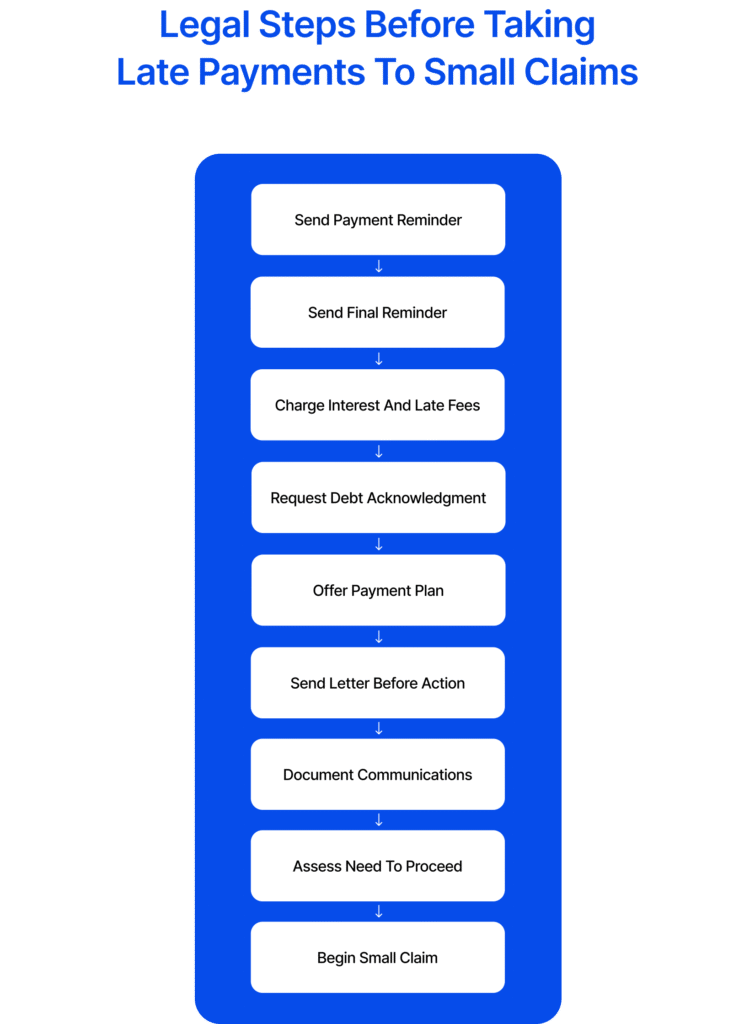

1. Unclear legal process – many people send informal demands but ignore the rules. Follow a nine-step protocol: review contracts, send polite reminders, calculate statutory interest correctly, document everything and serve a compliant letter before action. These steps demonstrate reasonable behaviour and strengthen your case.

2. Missing evidence and deadlines – failing to keep records or sending letters too late can doom your claim. Gather invoices, messages, bank statements and written acknowledgements; send a formal letter before action, giving the debtor 14–30 days, and keep a timeline of communication.

3. Complex court paperwork – preparing a claim yourself can be daunting. The CaseCraft.AI-driven platform generates legally compliant letters, organises evidence and calculates interest. When pre-action steps fail, it guides you through filing a small claim quickly and cost-effectively.

Introduction

Late payment is a chronic issue in the UK. In 2024 alone, over 1.73 million court claims were filed, and small firms lose billions each year due to unpaid invoices. Most disputes never reach trial because the pre‑action process, structured reminders, written demands and documented attempts to resolve, usually work. There is also mandatory mediation for money claims under £10,000 since May 2024. If you follow the right steps, you can recover what you are owed without expensive solicitors.

This guide explains how to chase late payments legally using a nine‑step procedure. It covers your legal rights, evidence gathering, polite reminders, calculating statutory interest, offering payment plans and serving a letter before action (LBA).

The article also highlights common mistakes, real examples and the role of CaseCraft.AI, an AI‑driven platform, in simplifying claims. Whether you are a freelancer, small business, landlord or friend who lent money, these practical steps will help you recover debts lawfully, and if all else fails, you will be prepared to file a claim through CaseCraft.AI.

Your Legal Rights When Someone Owes You Money

Understanding your legal rights for late payments is the first step before you decide how to chase late payments and what action is lawful.

Contractual Agreements, Consumer Rights and Unjust Enrichment

Your right to chase a late payment depends on the legal basis of the debt. Three typical sources are:

- Contractual agreements – When you have a written or oral contract, the debtor must pay under the agreed terms. Written agreements (invoices, purchase orders, loan agreements) are easiest to enforce, but verbal contracts are also binding if you can show offer, acceptance, consideration and intention to create legal relations. Evidence can include messages, emails and bank transfers.

- Consumer rights – For consumer debts (e.g., goods or services sold to individuals), the Consumer Rights Act 2015 requires that contract terms be fair. You cannot charge statutory late‑payment interest; any interest must be agreed in advance and be fair. Debtors can challenge unfair terms, so ensure your payment terms are clear and reasonable.

- Unjust enrichment – Even without a contract, the law may compel repayment under the doctrine of unjust enrichment. A claim succeeds if the defendant was enriched at your expense, the enrichment is unjust, and no defence applies. For example, if someone received duplicate payment or accepted money knowing it was a loan, you can seek restitution.

Commercial Obligations and the Late Payment of Commercial Debts Act

If your debtor is another business, the Late Payment of Commercial Debts (Interest) Act 1998 gives you extra rights. You can charge statutory interest at 8% above the Bank of England’s base rate and add fixed compensation for debt recovery (£40 for debts under £1,000, £70 for debts between £1,000 and £10,000 and £100 for larger debts). Statutory interest applies only if no other rate is agreed, and you cannot charge it on consumer debts. These rules encourage prompt payment and compensate you for lost cash flow.

Limitation Periods and Acknowledgements

Under the Limitation Act 1980, you usually have six years to sue for unpaid debts starting from the due date. The limitation period resets if the debtor makes a part payment or provides a written acknowledgement signed by them, which is why requesting an acknowledgement is important. If you miss the limitation period, your claim will be time‑barred.

Step 1: Review Payment Terms and Gather Evidence

Before chasing a debtor, ensure there is a legitimate debt. Check the payment terms in your contract or invoice and confirm the due date has passed. Then gather evidence that proves the debt exists. Useful documentation includes:

- Invoices or bills showing the amount and due date.

- Purchase orders or delivery notes.

- Messages or emails where the debtor agreed to pay, acknowledged the work or requested services.

- Bank statements or transfer confirmations demonstrating money lent or goods supplied.

- Screenshots of online agreements or chats.

For verbal agreements or loans to friends, gather proof that you lent money and expected repayment, such as bank transfers, text messages, social media messages, prior repayments or witness statements. Small claims courts accept such evidence. Organise all documents chronologically; they will be needed for your reminder letters and any future claim.

Step 2: Send a Professional Payment Reminder

The first step in chasing late payments is a polite payment reminder. Keep the tone neutral and assume the delay may be unintentional. A late payment reminder should include:

- Amount owed and invoice reference.

- Due date and number of days overdue.

- Summary of services or goods provided.

- A short deadline for payment (e.g., five working days).

- Contact details and a friendly invitation to discuss any issues.

Under UK guidance, gentle reminders can include resending the invoice, phoning the client and offering assistance; many invoices are paid after one or two reminders. Sending a polite reminder demonstrates reasonable behaviour under the pre‑action protocol and helps preserve the business relationship. If the debtor responds with a dispute, listen carefully and gather any further evidence required. Remember to maintain clear, written communication to show you acted fairly.

Step 3: Issue a Formal Final Reminder

If the debtor ignores your initial reminder, send a formal final reminder. This escalation signals that you are serious but still gives the debtor a chance to settle without legal consequences. The letter should:

- Clearly state the amount overdue and how long the payment has been outstanding.

- Provide a specific deadline, typically 7–14 days for commercial debts or 30 days when dealing with individuals, as required by the Pre‑Action Protocol.

- Mention that statutory interest and compensation will be added if payment is not received.

- Warn that failure to pay may result in a letter before action or court proceedings.

Do not threaten aggressive actions or short deadlines; these could be deemed unreasonable and could harm your case. Keep the letter factual and neutral. Record the date sent and method of delivery (email and post) for your evidence file.

Step 4: Charge Statutory Interest and Late Fees

When payment remains outstanding, you may have the right to charge interest on overdue payments and recover a late‑payment fee. How you calculate interest depends on whether the debt is commercial or consumer:

Business‑to‑Business (B2B) Debts

The Late Payment of Commercial Debts (Interest) Act 1998 allows you to charge statutory interest at 8% plus the Bank of England base rate and a fixed fee. For example, if the base rate is 4.75%, statutory interest becomes 12.75% per year. On a £1,000 debt overdue by 50 days, the annual interest is £127.50; dividing by 365 produces £0.35 per day, or £17.50 for 50 days. You can also claim £40–£100 in late‑payment compensation depending on the invoice value.

Consumer or Private Loans

For debts owed by individuals (non‑business), you cannot rely on the Late Payments Act. Instead, interest must be agreed in the contract and must be reasonable under the Consumer Rights Act 2015. If interest is not agreed, you may charge statutory interest under the County Courts Act 1984 when you file a small claim (currently 8% per year). However, you cannot charge interest during the pre‑action stage unless the contract allows it.

Statutory Interest and Compensation for B2B Debts

| Debt value | Fixed compensation | Interest rate (base rate 4.75%) | Example daily interest on £1,000 |

| Less than £1,000 | £40 | 12.75 % per year | £0.35/day (approx.) |

| £1,000–£9,999.99 | £70 | 12.75 % per year | £0.35/day (approx.) |

| £10,000 or more | £100 | 12.75 % per year | £3.49/day on £10,000 |

Note: The statutory interest rate for B2B debts is calculated as 8% plus the Bank of England base rate that was in force on either 30 June or 31 December immediately before the payment became overdue. The rate is fixed at that time and does not change even if the base rate changes later. As of November 2025, the current Bank of England base rate is 4%. For debts becoming overdue between 1 July and 31 December 2025, the applicable base rate would be the rate on 30 June 2025.

Charging interest shows you are serious and compensates you for being kept out of funds. It can also encourage debtors to pay promptly. If you charge statutory interest, issue a new invoice or add an interest schedule showing the calculation.

Step 5: Request a Debt Acknowledgement in Writing

An often overlooked but powerful tool is obtaining a written acknowledgement of the debt. When the debtor replies by email or letter confirming the amount owed or offering partial payment, it both admits liability and resets the six‑year limitation period. If possible, ask the debtor to sign a short statement acknowledging the debt and promising to pay by a certain date. Even a message such as “I know I owe you £500 and will pay in two weeks” is valuable evidence. Save these acknowledgements with dates and keep copies of any partial payments; they may be vital if the matter proceeds to court.

Step 6: Offer a Payment Plan (Optional)

If the debtor admits the debt but cannot pay immediately, consider agreeing on a payment plan. A structured plan can be better than litigation because it preserves relationships and avoids court fees. When proposing a plan:

Agree on clear instalments – Set an affordable monthly or weekly amount, with specific due dates and a final end date.

Put it in writing – Both parties should sign or confirm the terms by email. Clarify that failure to keep to the plan will trigger legal action.

Document all payments – Keep receipts or bank statements for each instalment. This evidence shows compliance or breach.

Include interest if justified – You may agree to charge interest on outstanding balances to compensate for delayed payment, provided it is reasonable and within the legal limits described above.

Payment plans demonstrate reasonableness and may be looked upon favourably by courts. If the debtor fails to keep to the plan, you have shown you tried to resolve the matter amicably.

Step 7: Send a Letter Before Action (LBA)

The letter before action is a formal legal demand and the final step before court. For individuals and sole traders, the Pre‑Action Protocol for Debt Claims (Ministry of Justice) sets out mandatory requirements: you must send a Letter of Claim explaining the debt, enclosing an information sheet, reply form and financial statement, and give the debtor 30 days to respond. For business‑to‑business disputes not involving individuals, a shorter final demand may suffice; however, best practice is to allow 7–14 days.

Your LBA should include:

- The debtor’s full name and address.

- The amount owed, including interest and compensation (if applicable), and a breakdown of how it was calculated.

- Copies of the contract or evidence supporting the debt.

- A clear deadline for payment (e.g., 30 days) and a warning that you will issue court proceedings if no response is received.

- Your contact details and a suggestion that the debtor seek debt advice.

Sending a compliant LBA is crucial. Courts may penalise you in costs if you skip this step or provide insufficient information. Use recorded delivery or email with read receipt, and keep a copy for your records. Many debtors settle after receiving an LBA because they understand you are prepared to litigate.

Step 8: Document All Communications

Throughout the process, document everything. Keep a timeline of all reminders, phone calls, emails, acknowledgements, and interest calculations. This documentation shows the court that you acted reasonably and complied with pre‑action rules. When preparing a claim or defending a dispute, you will need to show:

- Dates of invoices, reminders and final demand.

- Copies of any payment plans or acknowledgements.

- Notes of telephone conversations or meetings.

- Calculations of interest and compensation.

- Evidence of postage (proof of sending and delivery).

Organise the documents chronologically; this helps the judge follow your efforts and reduces delays. CaseCraft.AI’s platform can help you upload and organise documents in a secure dashboard, ready for court.

Step 9:When to Stop Chasing and Proceed to Small Claims

Sometimes, chasing debts informally fails. You should consider filing a small claim when:

- The debtor refuses to pay after receiving the letter before the action.

- The debtor disputes the debt or the amount owed without providing evidence.

- Communication stops, and deadlines expire.

- The debt is within the small‑claims limit (up to £10,000 for money claims) and is within the six‑year limitation period.

At this point, further reminders may be futile. Under the courts’ mandatory mediation scheme, claims under £10,000 must undergo a one‑hour mediation session before proceeding. If you still cannot reach a settlement, you can submit your claim online. Claims over £10,000 follow the fast track or multi‑track and may require a more complex procedure.

Common Mistakes When Chasing Late Payments

Avoid these pitfalls when chasing debts:

Using aggressive or threatening language – Harassing calls, or threats can constitute unlawful behaviour under the Administration of Justice Act 1970.

Not providing adequate deadlines – Giving only one or two days to pay or failing to give a clear final deadline can be unreasonable and may weaken your case.

Miscalculating interest – Claiming both contractual and statutory interest or using an incorrect base rate can be challenged.

Failing to keep evidence – Losing invoices, acknowledgements, or proof of sending letters leaves you with little to show in court.

Skipping the letter before action – Not serving an LBA may lead to cost penalties and delay your case.

Starting a claim too early – Issuing proceedings without giving the debtor time to respond to an LBA may be seen as disproportionate.

Example Scenarios

Consumer purchase, no delivery after payment. You bought a designer bag online and paid £450. The seller disappeared and ignored messages. You send a polite reminder and a final reminder. As it is a consumer debt, you cannot charge statutory interest; you may charge only what was agreed in your contract. After the letter before action giving 30 days, the seller still refuses to deliver. You file a small claim for the purchase price plus statutory interest under the County Courts Act from the date of filing.

Freelancer, unpaid invoice for services. A graphic designer invoices a company £2,500, payable in 30 days. When payment is 20 days overdue, she sends a gentle reminder. The company apologises but still fails to pay. After a formal final reminder with a 14‑day deadline, she adds statutory interest (at 12.75%) and £70 compensation under the Late Payments Act. She serves a letter before action with evidence of the contract. Payment is received five days before the deadline. The interest and compensation cover her lost time and cash flow.

Small business, overdue commercial invoice. A wholesaler supplies goods worth £10,000 to a retailer on 30‑day terms. After 60 days with no payment, the wholesaler sends a final reminder and then charges statutory interest at 12.75% plus £100 compensation. They offer a payment plan, but the retailer refuses. They send an LBA giving 14 days to pay. The retailer still refuses; the wholesaler files a small claim using CaseCraft. The platform organises evidence, calculates interest and generates court documents automatically. This efficient approach saves legal fees and time.

How CaseCraft.AI Helps if Payment is Still Not Made

Chasing late payments legally requires patience, documentation and adherence to protocols. By reviewing payment terms, gathering evidence, sending polite and formal reminders, calculating statutory interest, requesting written acknowledgements and serving a compliant letter before action, you demonstrate reasonable behaviour and maximise your chances of recovery. Avoid mistakes like threatening language, miscalculating interest or skipping the LBA; these errors can jeopardise your claim.

CaseCraft.AI is designed to simplify the claims process. Backed by a team of legal specialists and AI engineers, CaseCraft.AI provides lawful guidance, not legal advice, and reduces the time and cost of chasing debts.

Take action now: review your outstanding invoices, follow the nine‑step protocol and explore CaseCraft.AI to streamline your debt recovery. With the right tools and knowledge, you can enforce your rights, recover what you are owed and avoid costly court battles.

Note: This guide is provided for general information purposes only and should not be taken as legal advice. Every situation is different, and you may wish to seek independent legal guidance if you’re unsure about your rights or obligations.

FAQ: Chasing Late Payments Legally

How many reminders should I send before legal action?

Send at least two reminders: a polite payment reminder and a formal final reminder with a clear deadline. For consumer or individual debts, send a formal letter before action, giving 30 days to respond, as required by the Pre‑Action Protocol. More reminders may be appropriate for long‑standing clients, but avoid endless chasing; escalation shows you are serious.

Can I charge interest for late payment?

Yes, but the rules differ. For business‑to‑business debts, you can charge statutory interest at 8% above the base rate and a fixed compensation fee. For consumer debts, you can only charge interest if your contract allows it and it is fair under the Consumer Rights Act 2015. If you file a claim, statutory interest of 8% under the County Courts Act applies from the date of the claim.

What if the debtor disputes the amount owed?

Ask for evidence supporting their dispute and check your own records. You may need to adjust the invoice if you made an error. If the dispute persists, document the disagreement, offer to mediate and still follow the pre‑action protocol. The court will look at the correspondence to decide whether you acted reasonably. If the debtor provides a partial payment or acknowledgement, it resets the limitation period.

How long should I wait before sending a letter before action?

After the due date passes, send a polite reminder. If there is no payment within about 14 days, send a final reminder giving 7–14 days (for businesses) or 30 days (for individuals). If payment is still outstanding after the final deadline, issue the letter before taking action immediately. Do not delay beyond the six‑year limitation period.

Do I need a solicitor to demand payment or file a small claim?

No. You can send reminders, calculate interest and file small claims yourself. However, solicitors can advise on complex disputes or larger claims. Platforms such as CaseCraft provide step‑by‑step guidance and automatically generate the documents you need without the cost of traditional legal services.

What evidence do I need if the case goes to small claims?

Gather contracts, invoices, bank transfers, emails, messages and any written acknowledgements. Keep a timeline of reminders and responses, copies of the letter before action and proof of delivery. For verbal agreements, collect supporting evidence such as bank statements and witness statements. Presenting organised evidence greatly increases your chances of success.