1. Formal proof resets the clock – a written acknowledgement of debt can restart the six-year limitation period under the Limitation Act 1980, so getting the debtor to confirm the amount owed in writing protects your right to sue later.

2. Clarity is key – to be valid, the written acknowledgement must clearly admit the debt and be signed or sent by the debtor. Ambiguous or conditional statements will not reset the limitation period.

3. Early engagement saves costs – requesting a debt acknowledgement letter is a low-cost step that often leads to repayment without court action. If acknowledgement fails, platforms like CaseCraft.AI streamline the small-claims process and charge only a modest fee.

Introduction

Unpaid invoices and loans create stress for freelancers, landlords and small‑business owners. Before rushing to court, the pre‑action protocol for debt claims encourages creditors to communicate with debtors, share information and explore settlement. An often‑overlooked tool in this early communication is a debt acknowledgement letter. This document is a simple written statement from the debtor confirming that they owe you money. It is not a demand for immediate payment, nor is it a Letter Before Action; rather, it provides evidence that a debt exists and triggers a new limitation period.

Under UK law, most debts arising from contracts must be enforced within six years. If the debtor writes to you acknowledging the debt or makes a part payment, the six‑year clock restarts. A debt acknowledgement letter, therefore, protects your claim if negotiations or instalment plans drag on.

This article explains what a debt acknowledgement letter is, why it is legally significant, how to request debt acknowledgement in a professional way and how to use it in the small‑claims process. It also provides templates, examples of valid and invalid acknowledgements, common mistakes and guidance on what to do if the debtor refuses to confirm the debt.

What Is a Debt Acknowledgement Letter?

A debt acknowledgement letter is a document in which the person who owes money admits that the debt exists. It can take various forms: a formal letter signed by the debtor, a clear email or even a message that explicitly accepts liability. The crucial element is that the communication clearly confirms the outstanding amount and is made by the debtor or their authorised agent. Under section 29 of the Limitation Act 1980, a written acknowledgement or part payment causes a new right of action to accrue. Section 30 stipulates that the acknowledgement must be in writing and signed by the person making it. Verbal admissions are insufficient – the law requires something tangible.

Debt acknowledgement letters are distinct from letters before action required by the Civil Procedure Rules. A letter before action is a final warning that court proceedings will commence if the debt is not paid by a specified date.

It must include detailed information about the claim and comply with the Pre‑Action Protocol for Debt Claims. By contrast, a debt acknowledgement letter simply asks the debtor to confirm the amount owed, often to reset the limitation period or secure evidence for future proceedings. Obtaining such a letter can prevent disputes about whether the debtor admitted the debt and can make eventual court claims smoother.

Why a Debt Acknowledgement Letter Matters Legally?

In England and Wales, most money claims must be brought within six years of the debt becoming due. After that, the debt becomes statute-barred; it still exists, but cannot be enforced in court. The law allows this six-year period to restart in specific situations.

Key facts:

- Written acknowledgement resets the clock: Section 29(5) of the Limitation Act 1980 states that when a debtor acknowledges the debt or makes a payment, a new right of action accrues on that date.

- Must be in writing and signed: Section 30 requires acknowledgement to be in writing and signed by the debtor or their agent for the reset to apply.

- Legal guidance confirms this effect: The six-year period renews from the date of written acknowledgement or part-payment.

- Acknowledgement must be clear: The admission must be clear and unequivocal to restart the period.

Because each acknowledgement or payment can restart the limitation period, creditors often request written confirmation early. This preserves their ability to bring a claim while they negotiate repayment.

Encouraging Settlement Under the Pre‑Action Protocol

The Pre‑Action Protocol for Debt Claims aims to “encourage early engagement and communication between the parties” and resolve disputes without court proceedings. It requires creditors to send a Letter of Claim containing details about the debt, an information sheet and a reply form. A debt acknowledgement letter may be sent before or alongside the Letter of Claim as part of this cooperative approach. By clarifying whether there is any issue in dispute, it helps both parties decide whether to agree on a repayment plan or proceed to court.

What Counts as a Valid Written Acknowledgement?

For a written acknowledgement of debt to be effective, it must meet several requirements. The following points summarise the legal criteria and provide examples of valid and invalid statements.

Requirements for Validity

Written form and signature: The acknowledgement must be in writing and signed by the person making it or their authorised agent. An email or digital message that clearly identifies the debtor may suffice if it is traceable to them.

Clear admission of liability: The statement must unequivocally accept that the debt exists and that the debtor is liable. A written acknowledgement must be clear and unequivocal for the limitation period to restart. Ambiguous phrases like “I may owe you something” are insufficient.

Reference to the debt: It should refer to the specific amount or transaction so there is no doubt which debt is being acknowledged.

Communication from the debtor: The acknowledgement must come from the debtor or their authorised agent. A creditor’s note of a conversation does not count.

Timely delivery: For the limitation period to reset, the acknowledgement must be made within the existing six‑year window. If the debt is already statute‑barred, an acknowledgement cannot revive it.

Examples of Valid Acknowledgement

- “I confirm that I owe you £3,500 for the work carried out on 15 June 2024 and will arrange payment soon.” (clear, written acceptance)

- “I know I still owe the £2,000 and haven’t forgotten your money; thank you for your patience.” (explicit recognition of liability)

- “Yes, the outstanding invoice for £750 remains unpaid. I will pay it as soon as I can.”

What Does not Qualify?

- Silence or failure to respond.

- Vague statements such as “I’m looking into the invoice” or “we’ll sort something out” do not admit liability.

- Disputing the amount owed (“I don’t think I owe that much”).

- Conditional remarks that do not accept liability (“If I do owe you money, I will pay when I can”).

Comparison Table: Valid vs Invalid Acknowledgements

| Scenario | Valid acknowledgement? | Reason |

| “I owe you £1,000 and will pay next month.” | ✅ Valid | Clear, written admission of liability |

| “If I owe you anything, I’ll review the paperwork.” | ❌ Invalid | Conditional and does not accept the debt |

| Email from debtor saying “the £600 invoice remains outstanding.” | ✅ Valid | Written statement sent by debtor acknowledging debt |

| Message: “I’m still unhappy with the amount you’re claiming.” | ❌ Invalid | Disputes the amount and does not admit liability |

When to Request a Debt Acknowledgement Letter?

Timing matters when you ask the debtor to acknowledge the debt. Consider requesting written acknowledgement in the following situations:

- Persistent delays: The debtor keeps delaying payment but verbally admits owing you. Before the six‑year limitation period expires, a written acknowledgement resets the clock.

- Approaching limitation deadline: If the debt is five years old and the debtor has not made any payments, a prompt request for written acknowledgement preserves your right to sue. Without it, the claim could be statute‑barred.

- Before sending a Letter Before Action: When you are preparing to send a Letter Before Action under the pre‑action protocol, ask the debtor to confirm the debt so there is no dispute about liability.

- Verbal admission only: If the debtor verbally admits the debt, put that in writing and ask them to confirm. Verbal admissions alone do not reset the limitation period.

- Multiple invoices: When a debtor owes you for several invoices but agrees that some are valid, requesting a written acknowledgement clarifies which amounts are accepted.

How to Request a Debt Acknowledgement Letter?

Be professional and factual. The tone of your request should be courteous and factual. Avoid aggressive or threatening language. The pre‑action protocol encourages creditors to act reasonably and proportionately. Explain why you need a written acknowledgement to ensure your records are accurate and to confirm the amount owed. Provide the relevant invoice numbers or dates and state the outstanding balance. Give the debtor a reasonable deadline (usually 14 days) to respond.

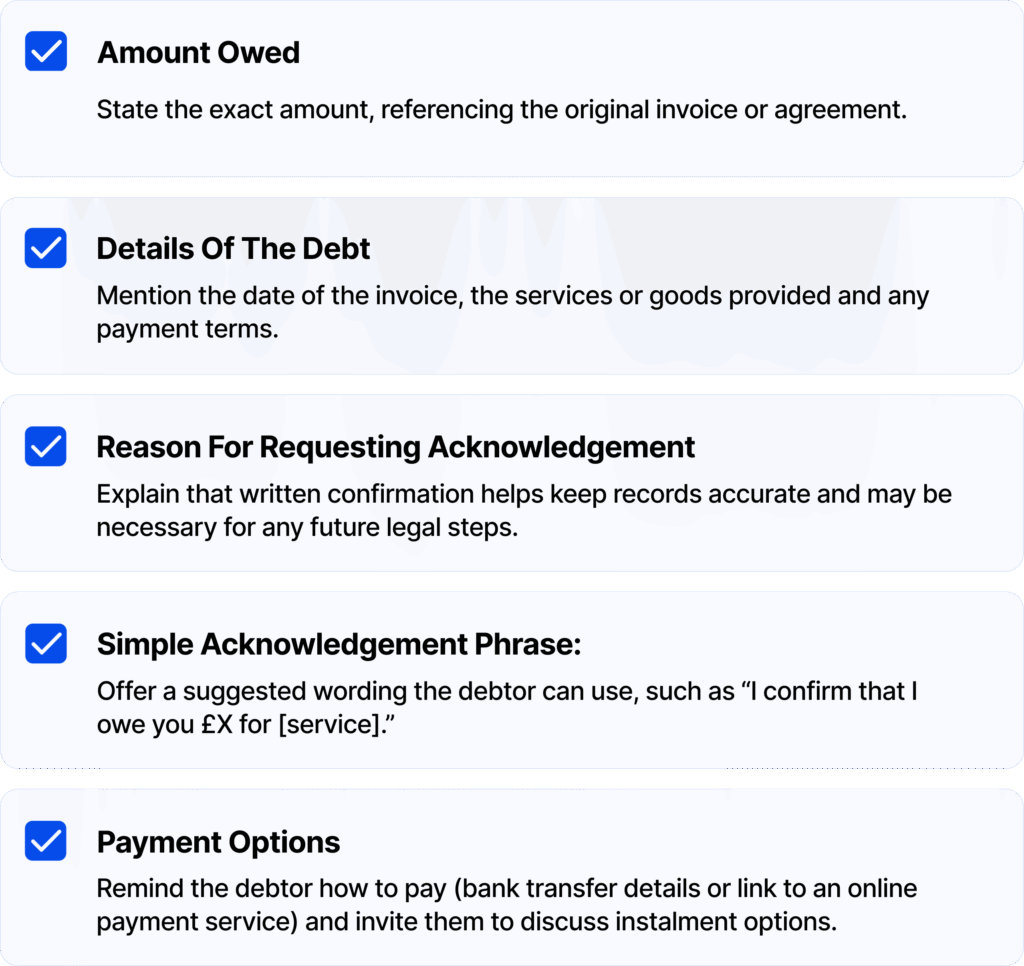

What to Include in the Request?

Effective Wording for Requesting Acknowledgement

Below are examples of wording that are compliant and non‑threatening. Adjust amounts and details to suit your situation.

- “Dear [Name], I hope you’re well. Our records show that invoice #123, dated 15 May 2025, for £750 remains unpaid. To keep our records accurate, could you please confirm in writing that this amount is still outstanding? This is not a demand for immediate payment, and we’re happy to discuss payment terms.”

- “Hello [Name], as discussed, the outstanding amount of £1,200 relates to the website design services we completed for you on 20 September 2024. Please could you confirm in writing that this debt is correct? This will help us update our records. Thank you for your cooperation.”

- “Dear [Name], thank you for acknowledging over the phone that you owe £3,000 for the loan we provided on 1 February 2023. Please confirm this in writing by [date]. If you need more time to pay, let us know, and we can agree on a repayment schedule.”

These phrases avoid threats and simply request confirmation. They also leave the door open for negotiation or instalment plans.

What Happens After the Debtor Acknowledges the Debt?

When the debtor returns a signed acknowledgement or sends a confirming email, several legal effects follow:

Limitation period resets: A fresh right of action accrues on the date of the acknowledgement. The six‑year clock starts again, giving you more time to pursue legal action if needed.

Stronger evidence: You now have written proof that the debtor accepts liability. This will be valuable if you later issue a claim. Good evidence is vital for small‑claims success.

Opportunity to settle: Use the acknowledgement as a foundation for negotiating a payment plan. Consider agreeing deadlines and, if appropriate, interest. Always confirm any payment plan in writing.

If the debtor pays in instalments, each payment will also reset the limitation period. Keep careful records of payments and confirmations to avoid disputes later.

What to Do if the Debtor Refuses to Acknowledge the Debt?

Sometimes debtors ignore requests for written acknowledgement or deny the debt. Here are practical steps:

- Request partial acknowledgement: Ask the debtor to confirm specific facts (e.g., date of invoice, goods received) even if they dispute the amount. Any written acceptance of part of the debt can reset the limitation period for that portion.

- Provide your own summary: Send a letter summarising the agreed facts and ask the debtor to correct any inaccuracies. If they do not respond, your letter may still serve as evidence of your attempt to resolve the dispute.

- Final reminder: Before escalating, send a polite final reminder explaining that if you do not receive confirmation or payment by a specified date, you may take further action. Remind the debtor of the pre‑action protocol requirement to exchange information.

- Letter Before Action: If the debt remains disputed or unpaid, send a Letter Before Action that complies with the protocol. The letter must include detailed information about the debt and give the debtor 30 days to respond. Failing to follow this step can lead to cost penalties in court.

- Proceed to small‑claims court: If there is still no resolution, you can issue a claim. Use a platform like CaseCraft.AI to prepare your claim, gather evidence and file online. The small‑claims process is designed to be straightforward; claims for up to £10,000 typically fall within the small‑claims track.

Common Mistakes When Requesting Acknowledgement

Learning from other creditors’ errors can help you avoid pitfalls:

- Threatening tone: Demanding payment or threatening court action in the request letter can discourage cooperation and may be seen as harassment. Keep the tone neutral.

- Ambiguous requests: Failing to specify the exact amount and why you need acknowledgement leads to confusion. Always include invoice numbers and dates.

- Verbal requests only: Relying on phone calls or conversations does not reset the limitation period. Put your request in writing and keep copies.

- Accepting vague responses: Only a clear admission resets the limitation period. If the debtor’s reply is unclear, ask for clarification.

- Losing evidence: Keep copies of all correspondence and proof of delivery (e.g., recorded delivery receipts or email read confirmations). Poor record‑keeping undermines your case.

How Debt Acknowledgement Helps in Small Claims?

A brief written admission strengthens your position by giving the court clear, early evidence that the debt exists.

Simplifying the Claim

Evidence of written acknowledgement simplifies court proceedings. The small‑claims track is intended to be accessible for lay people and typically deals with claims under £10,000. Having a signed acknowledgement reduces the time spent proving liability. The court will still examine whether the debt is payable, but an admission by the debtor is strong evidence.

Resetting the “Limitation Clock”

Because small‑claims actions must be filed within six years, resetting the clock matters. A written acknowledgement gives you more time to negotiate, pursue mediation or gather additional evidence without risking your claim becoming statute‑barred. Getting the other party to acknowledge the debt in writing or make a small payment can restart or extend your claim window.

Court Fees and Costs

| Claim amount | Court fee (GOV.UK) | Notes |

| Up to £300 | £35 | Standard small-claims filing fee |

| £300.01–£500 | £50 | GOV.UK fee band |

| £500.01–£1,000 | £70 | GOV.UK fee band |

| £1,000.01–£1,500 | £80 | GOV.UK fee band |

| £1,500.01–£3,000 | £115 | GOV.UK fee band |

| £3,000.01–£5,000 | £205 | GOV.UK fee band |

| £5,000.01–£10,000 | £455 | GOV.UK fee band |

Small‑Claims Limit and Track Allocation

England and Wales generally limit small claims to £10,000, while Scotland’s limit is £5,000 and Northern Ireland’s is £3,000. If your claim exceeds these limits, it may be allocated to the fast track or multi‑track with higher court fees and more complex rules. Keeping the claim within the small‑claims limit avoids these complications.

Evidence for Small Claims

The court expects claimants to provide documents such as contracts, invoices and letters or emails requesting payment. A debt acknowledgement letter complements this evidence. You should also keep records of any deposit requests, chase‑up emails and interest calculations. If you charge statutory or contractual interest, be clear about the rate and basis; for example, the Late Payment of Commercial Debts (Interest) Act 1998 allows businesses to charge 8% plus the Bank of England’s base rate. Acknowledging the debt in writing does not waive the right to claim interest, but it strengthens your claim for both principal and interest.

Conclusion

Obtaining a debt acknowledgement letter is a straightforward yet powerful step for anyone chasing overdue payments. It resets the limitation period, strengthens your evidence and often prompts voluntary repayment. When requesting acknowledgement, be clear, factual and polite; include the amount owed, the reasons for your request and a suggested response. Avoid threatening language and keep comprehensive records. If the debtor cooperates, use the acknowledgement to negotiate a payment plan. If they refuse, follow the pre‑action protocol by sending a Letter Before Action and, if necessary, file a claim.

Whether you are a freelancer, landlord or small‑business owner, acting early and documenting the debt properly will save time, reduce stress and respect the reader’s time. Your next step is simple: review your outstanding invoices, identify any approaching limitation deadlines and, where appropriate, send out a courteous request for written acknowledgement today.

Note: The information in this section is provided for general guidance and informational purposes only. It should not be taken as legal advice, nor relied upon as a substitute for advice from a qualified legal professional. Laws and procedures can change, and individual circumstances may require tailored guidance.

FAQ: Debt Acknowledgement Letters

What is a debt acknowledgement letter?

A debt acknowledgement letter is a written statement from the debtor admitting they owe a specific amount. It can be a formal letter, an email or a message that clearly confirms liability. This admission must be in writing and signed or traceable to the debtor. By obtaining such a letter, creditors secure evidence of the debt and may restart the limitation period.

Does a debt acknowledgement reset the limitation period?

Yes. Under section 29 of the Limitation Act 1980, when the person liable for a debt acknowledges the claim or makes a payment, the right to sue is treated as accruing from the date of that acknowledgement or payment. This effectively resets the six‑year time limit for bringing court proceedings.

Does an email count as an acknowledgement of debt?

An email can be a valid written acknowledgement if it clearly admits the debt and is sent by the debtor or their authorised agent. The law requires the acknowledgement to be “in writing” and signed. Courts generally accept emails where the sender’s identity is clear, and there is an unequivocal admission, such as “I know I owe you £X.”

How do I ask someone to acknowledge a loan?

When requesting confirmation of a loan, be polite and factual. State the amount lent, the date of the loan and any agreed repayment terms. Explain why you need written confirmation (for example, to ensure your records are accurate and to meet legal requirements). Provide a suggested acknowledgement phrase and give a reasonable deadline. Avoid threatening language and offer to discuss repayment options.

What if the debtor refuses to admit the debt?

If the debtor denies or ignores your request, consider sending a final reminder and then a compliant Letter Before Action under the pre‑action protocol. You may also ask them to confirm specific facts, even if they dispute the amount. If they still refuse, gather your evidence and prepare to file a small‑claims case using a tool like CaseCraft.AI. Remember that the claim must be brought within six years.

Does partial acknowledgement still count?

Yes. Acknowledging part of a debt or making a small payment resets the limitation period for that part. However, a payment of interest alone does not extend the time for claiming the principal unless the payment is expressly described as interest. Clear written admissions are safer than part payments alone.