1. Partial payments are still debts – even when a client pays only part of an invoice, the remaining balance is legally owed under contract law. The creditor can claim the outstanding amount and statutory interest.

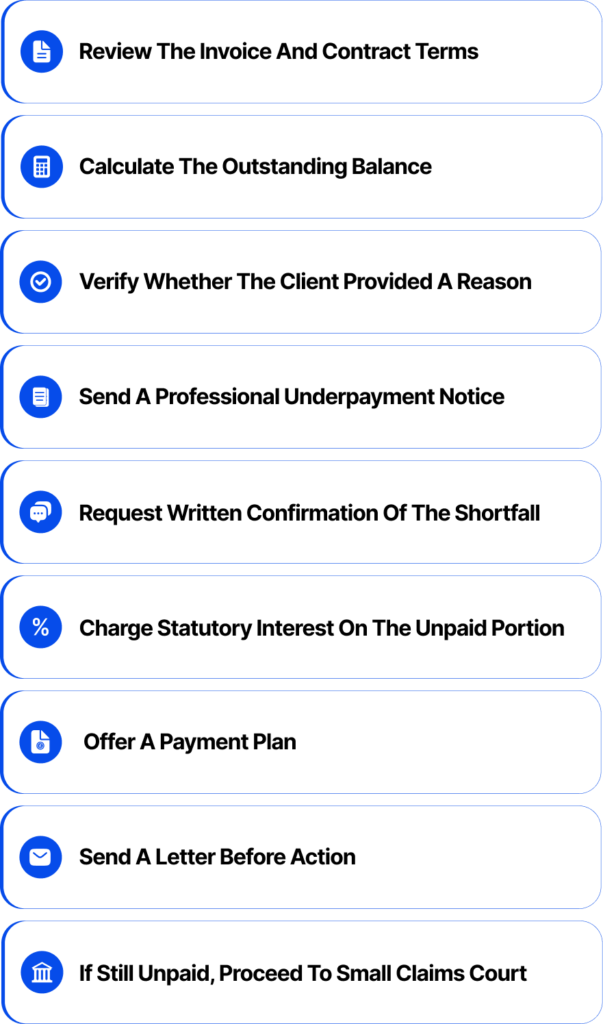

2. Follow the proper process – start by reviewing the contract, calculating the outstanding balance, communicating clearly, charging statutory interest where applicable, sending a compliant Letter Before Action, and, if necessary, going to the small claims court.

3. Use digital tools – CaseCraft.AI’s platform helps prepare evidence, calculate underpayments, generate notices and file small claims quickly.

Introduction

Prompt payment is essential for freelancers, contractors and small businesses. Unfortunately, a surprising number of invoices are paid only partially. This situation, known as invoice underpayment or an underpaid invoice, happens when a client pays less than they owe, disputes part of the bill or deducts unauthorised amounts. Under English law, the unpaid portion remains a debt. Creditors are entitled to claim the remaining balance owed, statutory or contractual interest and reasonable recovery costs.

Invoice underpayment can occur when a client ignores the contract terms, applies arbitrary deductions, withholds taxes or penalties without agreement, or claims they are paying what they think is fair. These actions fall under the same legal regime as outright non‑payment. The commercial debt recovery process in the UK encourages early dialogue and resolution through the pre‑action protocol before proceeding to court. It also imposes strict time limits: most breach‑of‑contract claims must be started within six years.

This guide explains how to handle an invoice paid partially. It walks through the legal steps for identifying underpayment of services, calculating the balance, understanding how to claim an unpaid invoice balance, charging interest on the unpaid amount, issuing a Letter Before Action and recovering the remainder through the small claims track.

When an Invoice Counts as Underpaid?

An invoice is underpaid when the amount received is less than the contractual amount owed. In many cases, this occurs alongside issues related to the late payment of invoices in the UK. Common reasons include:

- Partial payment or “goodwill” payment: A client pays only part of the total invoice, leaving an incomplete payment. They may claim cash‑flow problems or offer a lesser amount as a full settlement.

- Disputed line items: After the service is delivered, the client disputes part of the invoice or claims the work was not completed. Disputes may lead to a payment shortfall and need to be addressed under the contract.

- Unauthorised deductions: Clients sometimes deduct fees, taxes, “administrative charges” or penalties without agreement. These deductions breach the contract terms unless expressly permitted.

- Subjective adjustments: Clients pay what they think is fair rather than the agreed amount. The unpaid portion is still a commercial debt.

Under English contract law, these scenarios constitute a breach if the client fails to pay the agreed sum. The outstanding amount remains due, and the creditor may claim interest and costs. For business‑to‑business transactions, statutory interest of 8% above the Bank of England base rate applies under the Late Payment of Commercial Debts (Interest) Act.

Step‑by‑Step: How to Handle an Underpaid Invoice

Start by grounding yourself in the basics: before taking any action, make sure you fully understand what the contract actually requires from both sides.

1) Review the Invoice and Contract Terms

Begin by revisiting your service agreement. Check the scope of work, milestones, payment terms and any clauses about deductions or penalties. Ask whether:

- The contract allows set‑offs or deductions for alleged defects.

- There is a legitimate reason for underpayment, such as a prior agreement on price reductions.

- Any part of the invoice may not be enforceable, for example, if it includes additional services not covered by the contract.

If the deduction appears arbitrary or outside the contract, the client is likely in breach. Keep records of the original contract, amendments, purchase orders and any correspondence about changes.

2) Calculate the Outstanding Balance

To recover a partially paid invoice, you must know exactly what remains unpaid.

For example, if an invoice totals £2,500 and the client pays £1,500, the outstanding balance is £1,000. Interest applies only to the unpaid portion. If your contract stipulates a specific interest rate, follow that; otherwise, statutory or court‑ordered interest applies.

3) Verify Whether the Client Provided a Reason

Before escalating, ask the client why they paid less. There are three broad categories:

- Valid contractual reason: Deductions supported by the contract (for example, performance‑linked penalties or agreed retention sums). Confirm by checking the contract.

- Invalid or unilateral deductions: Deductions that are not authorised by contract terms, such as withholding taxes without agreement or imposing arbitrary fees, fall under invoice deductions without agreement. These constitute a breach of contract.

- No explanation: When the client doesn’t explain the shortfall or stops responding. In these cases, treat it as a debt and follow the recovery steps.

Under the pre‑action protocol for debt claims, creditors must provide sufficient information and encourage early communication. Document the client’s reasons (or lack thereof) for underpayment; this will form part of your evidence.

4) Send a Professional Underpayment Notice

If informal communication fails, send a formal Underpayment Notice (or Underpayment Letter) to the client. This document should:

- State the original invoice number and date.

- Specify the total amount owed, the amount received and the payment shortfall.

- Provide a deadline (usually 14 days) to pay the remaining balance.

- Refer to the relevant contract terms supporting your claim.

- Warn that failure to pay will result in interest charges and potential legal action.

Document delivery (e.g., email and post) and keep a record of the notice. An underpayment notice demonstrates good faith and may prompt the debtor to pay without further action. It also shows the court that you attempted early resolution.

5) Request Written Confirmation of the Shortfall (Optional)

Asking the debtor to acknowledge the unpaid balance in writing strengthens your case. Written admission that money is owed counts as strong evidence and may prevent future disputes. However, the debtor is not obliged to sign such a statement. If they refuse, keep your communications as evidence of attempted dialogue.

6) Charge Statutory Interest on the Unpaid Portion

- Consumer debts: When the debtor is an individual (not a business), you may be able to request interest under Section 69 of the County Courts Act 1984 when you obtain judgment. This section gives courts full discretion to award interest “at such rate as it thinks fit.” While 8% per annum is often used as a reference point, courts regularly award different rates based on the specific circumstances, including lower rates where appropriate. The court considers factors such as the nature of the debt, the conduct of the parties, and prevailing economic conditions.

- Business‑to‑business debts: If another business underpays you, the Late Payment of Commercial Debts (Interest) Act 1998 applies, according to GOV.UK, statutory interest is 8% above the Bank of England base rate. An example given on the GOV.UK shows that for a £1,000 debt with a base rate of 0.5%, annual interest would be £85 (0.085 × £1,000) and daily interest about 23p. You can also claim a fixed compensation fee: £40 for debts under £1,000, £70 for debts between £1,000 and £9,999.99 and £100 for debts over £10,000.

- Calculation example: Suppose your invoice for £2,500 is paid partially. The client pays £1,500 on time but withholds £1,000 without explanation. After 60 days, the base rate is 5.25%. Statutory interest is 8% + 5.25% = 13.25%. Annual interest on £1,000 is £132.50 (£1,000 × 0.1325). Daily interest is 36.3p (£132.50 ÷ 365). After 60 days, the interest is £21.78. You may also add a £70 compensation fee.

Charging statutory interest is not mandatory but can motivate payment. Notify the debtor in writing of the interest rate and start date, and send an updated invoice reflecting the new total.

Note: For business-to-business debts, you cannot claim statutory interest if there’s a different rate specified in the contract.

7) Offer a Payment Plan (If Appropriate)

Sometimes the debtor admits the debt but cannot pay immediately. To avoid court, you may propose a payment plan. Clearly outline the instalment amounts, due dates and consequences of default. This option preserves business relationships and shows the court you attempted reasonable alternatives. However, avoid extending the plan beyond the limitation period (six years for contract claims).

8) Send a Letter Before Action (LBA)

When the underpayment persists, the next step is a Letter Before Action (also called a Letter of Claim). Under the Civil Procedure Rules and the debt pre‑action protocol, this formal notice is mandatory before filing in court. The Pre‑Action Protocol for Debt Claims aims to encourage early settlement and avoid litigation. The creditor must send a Letter of Claim containing:

- Amount of the debt and any interest or charges.

- Reason for the debt (e.g., details of the contract or invoice).

- Information on how the debt can be paid and a reply form.

- 30‑day response deadline. If the debtor does not reply within 30 days, the creditor may start court proceedings.

A professional LBA shows the court that you complied with the protocol. Guides on letter‑writing emphasise including core details, interest calculations and a clear deadline. Failure to send a compliant letter can result in penalties: the court may pause proceedings, refuse interest or award costs against you.

9) If Still Unpaid, Proceed to Small Claims Court

If the debtor ignores your LBA or refuses to pay, you may file a claim in the County Court’s small claims track. In England and Wales, the small claims limit is generally £10,000. Claims between £10,000 and £25,000 usually go to the fast track; claims over £25,000 fall into the multi‑track.

When you file, you must pay an issue fee based on the value of your claim. The Civil Court Fees Schedule lists fees as follows:

| Claim value | Issue fee (money claim) |

| Up to £300 | £35 |

| £300.01–£500 | £50 |

| £500.01–£1,000 | £70 |

| £1,000.01–£1,500 | £80 |

| £1,500.01–£3,000 | £115 |

| £3,000.01–£5,000 | £205 |

| £5,000.01–£10,000 | £455 |

There is also a hearing fee for small claims, payable later, depending on the claim value: £27 for claims up to £300 and £346 for claims over £3,000. If you win, the court usually orders the debtor to reimburse the fees. If you lose, you may not recover them.

The claim should include:

- Copy of the invoice and contract.

- Evidence of partial payment (bank statements or receipts).

- Written communication showing that you requested the balance.

- Your underpayment notice and LBA.

- Interest calculation.

Claims under £10,000 rarely involve lawyers. Court forms can be filed online via the CaseCraft.AI platform. Evidence must be organised in a logical bundle with numbered pages, indices and statements. CaseCraft.AI simplifies this process by generating court‑ready forms, tracking deadlines and guiding you through submission.

Evidence You Need for an Underpayment Claim

Robust evidence strengthens your position and reduces the likelihood of invoice disputes in the UK. Gather:

- Invoices and statements showing the original amount and amounts received.

- Contracts, terms or purchase orders defining price and payment terms.

- Timesheets or work logs evidencing what work was done.

- Completion evidence such as photographs, delivery receipts or sign‑off forms.

- Bank statements showing partial payments and dates.

- Correspondence (emails, messages, call notes) where the client explained or disputed the invoice or where you reminded them.

- Timeline summarising when work was done, invoices sent and payments received.

Having a well‑organised evidence bundle makes settlement more likely and reduces court time. If you use CaseCraft.AI, the platform helps upload and organise documents in one place.

Common Reasons Clients Underpay (and How to Respond)

Understanding why clients underpay helps you decide how to respond:

- Payment mistake: The client misread the invoice or mistyped the amount. A polite notice often resolves the issue.

- Misunderstanding of terms: They believe the contract includes discounts or retention. Send them a copy of the relevant clause.

- Quality dispute: They claim the work was substandard or not completed. Offer to discuss and, if necessary, mediate. Document your performance.

- Cash‑flow issues: The client wants more time. You might agree to a short payment plan, but document it. For company debtors, consider requesting personal guarantees.

- Intentional deductions: The client unilaterally deducts amounts (e.g., withholding tax, service fees). These deductions are invalid unless the contract allows them. Follow the recovery steps.

Even when a client pays something, a partial payment usually acts as an admission of the debt. In court, a judge may view any payment as recognition that the contract exists and that the unpaid balance is owed.

How Much You Can Claim for Partial Invoice Payment?

You can claim:

Outstanding balance: The difference between the total invoice and the amount paid.

Interest: Statutory interest for business debts (8% above base rate), court‑ordered interest (typically up to 8%) under the County Courts Act for consumer debts, or contractual interest if the contract specifies a rate.

Fixed compensation fees: Under the Late Payment Act, £40, £70 or £100, depending on the debt size.

Reasonable debt recovery costs: Additional costs can be claimed if the cost of recovering the debt exceeds the fixed compensation fee.

Court fee: The fee you paid when filing the claim (recoverable if you win).

What you cannot claim without justification: punitive damages, extra “administration” fees not in the contract, or interest on amounts already paid.

How CaseCraft.AI Helps You Claim an Underpaid Invoice?

Partial payments can seriously disrupt your cash flow, but the law offers clear steps to recover your money. Start by verifying the contract, calculating the owed balance on the invoice, communicating professionally and charging appropriate interest. Follow the process carefully to recover the missing invoice amount, send a compliant Letter Before Action, and, if necessary, file a small claim. Remember that the burden of proof lies with you, so gather thorough evidence.

CaseCraft.AI makes the process of pursuing an underpaid invoice faster and easier. It generates all necessary documents, calculates the missing payment, shows you how to calculate outstanding invoice amount, organises evidence and guides you through the entire process, from negotiation to filing in court. For freelancers and small businesses facing an invoice dispute in the UK, using an AI-powered tool like CaseCraft.AI can mean the difference between writing off a debt and recovering the full amount.

If you’re dealing with an invoice underpayment, don’t ignore it. Follow the steps outlined here, stay organised and consider using CaseCraft.AI to streamline your claim. Recovering the outstanding amount with interest is your right. Take the next step and protect your business.

Note: This guide is for general information only and does not constitute legal advice. Always seek professional guidance if you need advice tailored to your situation.

FAQ: Underpaid Invoices

What counts as an underpaid invoice?

An underpaid invoice occurs when a client pays less than the amount agreed in the contract. Examples include partial settlement, unauthorised deductions or disputed line items. Underpayment is treated as a debt; the creditor can claim the remaining balance and interest.

Can a client legally pay only part of an invoice?

Only if the contract allows deductions or if both parties agree to vary the price. Otherwise, paying part of an invoice without agreement constitutes breach of contract. Partial payment is usually seen as an admission of debt.

How do I request the remaining balance?

Send a polite reminder first. If no response, issue an Underpayment Notice detailing the invoice, amount received, outstanding balance and deadline for payment. Follow with a Letter Before Action if necessary.

Can I charge interest on the unpaid amount?

Yes. Business debts attract statutory interest of 8% above the Bank of England base rate. Consumer debts may receive court‑ordered interest (commonly up to 8%) under the County Courts Act. Contractual interest applies if specified.

What if the client disputes part of the invoice?

Review the contract and evidence. Engage in dialogue and offer mediation. If the dispute has no contractual basis, send a formal notice. You may need to prove the work was done (via photos, logs or completion certificates) to convince the court.

How long should I wait before issuing a Letter Before Action?

Allow a short period after the Underpayment Notice (often 14 days). Under the debt protocol, an LBA should give the debtor at least 30 days to respond.