1. Unfair cancellation fees – businesses may try to impose penalties that don’t reflect their actual losses. UK law only allows charges that are a genuine estimate of the business’s loss.

2. Withheld refunds and deposits – if you cancel within the 14-day cooling-off period, you’re entitled to a full refund. Deposits and fees should only cover the trader’s real losses.

3. Forced renewals and subscription traps – many consumers find themselves locked into unwanted subscriptions. Auto-renewals without clear consent are likely unfair, and you can challenge them through the small claims court with CaseCraft.AI.

Know Your Cancellation Rights and Challenge Unfair Fees

Many companies rely on the fact that most people don’t know their rights when ending a contract. The good news is that UK consumer law gives you powerful tools to fight back. You can challenge a cancellation charge, insist on fair treatment, and, if necessary, take the business to the small claims court without hiring a solicitor. CaseCraft.AI guides you through every step.

This page is a detailed guide for anyone dealing with a contract cancellation dispute in the UK. It explains your cancellation rights, shows you how to challenge unfair cancellation fees, and offers a step‑by‑step process to cancel contracts and recover money. You’ll also learn how CaseCraft.AI’s platform can help you file a small claim without the need for a solicitor. All guidance is based on UK consumer law, including the Consumer Contracts Regulations and Consumer Rights Act 2015, and is up to date for 2025.

Why You Do Not Have to Accept Unfair Fees?

Unlawful terms: The Consumer Contracts Regulations give consumers a minimum 14‑day cooling‑off period for many distance or off‑premises contracts. If a trader fails to provide this, any early termination fee is likely unenforceable.

Proportionate charges: The government’s guidance on cancelling goods or services states that businesses may only keep deposits or charge cancellation fees to cover actual losses. Non‑refundable deposits should be small, and fees must be a genuine estimate of loss.

Unfair terms invalid: Under the Consumer Rights Act 2015, terms causing a significant imbalance (such as hidden auto‑renewals or high exit fees) may be unfair and unenforceable. The Competition and Markets Authority confirms that cancellation charges must not compensate the business twice or be excessive.

When Contract Cancellation Rights Apply?

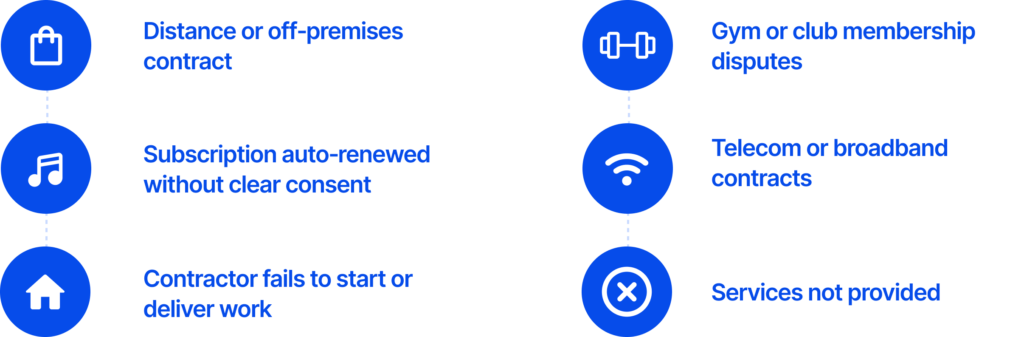

Most people associate cancellation with buying goods, but services and subscriptions are just as important. You may be able to cancel a contract and recover fees or deposits when any of the following situations apply:

- Distance or off‑premises contracts: You booked a service online or over the phone and cancelled within 14 days. The cooling‑off period under UK rule entitles you to cancel for any reason.

- Subscription auto‑renewed without clear consent: A gym membership or streaming service continues charging after you thought it had ended. Automatic renewals without transparent terms can amount to a subscription trap in the UK.

- Contractor fails to start or deliver work: You pay a deposit for home improvements, but the contractor doesn’t show up. This may be a service cancellation dispute.

- Gym or club membership disputes: You gave notice, but the gym still charges your account. These are classic unfair cancellation fee cases and often end up in small claims.

- Telecom or broadband contracts: Providers sometimes impose cancellation contract early charges if you end service before the minimum term. Only fees reflecting actual losses are enforceable.

- Services not provided: You paid for a service (cleaning, catering, or personal training) that never commenced. Keeping your money can amount to a refund refusal.

- Company refuses to acknowledge cancellation: Even after you send notice, the business ignores you or insists on hidden notice periods. This is when you need to assert your cancellation rights in the UK.

Consumers often have far more rights than they’re told. In the next section, we explain the laws in simple terms.

The Law on Contract Cancellations

Before looking at the specific laws, it helps to understand the basic rules that shape how cancellations work in the UK and what protections consumers have when ending a contract.

Consumer Contracts Regulations 2013

The Consumer Contracts Regulations apply to most contracts for goods, services or digital content made at a distance (online, telephone) or off‑premises. They require businesses to provide clear pre‑contract information and allow consumers a 14‑day cooling‑off period. During this period, you can cancel for any reason and receive a refund. Key points:

- Cooling‑off period: For distance and off‑premises contracts, the cancellation period starts the day after the contract is formed and lasts at least 14 days. Some traders offer longer periods.

- Refund timeline: Traders must refund you within 14 days of receiving your cancellation notice.

- Exceptions: There is no cooling‑off period for services arranged on business premises, accommodation, transport, car hire or leisure activities for specific dates.

- Negative options banned: The regulations prohibit hidden charges and negative‑option selling

Consumer Rights Act 2015

This Act consolidates UK consumer law and sets out rules on fairness and transparency. It requires that:

- Fair and proportionate fees: Cancellation fees must reflect genuine business losses. Penalties or fees that exceed actual costs are unenforceable.

- Transparent terms: Businesses must clearly state any cancellation charges and notice requirements. Hidden or misleading clauses are likely unfair.

- Unfair contract terms: If a term causes a significant imbalance to the consumer’s detriment, a court can strike it out. This includes auto‑renewals without express consent or misleading cancellation terms.

- Reasonable notice: Contracts should include a fair notice period. What counts as reasonable depends on the industry, but 7–30 days is common for services and subscriptions.

Contract Law Principles

Even outside consumer law, general contract principles apply:

- Actual loss: A party cancelling may owe compensation limited to the other side’s actual losses or costs. Penalties are not recoverable.

- Duty to mitigate: The party suffering loss must take reasonable steps to reduce their losses.

- Refunds when service is not provided: If no service is performed, you should receive a full refund of any deposit or payment.

Understanding these rules is essential when assessing whether a contract termination right exists and whether an unfair cancellation fee can be challenged.

When Cancellation Fees are Enforceable and When They Are Not?

Not all fees are unlawful. This section explains the difference between fair and unfair charges. Use it to judge whether your situation involves a wrongful cancellation fee.

Valid Cancellation Fees

- Reflect actual loss: The fee is a genuine estimate of what the business loses when you cancel (materials ordered, time spent, lost profit).

- Transparent terms: The contract clearly explains the amount or method of calculation, not hidden in small print.

- Notice period honoured: You cancelled within the agreed notice period, and the fee reflects the business’s unrecoverable costs.

- Cooling‑off exceptions: You cancelled after the cooling‑off period or requested immediate service during the period. The business may deduct costs for services already provided.

- Reasonable in context: Fees are proportionate to the value of the contract and industry norms (for example, a small admin fee for cancelling an online course).

Unfair or Unenforceable Fees

- Excessive or punitive: The charge is far higher than the business’s actual loss. The CMA says such charges may be unfair.

- Hidden or unclear: Fees buried in terms or sprung on you after cancellation are likely not enforceable.

- Auto‑renewal without consent: Subscription terms that renew automatically without clear upfront notice can be challenged. These often fall under subscription cancellation rights.

- Charging for services not provided: Demanding full payment when no service has been delivered breaches the principle that compensation is limited to actual loss.

- No refund under any circumstances: Terms stating deposits are always non‑refundable or that the whole contract value is due after cancellation are likely unfair.

If your case matches any of the unfair scenarios, you have strong grounds to challenge the cancellation charge and pursue a contract cancellation dispute.

What to Do if a Company Will Not Cancel Your Contract?

Dealing with a refusal to cancel is frustrating, but following a methodical process will strengthen your case. Use the steps below to prepare for a contract termination rights dispute.

1) Gather All Evidence

- Collect your original contract or terms of service, including any changes or renewal notices.

- Keep copies of emails, chat logs or letters requesting cancellation and any replies (or lack of reply). Screenshots showing dates are crucial.

- Note when the service started and stopped. Collect proof that the service was not provided, such as photos or witness statements.

- Download bank statements showing payments and any fees deducted.

- Create a timeline of events so you can present a clear story. Organising evidence early will help if you end up in the small claims court.

2) Check Your Cooling‑Off Rights

Determine whether the cooling‑off period applies in the UK:

- Distance/off‑premises contracts: You generally have 14 days after the contract is formed to cancel.

- On‑premises contracts: When you buy from the trader’s premises, you usually don’t get a statutory cooling‑off period.

- Exceptions: Accommodation, transport, vehicle hire and leisure activities often fall outside the Regulations.

If you are within the cooling‑off period, you can cancel without paying anything beyond services already delivered. If you requested the service start during the cooling‑off period, the company may deduct costs for the work performed.

3) Send a Formal Cancellation Notice

Write to the business confirming you’re cancelling under the contract. State your name, contract details, the date and reason. Send it by email and recorded post so you have proof of delivery. Keep copies and screenshots.

4) Request Fee Justification

If the company claims you owe a fee, ask for a detailed breakdown showing how it reflects their actual losses. Cite the Consumer Rights Act 2015 and government guidance that fees must be proportionate.

5) Challenge the Fee

If their justification is poor or the fee is excessive, explain that under UK consumer law, unfair terms aren’t enforceable. Highlight that a wrongful cancellation fee could be challenged and that you’re prepared to take further action.

6) Send a Letter of Complaint

If the company refuses to engage, send a formal complaint letter. Refer to relevant laws (Consumer Contracts Regulations and Consumer Rights Act 2015), describe your dispute, request a refund or fee reduction, and give a deadline (typically 14 days) for a response. Keep copies.

7) Issue a Letter Before Action

Before filing a claim, you must warn the other party. A letter before action states that you will start court proceedings unless they resolve the matter. You should outline the dispute, your evidence and the compensation you seek. CaseCraft can generate this letter for you automatically.

8) File a Small Claim

If the company still refuses to refund or drop the fee, you can file a claim. Use the small claims process when your claim value is within the limit. In England and Wales, you can claim up to £10,000. In Scotland and Northern Ireland, the limit is £5,000. Claims above these amounts or complex cases may go through a different track. CaseCraft guides you through the online filing process, generates court documents and tracks deadlines.

What You Can Claim in a Contract Cancellation Dispute?

When you file a claim, you can recover money or costs connected to the unfair charge. You cannot claim for emotional distress or punitive damages. Typical recoveries include:

- Refunds of wrongfully charged amounts: Money taken after cancellation or under unfair terms.

- Return of deposits: Deposits withheld when no service was provided or when the amount withheld exceeds actual loss.

- Excessive cancellation fees: Any part of a fee that doesn’t reflect genuine business loss.

- Payments for services not provided: Recovery of money for work never performed or goods never delivered.

- Court filing fee: If you win, you can recover the small claim fee and sometimes interest on the amount owed.

How CaseCraft.AI Helps Resolve a Contract Cancellation Dispute?

CaseCraft.AI is an AI‑driven platform designed to make the small claims process fast, affordable and accessible. It’s not a law firm; instead, it automates legal tasks and helps you act as a “litigant in person” with confidence. You can upload contracts, emails and bank statements to your secure dashboard. CaseCraft.AI automatically organises your documents and creates formal request letters, including the initial cancellation notice, fee justification request and complaint letter.

Whether you need to enforce your contract termination rights or defend against a claim, CaseCraft provides tools to prepare statements, track cases, and stay organised. It is designed to work for both sides of a dispute.

If you’re dealing with a contract cancellation dispute, using CaseCraft.AI can save you time, stress and money. Learn more about breach of contract claims or explore our gym membership disputes guide to see how our platform tackles similar problems.

Note: This information is for guidance only and is not legal advice. It provides general information about UK consumer rights and small claims procedures. If you need advice tailored to your specific situation, you should seek independent legal assistance.

FAQ: Contract Cancellation Disputes (UK)

Can a company charge a cancellation fee?

Yes, but only if the fee reflects the business’s genuine financial loss. UK law does not allow punitive or excessive charges. A fair fee should cover limited costs, such as materials or time already spent. If the amount is much higher than the real loss, it may be unenforceable.

Do I have cooling-off rights?

For most online, phone, and off-premises contracts, you have a 14-day cooling-off period. You can cancel for any reason and receive a full refund. The only exception is when you ask the service to start immediately, in which case the business can deduct the value of anything already provided.

What if the company says the contract is auto-renewed?

Auto-renewals must be clearly highlighted before you enter the contract. Hidden renewals or unclear notice periods can be challenged as unfair terms. If you were not given clear information or consent, you may dispute the renewal and recover any resulting charges through complaint procedures or small claims.

Can I get my deposit back if no service was provided?

Yes. If a business provides no service at all, deposits must usually be refunded. A company may keep only a small portion that reflects genuine costs, such as materials already purchased. “Non-refundable deposit” terms must still be fair, proportionate, and linked to actual loss under UK consumer law.

Are cancellation terms enforceable without a signature?

Often, yes. UK contract law recognises verbal agreements and contracts formed by conduct, such as paying for a subscription. However, the business must still show that you were given clear notice of any cancellation fees. If the terms were hidden or unclear, they may not be enforceable.

What evidence do I need?

Gather the contract or terms, cancellation emails or messages, screenshots showing dates, and bank statements proving payments. Include proof that the service was not provided or that the terms were unclear. A simple timeline showing what happened and when strengthens your case and helps the court assess the dispute.