Worried about rent arrears? Learn what happens if your landlord takes you to court for unpaid rent: guide, rights, defences and next steps for tenants facing small‑claims in 2025.

Landlord taking you to court for unpaid rent? You still have options and rights if you move fast, regarding unpaid rent legal action in the UK. Landlords must follow the legal process, and the court looks at evidence, not pressure. Landlords must follow the legal process, and the court looks at evidence, not pressure.

This page sets out what happens next, from notices to hearings. You’ll learn when a claim becomes a CCJ, when it becomes a possession case, and how to protect your position.

We show the defences that actually land: disputed calculations, disrepair counterclaims, and affordability backed by proof. You’ll see the documents that persuade judges and the deadlines you can’t miss.

CaseCraft.AI helps. It turns your facts into court-ready forms, organises exhibits, and tracks every deadline. File or respond in minutes, not days, without guesswork or jargon. Ready to take control? Start your defence or file a small claim with CaseCraft.AI today.

Can a Landlord Take You to Court for Rent Arrears?

Landlords have two broad options when a tenant owes rent: they can make a money claim in the small‑claims track for the debt, or they can issue possession proceedings to regain the property. Whichever route they take, the law requires them to follow strict procedures and to treat court action as a last resort.

Rent arrears often accumulate through no fault of your own – job losses, family emergencies or benefit delays can leave you struggling, rent arrears court UK. But ignoring the problem will not make it go away. Landlords are entitled to recover unpaid rent through the courts, yet they must give proper notice and allow you to respond. You can contest inaccurate calculations, raise counterclaims and propose realistic repayment plans; acting early may stop the case from reaching court.

When Landlords Can Start Legal Action

Before going to court, landlords must try to resolve the arrears. Guidance from the UK government urges them to discuss the problem and consider mediation; the court should only be used as a last resort. To start possession proceedings, they must serve a valid Section 8 or Section 21 notice and, if you do not leave, file a claim and then apply for a warrant of eviction. Money‑only claims require a formal letter of claim. Most landlords sue for rent arrears in the UK using the small‑claims track (up to £10,000, or £1,000 where the dispute is about repairs); larger amounts go through more complex procedures.

Small claims vs possession claims

The table below summarises the key differences between small‑claims proceedings and possession claims:

| Aspect | Small claims (money only) | Possession claim |

| Purpose | Recovering unpaid rent or other money, without seeking to evict | Recovering the property (eviction) and often claiming rent arrears at the same time |

| Claim limit | Up to £10,000 (or £1,000 for property‑repair disputes) | No financial limit – landlords can combine rent arrears and other grounds |

| Outcome | A County Court Judgment (CCJ) ordering the tenant to pay may include instalments | Possession order requiring the tenant to leave, plus a money judgment for arrears |

| Process | Claim form, defence form, mandatory mediation for disputed claims, short hearing; simpler rules | Serve Section 8/21 notice, file possession claim, hearing or accelerated decision, and possible warrant of eviction |

In practice, a small‑claims action works like any civil debt claim: the parties exchange paperwork, attend mediation and appear at a short hearing. Possession claims, by contrast, directly affect your home, and the court scrutinises notices and deposit rules because eviction is on the table. Money judgments can be enforced through instalments or charging orders, whereas possession orders can lead to bailiffs physically removing you. Understanding these differences helps you decide how to respond.

What Happens if You’re Taken to Court for Unpaid Rent?

Once your landlord starts court action, you will receive documents from the court. The claim form sets out the landlord’s case, and the “particulars of claim” explain why they believe you owe rent. You will also receive a defence form to fill in. The hearing date is usually within eight weeks of the claim being issued. Respond promptly: you have only 14 days to return the defence form and can ask for more time only in exceptional circumstances.

The Claims Process Explained

The court process follows a predictable path:

Pre‑action notice: The landlord serves a Section 8 or Section 21 notice and sends a letter before claim where required. This is your opportunity to pay or negotiate.

Claim filed and served: If you do not resolve the arrears during the notice period, the landlord files a possession or money claim. You receive court papers (claim form, particulars and defence form) and have 14 days to respond. Small‑claims money cases under £10,000 go to mandatory mediation.

Hearing and judgment: If the claim is defended, the court will list a short hearing – often by phone or video. The judge can adjourn, dismiss, make a suspended possession order, issue an outright possession order or grant a money judgment depending on the evidence.

County Court Judgment (CCJ) and Your Credit Record

If the court decides you owe rent, it will record a CCJ for unpaid rent against you. Citizens Advice warns that a CCJ will appear on your credit file and make it harder to borrow money or even to rent another property. The judgment stays on the public registers for six years. Paying the debt within one month may allow you to remove the entry, but otherwise it will remain until satisfied. Landlords sometimes use the CCJ process without seeking eviction; they may later enforce the judgment using bailiffs if you do not pay.

A CCJ for unpaid rent can affect more than your credit score. Employers and letting agents may see it as a warning sign. Once entered, the judgment remains on the public register for six years and can only be marked as “satisfied” after you have paid. Some landlords use CCJs tactically to pressure tenants; they can still apply for possession later if the arrears persist. Engage with the process even if you cannot pay everything immediately.

Possession Proceedings and Eviction Risk

A possession claim is more serious because it seeks to end your tenancy. The judge can make different types of possession orders. A postponed or suspended possession order lets you stay as long as you pay current rent and an agreed amount off the arrears. An outright possession order requires you to leave – usually within 14 or 28 days. If you do not leave, the landlord must apply for a warrant of eviction. Bailiffs will then give at least 14 days’ notice before carrying out the eviction.

How Much Rent Arrears Can a Landlord Claim?

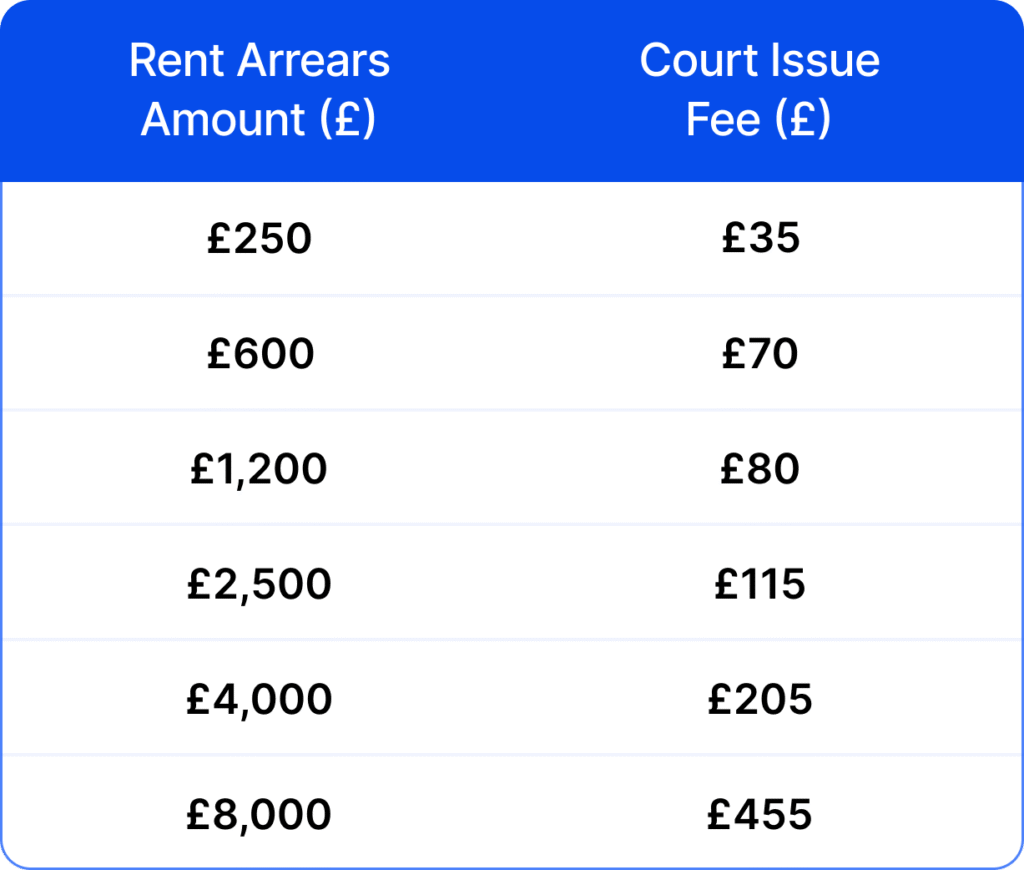

There is no minimum amount for a rent-arrears claim, but court fees and effort make it sensible to consider whether it is worth suing, rent arrears court UK. In England, small‑claims cases cover up to £10,000 or £1,000 for property‑repair disputes. Claims above this threshold follow more complex procedures and carry higher costs. The table below illustrates example rent arrears and the court issue fee (exclusive of hearing fees) based on official fees for 2025.

Your landlord can ask for a money order for unpaid rent at the same time as seeking possession. They may also claim court fees and, in some cases, reasonable legal costs. If the arrears are below £10,000 and your landlord does not seek eviction, the claim will go through the small‑claims track with simpler rules and limits on recoverable costs.

Ground 8: Mandatory Rent-Arrears Threshold

Ground 8 is the “serious rent arrears” ground. If you owe at least two months’ rent (or eight weeks where rent is paid weekly), the court must grant a possession order, provided the threshold is met both when the notice is served and on the day of the hearing. Judicial discretion is therefore limited once Ground 8 is proved.

If you can reduce arrears below the threshold before the hearing, Ground 8 fails, and the landlord would have to rely on discretionary grounds (Ground 10 for “some arrears” or Ground 11 for “persistent late payment”), where the judge can weigh your circumstances.

For timing, Section 8 rent-arrears grounds (8, 10, 11) normally require a minimum of two weeks’ notice before a claim can be issued. (Always check your paperwork and dates carefully.)

Legal basis. The possession grounds are set out in Schedule 2 to the Housing Act 1988; Ground 8 is the mandatory rent-arrears ground. Government guidance confirms that Section 8 notices must correspond to a specific statutory ground.

Defences Against a Rent Arrears Claim

You are not powerless when you receive a claim form. There are several ways to challenge a rent‑arrears claim. Always return the defence form and explain your reasons clearly.

Disputed Rent Calculations

Check the landlord’s figures. You may believe that the arrears are smaller or that you do not owe rent at all. For example, another person might be responsible, or the landlord may have miscalculated the debt. Provide evidence such as rent statements, bank transfers, or receipts to support your position.

Sometimes arrears result from simple accounting errors: perhaps you paid in cash and the landlord forgot to record it, or the rent was increased without your agreement. Cross‑reference the demand with your tenancy agreement and payment history. If you believe the claimed amount is inflated, write back explaining your calculation and include proof. Courts expect both sides to narrow the issues; showing you have tried to resolve differences will strengthen your defence.

Disrepair or Landlord’s Breach of Duty

You can challenge a claim by raising issues with the property or the landlord’s conduct. Shelter notes that counterclaims for disrepair, deposit breaches or unlawful discrimination can offset arrears and sometimes prevent eviction. You must notify the court in your defence and provide your own particulars, and you may incur costs if unsuccessful.

Benefits, Delays, and Affordability Issues

Explain any benefit delays or financial hardship that caused the arrears. You can tell the court if you are waiting for Universal Credit or Housing Benefit payments; judges must consider exceptional hardship and may suspend possession orders. Shelter notes that the Department for Work and Pensions can deduct rent arrears from your benefit if you owe at least two months’ rent; the DWP must take affordability into account. Negotiating a payment plan with your landlord may persuade them to withdraw the claim.

What Evidence Do You Need in Court?

The judge will look for documents that support your defence. Bring your signed tenancy agreement (or emails confirming the rent), bank statements, receipts showing payments, and correspondence with your landlord about arrears and repairs. Photographs of disrepair and copies of official notices can strengthen a counterclaim. In general, written records and objective evidence carry more weight than verbal assurances.

To illustrate the importance of evidence, the table below contrasts strong documentation with weak or insufficient proof. Use it as a checklist when organising your papers:

How to Respond if You’re Taken to Court for Rent Arrears

Facing a claim is stressful, but a clear plan helps. Read the claim form carefully and check that the arrears and notice are correct; mention any errors in your defence. Return the defence form within 14 days (or seek an extension) and, if you admit some of the debt, propose a realistic repayment plan. Gather your evidence (tenancy agreement, payment records, emails and a budget statement). Attend the hearing and explain your case; duty advisers and legal aid may be available.

Where possible, negotiate with your landlord before the hearing if you’re facing a landlord possession claim in the UK. Offer a realistic repayment plan that matches your income and essential expenses; this demonstrates good faith and may persuade the landlord to suspend the claim. Suppose you are pursuing a counterclaim, set out your allegations clearly and provide supporting documents. On the day of the hearing, arrive early to talk to the duty adviser who can help you present your case. Be concise and respectful when addressing the judge.

What Happens if You Lose a Rent Arrears Case?

Losing the case can lead to a County Court Judgment requiring you to repay the arrears. In planning your rent arrears defence UK, remember a CCJ stays on your credit file for six years; paying within a month may remove it. If you do not pay, the landlord can seek enforcement through bailiffs or other methods and must give at least 14 days’ notice before eviction. Possession orders vary: postponed or suspended orders allow you to stay if you keep up with payments, while outright orders require you to leave. You can ask for a delay if eviction would cause hardship.

If the landlord enforces the judgment, they might seek an attachment of earnings, a charging order on property or instruct bailiffs. Courts usually expect landlords to try proportionate enforcement first and to agree on reasonable repayment plans. If your circumstances change, you can apply to vary the payment terms and avoid further enforcement action.

Common Mistakes Tenants Make in Rent Disputes

Common pitfalls include ignoring correspondence (which can lead to default judgments), skipping the hearing, relying on memory rather than written proof, proposing unrealistic repayments, failing to review tenant rights, unpaid rent guidance, and not seeking free advice from organisations such as Citizens Advice and Shelter.

Facing Court for Unpaid Rent? Protect Your Rights with CaseCraft.ai

Falling into rent arrears can happen to anyone. Illness, job loss, or benefit delays can create a spiral that feels impossible to escape. But your landlord cannot simply change the locks or evict you without following the law. Understanding the process – from notices and claims to hearings and orders – empowers you to protect your rights and find a fair solution. Always communicate with your landlord, keep paying what you can and seek advice early from organisations such as Citizens Advice and Shelter. When needed, legal aid and duty advisers can support you at court.

CaseCraft.ai was built to make navigating these issues simpler. The platform auto‑generates the right legal forms, organises your evidence and guides you through each stage. Filing or defending a claim takes minutes, not days. Transparent pricing – a £15 set‑up fee and a modest success fee – means you know where you stand, whether you’re pursuing a small claim or responding to a rent‑arrears lawsuit. CaseCraft.ai helps you stay on top of deadlines and craft court‑ready documents.

Take control of your dispute today. Start your claim or prepare your defence with CaseCraft.ai and move towards a resolution with confidence.

Disclaimer: This page provides general information only and is not legal advice. Laws and outcomes vary, so always seek independent advice for your situation.

FAQ About Rent Arrears Court Cases

Can a landlord take me to court for unpaid rent?

Yes. They must serve a proper notice and then file a small‑claims or possession claim; the court should be a last resort.

What happens if I lose a rent arrears case?

The court may grant a money judgment or possession order, meaning you have to repay the debt and possibly leave your home.

How do I defend against a claim?

Return the defence form on time, dispute incorrect calculations, raise disrepair or benefit delays, and provide supporting evidence.

Does unpaid rent affect my credit rating?

A CCJ for unpaid rent appears on your credit file for six years and can make it harder to borrow or rent.