UK guide on how to negotiate payment terms: key clauses, invoice timing, and payment terms examples, plus small claims options with CaseCraft.ai.

There’s a moment every owner recognises. You’ve delivered. The invoice has gone. And still you’re refreshing the bank feed. Payment terms decide how long that feeling lasts. They are less about jargon and more about time, risk and cash. In the UK, that matters. Government and professional bodies have spent this year warning, again, about the drag of overdue payouts on small firms, and pushing the system further online to make recovery faster. Statutory interest on late payments between businesses remains eight percentage points above the Bank of England base rate; it exists to price delay, not to punish. Use it. State it. And, if you must, claim it.

Mastering Contract Negotiation for Payment Terms

Why Payment Terms Matter

A contract isn’t a place for wishful thinking; it’s a place for operational reality written down. If your delivery happens quickly and your outlay hits day one, ask for advance funds. If quality is proven at handover, make that the acceptance trigger so the invoice date starts the clock. If you’re asking how to negotiate payment terms, begin by mapping the work to the risk, then fix when the invoice is due and what happens if it isn’t paid. Clear, fair payment terms let you predict cash flow and signal professionalism, which in turn builds trust with your customers.

Without payment terms, it can mean waiting months for the settlement or chasing overdue invoices. In the UK, invoices are legally classed as overdue if they aren’t paid 30 days after the invoice is sent, or 30 days after the supply of goods or services (whichever is later). Having payment terms will also make it easier to charge statutory interest on unpaid invoices of 8% above the Bank of England base rate for business‑to‑business debts. Consumer transactions have different statutory protections and interest mechanisms.

It is important to have good payment terms if you are a small business, as you may not have money sitting in cash reserves for late settlements to be absorbed. CaseCraft.ai reports that unpaid invoices stop your operations, as you cannot purchase stock or pay employees. A clear set of payment terms builds fewer disputes against you, and makes it easier if the customer fails to pay, to take action.

Common Challenges

Two patterns recur. First, the buyer who treats “Net 30” as “whenever accounts sign it off”. Second, the suppliers who insist on COD because their own credit lines are tight. Both are solvable if the terms are plain and your process is disciplined: issue the invoice on time; remind early, escalate when the amount falls due. When goodwill and reminders fail, the online CaseCraft.ai’s money claims route exists for a reason.

Essential Clauses to Consider

Write for the person who will actually pay you. A good clause and its close cousins include:

- A defined term (“Net 7”, “Net 30”, “EOM”), with the due date shown as a calendar date. A net 30 term means that payment is due 30 days from the invoice date, and a net 60 would be a 60-day invoice (not the day the invoice is sent). You can also offer early payment discounts, such as 2/10 net 30 (2% discount if paid within ten days).

- The acceptance trigger (what counts as delivery, and when “time” starts).

- Any early-payment incentive (e.g., 5% within 10 days) and the late-payment consequence (statutory interest or a standard agreed rate).

- Methods you accept (bank transfer, card, no cheques; if international, whether CIA or letter of credit).

- A short, practical settlement disputes path so small queries don’t stall the full amount.

These are common in the UK and understood by finance teams, which is why they work.

How Do You Negotiate Payment Terms?

Negotiation is a trade, not a confession. Start with your ideal; move only if the counterparty gives something back that reduces your risk or improves your cash flow.

Start by Asking for Your Ideal Terms

If the work is bespoke or materials-heavy, ask for PIA or a deposit. For short projects, Net 7 or Net 10. For steady relationships, Net 30 with a small early-payment discount. These are not exotic; they are types of payment terms the market recognises, and they set expectations cleanly. In other words, choose from payment terms examples that mirror delivery risk, approval cycles and cash exposure, so the finance rhythm matches the operational one.

Understand the Other Party’s Perspective

Your customers will talk about internal approvals; your suppliers will talk about lead times and outlay. Hear them. Then tie each concession to a countermeasure. Longer terms? Then milestone billing. A request for different methods? Then, stricter acceptance criteria. If you still hit a wall, remember the small claims track exists for modest amounts, built to be quick, online and, now, increasingly mandatory for eligible claims.

Highlight the Mutual Benefits

Short, clear terms reduce admin on both sides. Early-payment options reward fast payments; explicit consequences reduce drift; clearer wording means fewer queries. Reference to statutory interest isn’t a threat so much as a reminder that time has a price in business-to-business credit.

Which Clause of the Contract Must Be Negotiated?

If you can only win one point, win “when” and “how” you get paid. That means: (1) the acceptance trigger; (2) the days from invoice to due; (3) the interest/late payment mechanism. Everything else is secondary because these decide cash.

What Are the Payment Clauses in a Contract?

The basics never change: amount, timing, method, early-payment incentive, late-payment consequence, and dispute handling. For cross-border work, add a CIA or a letter of credit where risk demands it. For small domestic jobs, keep it lean and plain.

- Scope and deliverables – Identify the specific goods or services you will provide. In situations where it is ambiguous as to what deliverables will be provided, it often leads to disputes over whether the payout is due. A contract which clearly explains what is being supplied reduces the exposure to late payouts arising from

- Price and adjustment mechanisms – Provide the price and state whether the price is fixed or variable. For longer-term projects, have a formula for price adjustments due to inflation and material costs; if your price is variable, explain how and when you will renegotiate.

- Settlement schedule – Specify whether the payment is in advance, on delivery, on completion or by work stages. Stage payments align cash inflow with work progress, reducing risk for the supplier.

- Late‑settlement penalties and interest – State the interest rate, penalty amounts and grace period for charges to apply. State how interest accrues and the legal basis for charging it (statutory or contractual interest).

- Dispute resolution – Include a clause describing how disputes will be resolved (e.g. negotiation, mediation, arbitration, court). For small amounts, specify that disputes can go to small‐claims court. In England and Wales, this track considers claims of up to £10,000; lower limits apply in Scotland and Northern Ireland.

What Are the 5 Special Clauses Which Are Found in Contracts?

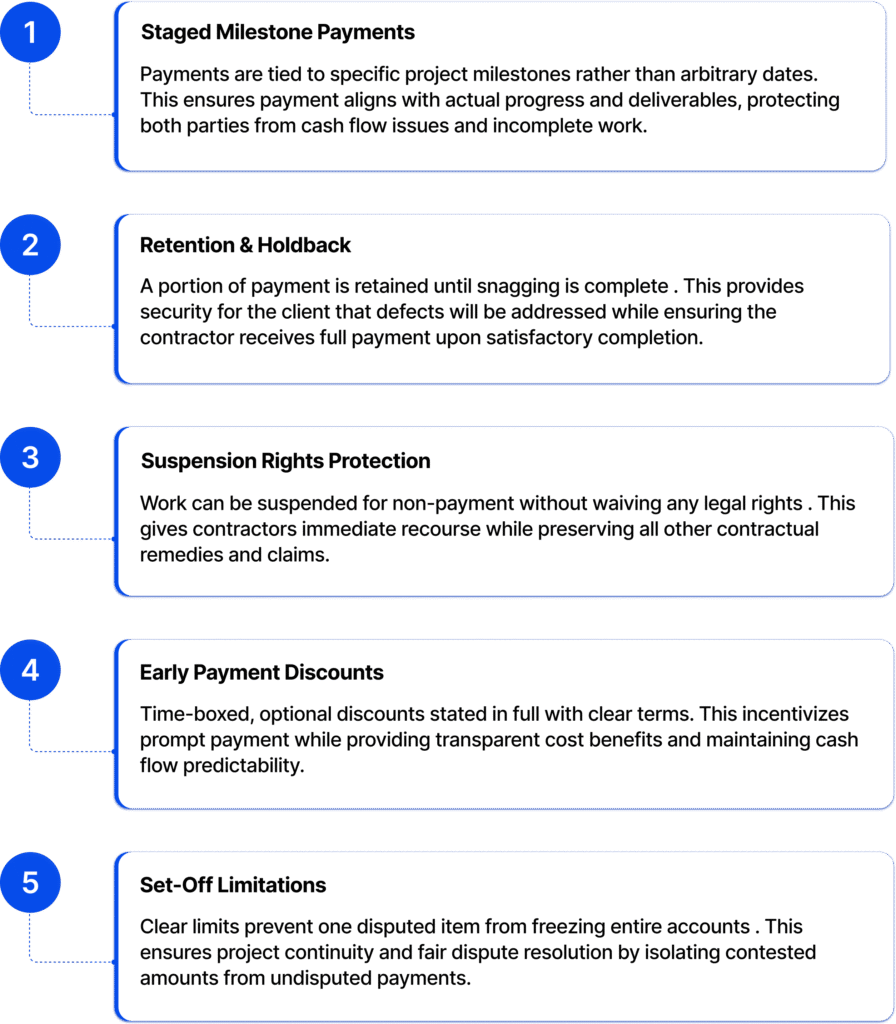

In payment-heavy contracts, you’ll often see: (1) staged payments tied to milestones; (2) retention/holdback until snagging is done; (3) suspension for non-payment without waiving rights; (4) early-payment discount (time-boxed, optional, stated in full); (5) set-off limits so one disputed item doesn’t freeze a whole account. Breaches may lead to damages or termination of the contract.

Understanding the Basics of Payment Terms in Business Contracts

A quick glossary for the person skimming on a train:

| Term | Description |

| Net 7 / Net 10 / Net 30 / Net 60 / Net 90 | Payout is due within 7, 10, 30, 60 or 90 days of the invoice date. |

| Payment in Advance (PIA) / Cash in Advance (CIA) | Payout must be made before goods or services are delivered. |

| Cash on Delivery (COD) / Cash with Order (CWO) | Payout is collected at delivery or when the order is placed. |

| End of Month (EOM) | Payout is due at the end of the month when the invoice is issued. |

| 21 MFI | Payout must be made on the 21st of the month following the invoice date. |

| 2/10 Net 30 | A 2% discount applies if the payout is received within 10 days; otherwise, the full amount is due within 30 days. |

| Stage payments | Payouts are made at specific milestones during a project. |

Negotiating Essential Clauses for Favourable Payment Terms

Depending on your company’s situation or financial objectives, you can achieve preferred terms through negotiation and agreements. Experts in the field recommend that you adopt separate approaches to new customers and existing customers. With new customers, establish expectations early in the transaction by offering early payment discounts, outlining when late fees will be charged and setting expectations from the start. With existing customers, listen to their reasons for late settlement, offering payment plans where possible and work towards mutually acceptable changes.

Make movement conditional. If a buyer asks for Net 45, trade for a deposit against materials. If a supplier demands COD, split it: part in advance, balance within seven days of delivery. If a customer wants a different method, tighten verification. Every concession should either reduce exposure or speed flow.

Accounts Receivable Management: Beyond Basic Payment Terms

Words on paper won’t save you if execution is sloppy. Include the due date in the invoice header. Send it the day work completes. Chase at your timetable, not theirs. Keep a clean log. Where an example invoice sits with no movement, compute the interest daily and communicate it calmly. Public guidance is explicit: in B2B contexts, the statutory calculation is eight per cent above base unless you have agreed otherwise. Don’t waive clarity.

Crafting a Payment Disputes Resolution Clause

Build an off-ramp before the motorway. Require prompt notice of any query, a short window to exchange evidence, and escalation to a named contact. If that fails, step into the online civil money claims service, where eligible claims must now go online, where mediation is hard-wired into the journey for many cases. The point is speed, not drama.

Ensuring Payment: Security and Guarantee Clauses

Use the lightest instrument that manages risk. For micro-entities, a modest deposit and staged payments are often enough. For higher exposure, a director’s guarantee. For some cross-border transactions, a CIA or a letter of credit is required. The aim isn’t to burden; it is to align risk with delivery so neither side bankrolls the other longer than necessary.

Where CaseCraft.ai Fits When Payment Still Does Not Arrive

When the amount owed sits in the small claims bracket, the right tool is one that makes the path from “overdue” to “order” tolerable. CaseCraft.ai is built for exactly that UK use case. You describe the work and the terms (Net 7, Net 30, PIA, COD, or other contract you agreed); the platform compiles the claim in the format the court expects; it nudges you through pre-action steps and structured settlement offers first, then filing if you need it. Pricing is blunt and transparent: a fixed £15 setup fee and 10% only if you win, no subscription, no opaque extras. For small balances where hiring a lawyer would erase the value, that model makes sense.

If you do issue, you’ll do it online. Money Claim Online and its successor services are the gatekeepers for fixed-sum claims, with the HMCTS user guides spelling out who can claim and how. The track is designed for speed: short forms, early mediation, proportionate hearings. None of that replaces careful drafting; it simply rewards it.

Key Strategies for Successful Payment Term Negotiation

Write terms the way you speak to a colleague you trust: “This is the amount; this is the date it’s due; here’s how you pay; here’s what happens if payment slips.” Start negotiations with the terms that suit your time to deliver. Trade, don’t yield. Put incentives where they change behaviour, and consequences where they keep you whole. Then run your receivables like you run your projects: clear ownership, short cycles, calm escalation. If, after all that, you’re still chasing, take the short road. The UK system has made small claims more accessible online, and CaseCraft.ai’s small claims-only model is built around that reality. It won’t fix a bad bargain, but it will turn a good one into cash with fewer detours.

FAQ: Negotiating Payment Terms

What are standard payment terms in UK business contracts?

Most UK contracts use familiar structures such as Net 30, Net 60, EOM or stage-based billing. These terms set a clear due date from the invoice date and help both sides manage cash flow. If nothing is agreed, business-to-business invoices become legally overdue after 30 days, and statutory interest at 8% above the Bank of England base rate can be charged.

How do I negotiate shorter payment terms with a new customer?

Start with the terms that reflect your exposure—PIA or a deposit for material-heavy work, Net 7 or Net 10 for short projects. Explain why the timing aligns with delivery risk, and trade concessions rather than giving them away. If the buyer wants longer terms, balance it with milestones, a deposit or a small early-payment incentive.

Can I charge interest on overdue invoices?

Yes. For business-to-business contracts, you can charge statutory interest of 8% above the Bank of England base rate unless you’ve agreed a different contractual rate. State this clearly in your terms, compute it daily once the invoice becomes overdue and communicate it calmly as part of your standard credit control process.

What should a good payment clause always include?

A solid clause covers the acceptance trigger, the due date (shown as a calendar date), the method of payment, any early-payment discount and the late-payment consequence. For larger or higher-risk projects, add milestone payments or a modest deposit. Clear wording reduces delays, avoids disputes and makes any escalation, mediation, negotiation or small claims, far smoother.