Learn how to claim compensation for property damage in the UK. Steps, evidence, court fees, insurance, and the small claims process are explained.

Property damage claims arise when someone else causes loss or harm to your possessions. In the UK, owners, tenants and even companies can be held liable if their negligence or deliberate acts damage another owner’s property. Typical scenarios include accidental damage in the home or workplace, neighbours causing leaks or structural damage, contractors breaking equipment, landlords failing to maintain a property, or companies causing harm through faulty products or poor services. Small claims courts deal with simple cases where the amount claimed is relatively low – up to £10,000 for most claims in England and Wales. This makes the small‑claims process an accessible route for recovering repair costs and other losses when insurance or negotiations fail.

CaseCraft.ai’s focus on small claims reflects this landscape. The platform uses artificial intelligence tools to help individuals and small businesses prepare and manage claims under £10,000. It can create pre‑action correspondence, draft claim forms and generate witness statements, meaning users get a ready‑made case without specialist legal training. For property damage, the system guides you through describing the incident, uploading evidence and estimating losses because it is built specifically for small claims. CaseCraft.ai keeps you within the monetary limits and procedural rules that apply to this track in the county court.

Collecting Evidence of Damage

Strong evidence underpins any successful property damage claim. Gather proof quickly before conditions change. Photographs and videos showing the damage from several angles help demonstrate the extent of the harm. Keep any physical objects that were damaged or defective, and label them to preserve the chain of evidence. Obtain expert reports – for example, a builder’s assessment of a cracked wall or a plumber’s report on a leaking pipe – and gather written estimates or invoices for repairs or replacements. If another party admitted fault, make a note of what they said or obtain a written statement. Witness statements can also be valuable; ask neighbours or colleagues who saw the incident to write down what they observed.

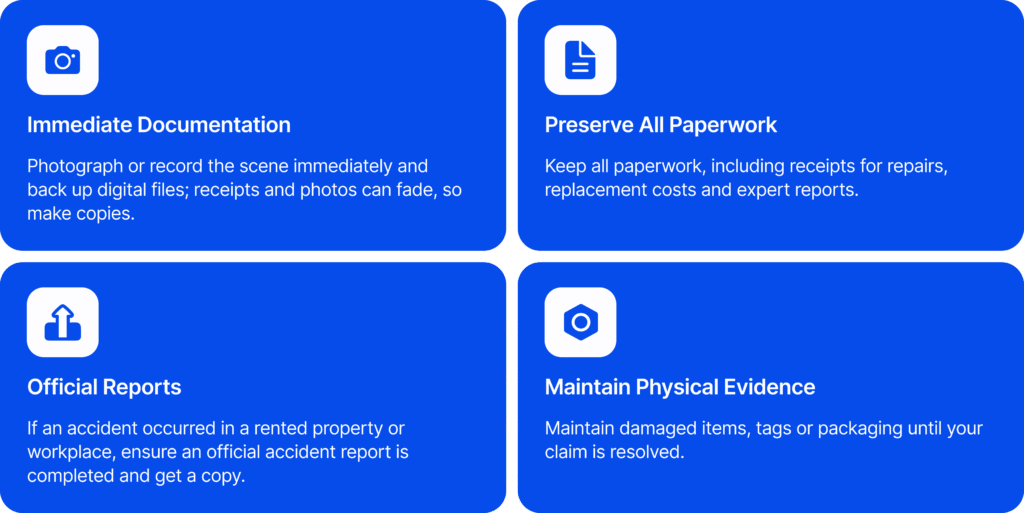

Evidence gathering tips:

Preserving evidence is not just prudent; courts expect parties to disclose relevant documents. Failing to do so can jeopardise your case. Advicenow notes that you may have a duty to preserve evidence. CaseCraft.ai allows users to upload photographs, videos and documents so that all evidence is stored securely and attached to the claim.

Contact the Responsible Party First

Before turning to court, UK law expects you to give the other side a chance to resolve the dispute. This is known as pre‑action conduct. A letter before claim (or letter of claim) sets out your case clearly and invites the responsible party to resolve it. Citizens Advice recommends including your name and address, a summary of what happened, what you want the other party to do, how much you are claiming and how you calculated that amount, a deadline for reply (usually 14 days), and a warning that you will start court processes if they do not respond. You should also refer to the Practice Direction on Pre‑Action Conduct so that the defendant understands the consequences of ignoring the letter. Keep a copy of the letter and send it by recorded delivery as proof of postage.

CaseCraft.ai automates this step. After you input the details of the incident, the platform generates a compliant letter before claim addressed to the responsible party. You can review and edit the letter before it is sent, but using the template ensures you include all necessary information and deadlines. Many disputes settle at this stage; if the other party accepts liability, they may agree to pay for repairs or replacement without further action. If they deny responsibility or ignore your letter, you will be able to demonstrate to the court that you attempted to resolve the matter first.

Making a Formal Complaint

If informal contact does not lead to a resolution, you might need to make a formal complaint. The procedure depends on who is at fault:

- Neighbour or individual – Write a detailed complaint letter outlining what happened, the damage caused and the amount you seek. Attach photos and repair estimates. State what you expect the neighbour to do (e.g., pay for repairs) and give a deadline for response. Neighbour disputes often benefit from mediation; the Civil Mediation Council or local authorities can help you find a mediator.

- Landlord or letting agent – Landlords have statutory duties to keep properties in repair. Shelter explains that tenants can take landlords to court if they refuse to carry out repairs or do them badly; the court can order repairs or award compensation for financial loss and stress. Before suing, check your tenancy agreement, notify the landlord in writing and give them time to act.

- Company or contractor – Follow the company’s complaint procedure. Keep copies of all correspondence and give them a reasonable time to respond. If the company acknowledges the issue but disputes liability or quantum, consider asking an ombudsman or professional body to intervene.

- Insurance company – If you have home or contents insurance, contact your insurer first. Provide full details of the incident and evidence. Insurers might reject claims because of incomplete information, not taking ‘reasonable care’, omissions in the application or failing to follow the claims process. If a claim is rejected, check your policy documents and challenge unfair decisions. Record or highlight the policy wording that supports your claim, and contact the insurer’s complaints team. Your complaint letter should include the date, your name and policy number, evidence to support your complaint, what you would like the company to do and a warning that you will go to the Financial Ombudsman Service if necessary.

In each case, keep a record of your complaint, the date you sent it and any response received. Written communication protects your position and shows the court that you tried to resolve the matter without litigation.

Claiming Through Insurance

Quick takeaways:

- Check your cover first: buildings vs contents, and whether accidental damage is included.

- If a neighbour or third party caused the damage, you can still claim on your own policy; your insurer can then pursue the responsible party’s insurer (subrogation). Many guides note that claims can be refused where negligence or poor maintenance is on your side.

- If an insurance claim is rejected or reduced, follow the formal complaints route and escalate to the Financial Ombudsman Service (FOS) if needed.

What to do, step by step:

Start by reviewing your policy schedule and wording. Confirm whether the loss is a building’s issue (e.g., walls, roof, fixed fittings) or contents (belongings), and whether you paid for accidental damage add-ons. Insurers commonly exclude wear and tear or poor maintenance; storm damage to items like fences may also be excluded.

Report the incident to your insurer as soon as possible and keep a clear property damage claim record: photographs, video, invoices, damage report or cost estimate, and any messages exchanged with the responsible party. If a neighbour caused the damage to property, many providers advise claiming on your own policy first, and your insurer can seek a settlement offer from the other side later. Expect questions about liability and negligence; be precise and consistent.

If your insurer refuses to pay or cuts the compensation, challenge it in writing. MoneyHelper recommends: check the exact reason against your policy, note any ambiguous wording, and confirm you supplied accurate information. Then send a complaint to the insurer’s complaints handler (you can use ready-made letter templates). If you’re still unhappy after the insurer’s response, or eight weeks have passed, escalate to the FOS. Its service is free, and decisions are binding on insurers. Time limits usually apply: within six months of the insurer’s final response and within six years of the event (or three years from when you realised there was a problem).

Handled well, an insurance claim can cover repair costs, replacement and associated financial loss, and if talks stall, you still have the small claims court UK route for resolution and legal action to recover what’s owed. Keep every piece of evidence; it strengthens your position in negotiation, mediation or court.

Taking the Case to Small Claims Court

If negotiations and insurance routes fail, you can take your property damage claim to the county court via the small claims track. This process is designed for cases up to £10,000 (or £1,000 if claiming for repairs against a landlord). Before starting, ensure you have the defendant’s correct name and address, evidence, and proof that you followed pre‑action steps.

Filing the Claim

CaseCraft.ai is designed for people who need to recover losses through the small claims court in the UK without paying expensive solicitor fees. The platform handles the paperwork, evidence bundles and deadlines, so you can focus on your case.

Pricing is simple: £15 processing fee + 10% success fee, and CaseCraft.ai works on a no-win, no-fee basis. If the claim doesn’t succeed, you’re not hit with solicitor costs, just the small, fixed platform fee.

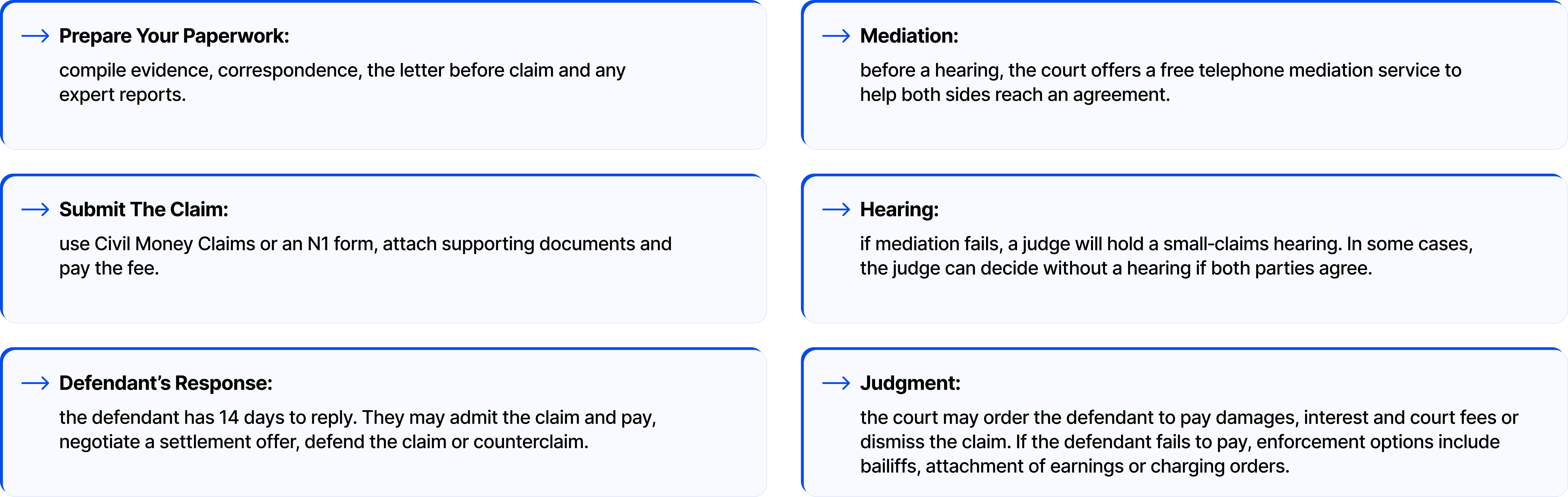

Key small‑claims steps:

Hearing Fees and Costs

Besides the initial court fee, a hearing fee is payable if the case goes to a hearing. The table below summarises current small‑claims fees (England and Wales):

| Claim amount | Issue fee | Hearing fee |

| Up to £300 | £35 | £27 |

| £300.01–£500 | £50 | £59 |

| £500.01–£1,000 | £70 | £85 |

| £1,000.01–£1,500 | £80 | £123 |

| £1,500.01–£3,000 | £115 | £181 |

| £3,000.01–£5,000 | £205 | £346 |

| £5,000.01–£10,000 | £455 | £346 |

Remember that you may have to pay further fees for enforcement if the defendant does not pay voluntarily. If you win, the court can order the defendant to reimburse your court fees, but it generally does not award solicitor’s costs in small‑claims cases.

Possible Outcomes and Compensation

Damages for property claims aim to restore you to the position you were in before the loss. Compensation can include:

- Repair or replacement costs – the court will usually award the reasonable cost of repairing the damage or, if repair is uneconomical, the cost of replacement. Provide estimates and receipts as evidence.

- Loss of value – if the property cannot be repaired, you can claim for the diminution in value. For example, if a neighbour’s building work causes a crack that reduces your home’s market value.

- Consequential losses – costs directly resulting from the damage, such as the expense of alternative accommodation while repairs are carried out or the cost of hiring equipment while yours is being repaired.

- Inconvenience and distress – courts sometimes award modest sums for inconvenience or loss of enjoyment, particularly against landlords who fail to carry out repairs.

- Interest – you can claim statutory interest at 8% per year on the amount owed. GOV.UK explains that to calculate interest, multiply your claim by 0.08 to get annual interest, divide by 365 for daily interest and multiply by the number of days overdue.

Preventing Property Damage Disputes in the Future

While the UK law provides remedies, prevention is always preferable. To reduce the risk of future disputes:

- Maintain proper insurance – ensure you have buildings and contents cover with accidental damage included. Review your policy annually so sums insured reflect current values.

- Inspect and maintain your property – regular maintenance (e.g., checking roofs, gutters and plumbing) reduces the risk of leaks or structural damage. Keep records of work carried out and communicate promptly if you notice a potential problem.

- Use written agreements – for tenancies or services, have clear written contracts that specify responsibilities for maintenance and liability for damage. This helps resolve disputes quickly and can be used as evidence.

- Communicate with neighbours – inform neighbours before undertaking work that might affect them and respond quickly if they tell you about a problem. Cooperation can prevent minor issues from becoming legal disputes.

- Document everything – even when there is no dispute, keep receipts, photographs and correspondence relating to major purchases, repairs or works. Should a problem arise, you’ll have ready evidence.

Examples of Property Damage Claims in the UK

- Neighbour’s leak damaging your ceiling – An upstairs neighbour’s faulty washing machine floods your ceiling, causing plaster damage and ruining paint. You photograph the damage, obtain repair quotes and send a letter before the claim to the neighbour asking them to cover the £800 repair costs. When they refuse, you claim on your own home insurance, which pays out and then seeks recovery from the neighbour’s insurer. A similar scenario could be managed through CaseCraft.ai’s system, allowing you to pursue the neighbour directly if insurance does not resolve it.

- Removal company damaging furniture – During a house move, a removal company drops and breaks an antique table worth £1,200. You ask the firm to pay for repair or replacement, but they offer only £200. You send a pre‑action letter detailing the damage, the table’s value and expert valuations. When negotiations fail, you use CaseCraft.ai to file a small claim for the difference, relying on photographs and expert reports to prove value.

- Building works causing structural cracks – Construction next door causes vibration that cracks your wall, reducing your property’s value. You collect evidence (photos, surveyor’s report, quotes for repairs) and engage in mediation with the builder’s insurer. If they refuse to pay, you can file a claim for the repair costs and loss of value.

- Landlord’s failure to fix a leak – A landlord ignores repeated requests to repair a leaking roof. Water damage ruins your belongings and leads to mould. After documenting the damage and writing a formal complaint, you claim compensation for the cost of damaged goods, higher heating bills and distress. Shelter notes that courts can order landlords to carry out repairs and compensate tenants for financial loss and inconvenience. CaseCraft.ai assists by drafting a claim that details the disrepair, evidence and statutory obligations.

Conclusion

Pursuing compensation for property damage can seem daunting, but the UK small‑claims system and modern tools like CaseCraft.ai make it achievable for ordinary people. By gathering thorough evidence, following pre‑action protocols, making formal complaints and understanding when to involve insurers or ombudsmen, you increase your chances of resolving disputes without costly litigation. If the court process becomes necessary, the small‑claims track provides a streamlined process for claims up to £10,000, with clear guidelines on fees and procedures.

FAQ: Compensation for Property Damage in the UK

What qualifies as a property damage claim in the UK?

A property damage claim in the UK involves damage to your building or belongings caused by negligence, accident, or deliberate act. Examples include leaks from upstairs neighbours, damage during building work, storm damage, or vandalism. To succeed, you’ll need proof of damage to property, proof of who’s responsible, repair or replacement costs, and evidence such as photos or repair invoices.

How do I start a compensation claim for property damage in the small claims court in the UK?

First, collect all evidence: photos/videos, cost estimates, receipts, expert reports. Then write a letter of claim to the responsible party. If that fails, file a claim for compensation via the small claims court in the UK under the £10,000 limit. You’ll need to fill in the claim form, pay a court fee, and attend any hearings if required.

How long do I have to make a property damage claim in the UK?

Under UK law, most property damage claims fall under a six-year limitation period (Limitation Act 1980). For insurance complaints, after your insurer’s final response, you usually have six months to escalate to the Financial Ombudsman Service. Always check your policy and relevant legal deadlines.

Can insurance cover my property damage claim, and how does that affect small claims?

Yes, if your buildings or contents policy includes accidental damage or liability, you can claim through insurance. If your insurer pays, they may then pursue (subrogate) the responsible party. If insurance doesn’t cover you, or is rejected, you can still pursue a small claims court UK action to recover repair costs, replacement, and possibly other compensation.

What compensation can I expect from a small claim for property damage?

Compensation may include repair or replacement costs, depreciation (depending on policy/policy wording), and additional losses like financial loss caused by the inability to use damaged items. Courts may reduce amounts for wear and tear or non-maintenance. Amounts are capped in small claims (usually up to £10,000), so realistic estimates and strong evidence are essential.

What happens if my insurance company rejects my property damage claim?

If your insurer rejects or reduces your claim, check your policy to understand why. You can send a formal complaint letter, providing all documentation and referencing policy wording. If unsatisfied with their final response, you may escalate to the Financial Ombudsman Service (free, binding on insurers). Keep to time limits: usually within six months of the final response and within six years of the damage occurring.