claims procedures.

What Are the Alternatives to Joint Ownership?

Buying together isn’t the only way onto the property ladder. If one reason you’re considering joint ownership is affordability, look at these alternatives:

- Lifetime ISA (LISA). If you are aged 18‑39, you can save up to £4,000 a year towards your first home, and the government adds a 25 % bonus. Shop around for competitive rates and be aware of withdrawal penalties.

- Shared ownership. This scheme lets you buy a share (usually 25–75%) of a property and pay rent on the rest. You can “staircase” your way up to full ownership over time.

- Guarantor mortgages. A parent or relative guarantees part of your loan, allowing you to borrow more. Some products require no deposit, but the guarantor’s property may be at risk.

- Family help. The “bank of Mum and Dad” remains an important source of deposit funds. Gifts should be documented to avoid future disputes.

- Status in 2025: 100% (no-deposit) mortgages have made a comeback, with lenders like Gable and April Mortgages offering them. However, interest rates are relatively high, around 5.95% to 5.99%.

Caution advised: These mortgages carry significant risks, such as negative equity if property values fall. Stricter eligibility criteria and affordability checks are now common.

How to Buy a House with a Partner: What Next?

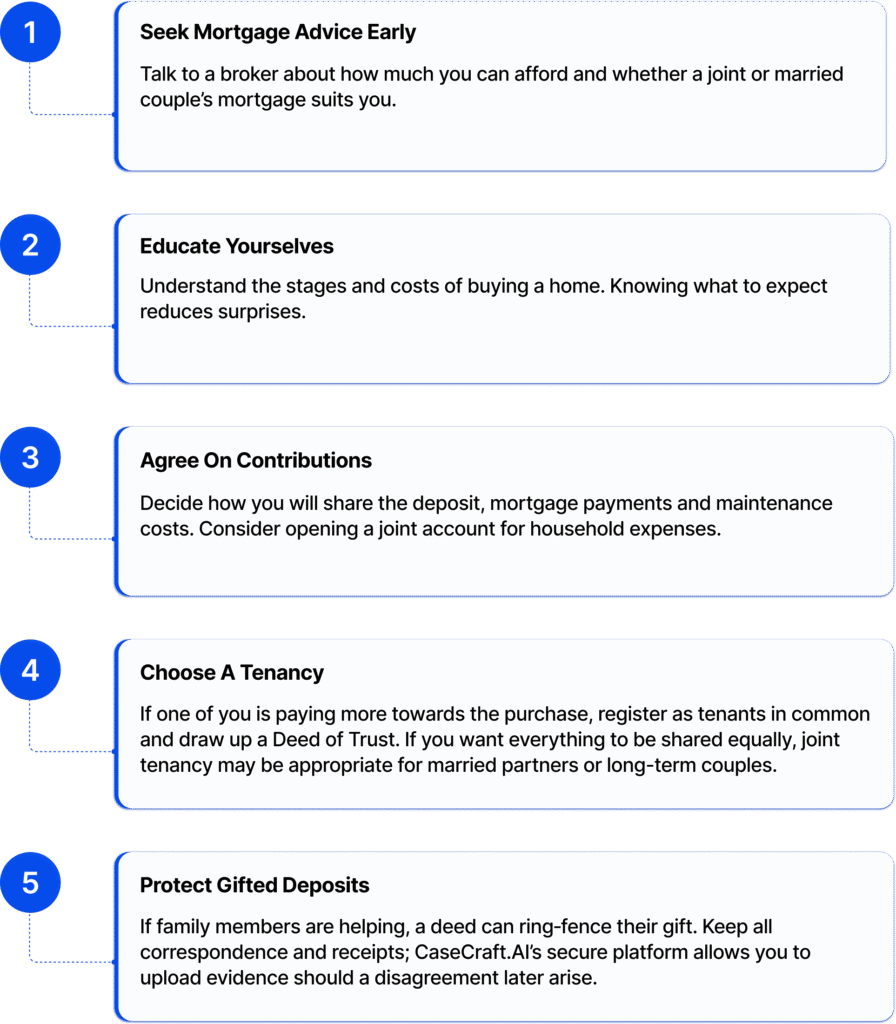

If, after exploring your options, you decide to proceed, there are several practical steps to take. Get mortgage advice and instruct a solicitor or conveyancer. Discuss with them whether you should hold the property as joint tenants or tenants in common and whether a Deed of Trust or a cohabitation agreement is appropriate. Consider writing or updating your wills to reflect your wishes. Record all contributions to the deposit and mortgage; this will help if there is ever a disagreement about equity.

Finally, familiarise yourself with the UK’s small‑claims process in case minor disputes arise, for example, disagreements over a £5,000 repair bill or an unpaid share of the mortgage. CaseCraft.AI’s platform provides an eligibility check and automates documents to make filing or defending such claims straightforward. With transparent pricing and a success‑based fee structure, it offers a cost‑effective alternative to instructing a lawyer when the sums at stake are relatively modest.

Buying a house with a partner is a significant step. Taking the time to understand the legal structures, agree on contributions and put written agreements in place can save heartache later. Use professional advice where needed and embrace digital tools that simplify paperwork and dispute resolution. With the right preparation and support, your new home can be a foundation for building your future together rather than a source of conflict.

FAQ: Buying a House with a Partner

What is the difference between joint tenancy and tenancy in common?

Joint tenants each own the whole property and inherit automatically. Tenants in common hold defined shares, can leave their portion in a will, and often use a Deed of Trust to record contributions.

Does my partner gain rights to my house if they move in?

No. Cohabitation alone does not create ownership rights. A partner gains an interest only if they can prove financial contributions made with an understanding they would acquire a share.

Do unmarried couples need a Deed of Trust when buying together?

It’s strongly advised. A Deed of Trust records unequal deposits, contributions and what happens if you sell or separate, reducing disputes and protecting each partner’s share.

What happens if we disagree about contributions or costs later?

Small disputes, often under £10,000, can be resolved through the small-claims court. Tools like CaseCraft.AI help gather evidence, draft documents and manage deadlines efficiently.