1. Lack of evidence stalls claims – courts need proof that money was lent and remains unpaid. Evidence can include bank transfers, text messages or emails where the borrower acknowledges the loan, and even witnesses. Organise all evidence before making demands.

2. Pre-action steps are mandatory – UK courts expect lenders to follow the debt pre-action protocol, send polite reminders, request written acknowledgement and interest, and issue a detailed Letter Before Action giving at least 14–30 days to respond before suing. Skipping these steps could reduce recoverable costs.

3. Interest and costs can be claimed – if no contractual rate exists, you can claim up to 8% simple interest under the County Courts Act 1984. Court fees depend on the claim amount; issuing a claim for £5,000 currently costs £205, and hearing fees start at £25

Introduction

Every year, thousands of people in England and Wales lend money to friends, relatives or business partners and then struggle to get it back. Most of these claims involve overdue loan repayment, money owed loan repayment or other debts under £10,000.

Whether your loan was private, informal or documented with a contract, you have legal options. The UK pre‑action protocol for debt claims encourages creditors and debtors to resolve disputes without litigation. It requires the creditor to provide full information about the debt, give a reasonable response window (usually 30 days), and consider repayment plans. If pre‑action steps fail, the matter can be escalated to the small claims court, which currently handles money claims up to £10,000.

This guide provides a step‑by‑step roadmap for how to recover unpaid loan balances. You will learn when a loan becomes overdue, how to gather loan evidence in the UK, send reminders, charge interest, and prepare a letter before taking action on loan repayment. It also shows how digital platforms like CaseCraft.AI organise evidence, calculate interest, generate letters and file a claim when repayment is still not made. The goal is to recover the money owed to you through legal, fair and efficient loan repayment.

What is an Overdue Loan?

An overdue loan is a sum of money that was lent under a written, verbal or implied agreement where the repayment date has passed or a reasonable time has elapsed without repayment. UK civil law recognises both formal and informal loans; however, written agreements and clear evidence strengthen the lender’s position. When a loan becomes overdue, the lender can demand repayment, charge reasonable interest, send a formal notice, and, if necessary, file a claim through the county court. The following sections explain how to recover an unpaid loan while complying with the debt pre‑action protocol and preparing for small claims litigation.

When Is a Loan Considered Overdue?

A loan becomes overdue when the borrower fails to repay according to the agreed terms. The following situations indicate that your loan is now overdue:

- The repayment date has passed. If the loan agreement specified a date or schedule, missing it constitutes default. Even a “repay when you can” arrangement becomes overdue after a reasonable time (often 30 days for private loans).

- A repayment schedule was missed. When instalments are agreed, and one or more payments are skipped, the remaining balance becomes overdue.

- Partial repayment with outstanding balance. Paying part of the loan does not discharge the obligation; the remainder remains overdue.

- Non‑response or avoidance. If the borrower ignores reminders or refuses to communicate, you can treat the loan as overdue.

- Reasonable time elapses. For informal loans without a fixed date, courts accept that lenders can expect repayment within a reasonable period (often within months rather than years).

Overdue loans can be personal, informal or business‑related. The same steps apply to private loan repayment in the UK and to money lent between businesses. Written agreements are not essential: a loan agreement in the UK can be verbal, but written evidence or messages confirming the loan strengthen the claim.

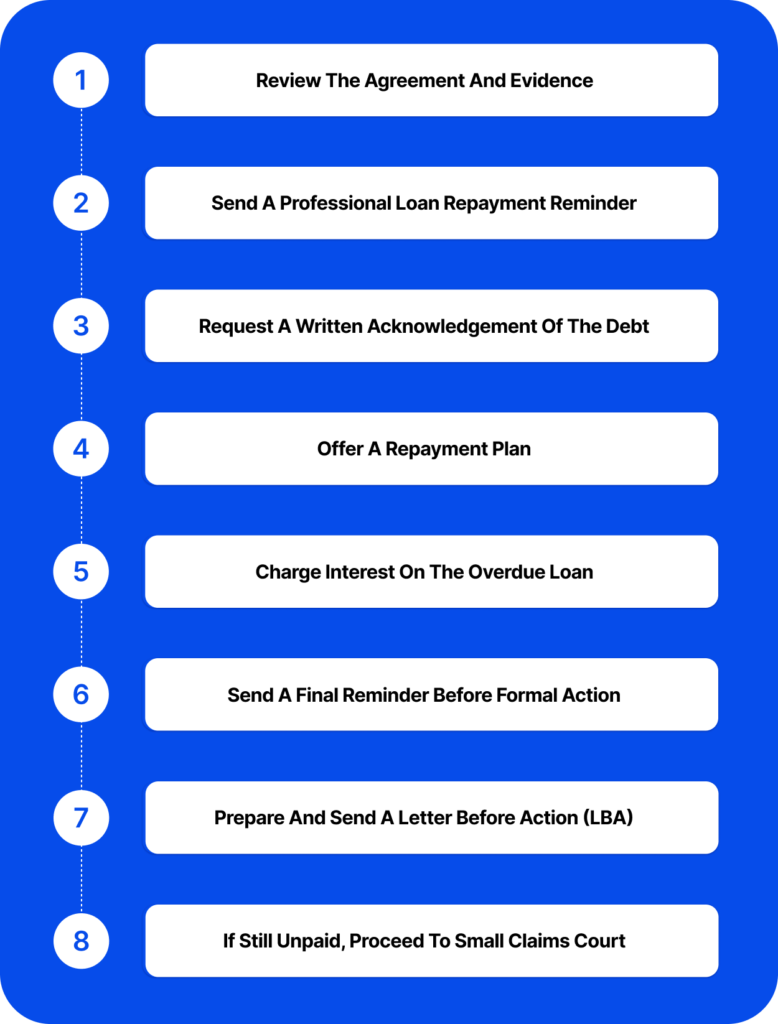

Step‑by‑Step: Legal Options to Recover an Overdue Loan

Before you move to any formal step, start by understanding what evidence you already have and whether the original terms of the loan were clear. This foundation matters because every later action, reminders, requests, interests, and formal notices, depends on proving that the loan existed and is now overdue.

1) Review the Agreement and Evidence

Before you do anything, gather and review all evidence that proves the loan exists and remains unpaid. The court will not take your word for it; you must be able to show that you gave money and expected repayment. Evidence can include:

- Bank transfers or payment records showing the funds leaving your account and references indicating “loan” or similar.

- Emails, text messages or social media messages discussing the loan and repayment terms.

- Written agreements or IOUs signed by the borrower.

- Screenshots of messages acknowledging the debt or promising repayment.

- Witness statements from anyone present when the loan was agreed.

Reviewing evidence is essential not only for the court but also for pre‑action correspondence. A loan repayment dispute in the UK can quickly become a debate about whether the money was a loan or a gift. UK courts look at all circumstances; even with a written agreement, borrowers sometimes claim that money was a gift. Emails or messages may muddy the waters. Therefore, compile a clear and chronological file of the loan evidence in the UK before contacting the borrower.

2) Send a Professional Loan Repayment Reminder

The first formal step is a loan repayment reminder. A polite reminder demonstrates reasonable conduct and may prompt payment without further action. The reminder should:

- Confirm the amount owed and refer to the original agreement or evidence.

- State the missed deadline or that the loan is overdue and request payment within a reasonable time (often 7–14 days for informal loans).

- Document the communication: send the reminder by email or recorded post and keep a copy.

Reminders show that you tried to resolve the matter amicably, which is important if the dispute goes to court. Keeping a record of dates, responses and any part‑payments helps show the court you have acted proportionately.

3) Request a Written Acknowledgement of the Debt

A written acknowledgement of the debt has two crucial effects. First, it confirms that the borrower accepts owing you money. Second, under Section 29(5) of the Limitation Act 1980, it resets the limitation period for bringing a claim. The standard limitation period for debt recovery is six years from the breach. If the debtor signs a written acknowledgement (including digital signatures or emails) or makes a part payment, the six‑year limitation clock starts again. This means you have six years from the acknowledgement date to bring a claim.

When requesting acknowledgement:

- Ask the borrower to confirm in writing that they owe the outstanding balance (for example, “Please confirm in writing that the outstanding loan balance is £X”).

- Specify the amount, date of the loan and any interest being added.

- Retain their reply; this is strong evidence for the court.

4) Offer a Repayment Plan

If the borrower admits the debt but cannot pay in full immediately, consider offering a written repayment plan. Courts view repayment plans favourably because they show flexibility and reasonable behaviour. A repayment plan should:

- Specify the instalment amounts and payment dates.

- Confirm any interest or charges being applied (if any).

- Explain what happens if the borrower misses a payment (for example, the full balance becomes due or interest increases).

- It was agreed and signed by both parties (digital signatures are acceptable).

Use clear language and avoid punitive terms. A reasonable plan can encourage cooperation and reduce the need for court action.

5) Charge Interest on the Overdue Loan

Interest can compensate you for being without your money. The rules differ depending on whether the loan is between businesses or personal, and whether a contract specifies interest.

- Contractual interest – If your loan agreement specifies an interest rate, you can charge that rate. Ensure the rate is not “penal”; excessively high default rates may be unenforceable.

- Statutory commercial interest – When both parties are acting in business, the Late Payment of Commercial Debts (Interest) Act 1998 allows you to charge 8% above the Bank of England base rate.

- Reasonable interest (non‑commercial debts) – For private loans without a contract specifying interest, you can claim simple interest at 8% per year under Section 69 of the County Courts Act 1984. The court has discretion and may award a lower rate. To calculate: multiply the debt by 0.08 to get annual interest, divide by 365 to get daily interest and multiply by the number of days overdue.

- Example – If £1,000 is overdue, annual interest at 8% is £80. Daily interest is about £0.22. After 50 days, the interest would be £11.

When communicating interest, be transparent. Explain how you calculated the amount and the period covered. Include interest details in the reminder and in the Letter Before Action.

6) Send a Final Reminder Before Formal Action

If the borrower still does not pay after the initial reminder and acknowledgement request, send a final reminder. This notice should:

- Recap the outstanding balance and any interest accrued.

- Provide a final deadline (usually 7–14 days) to pay or propose a repayment plan.

- Warn that you will issue a Letter Before Action or start court proceedings if no payment is received.

Keep the tone factual and professional. This final reminder, along with previous communications, creates a clear paper trail showing that you acted reasonably before escalating.

7) Prepare and Send a Letter Before Action (LBA)

A Letter Before Action (sometimes called a Letter of Claim) is a formal notice required under the debt pre‑action protocol. The protocol applies when a business seeks payment from an individual or sole trader. Even in other situations, courts expect parties to follow similar steps. The letter should:

- State the legal names and addresses of both parties.

- Summarise the loan: amount, date and terms.

- Provide a statement of account showing any interest or charges.

- Include copies of evidence supporting the debt, such as bank statements and messages.

- Ask for repayment within a set period (the protocol recommends 30 days for individuals; for business‑to‑business debts, 14–30 days is considered reasonable).

- Explain what will happen if the borrower does not respond (court proceedings).

Sending a well‑drafted LBA shows the court you complied with the pre‑action rules. It may prompt the borrower to repay. If they ignore the letter, you can proceed confidently knowing that you fulfilled your obligations.

You can draft the letter yourself or ask a solicitor to send it. Digital platforms like CaseCraft.AI provide templates and automatically insert your data, which can save time and ensure compliance.

8) If Still Unpaid, Prepare for Small Claims Court

If the borrower does not repay after the LBA deadline, you may issue a claim in the county court. Key considerations:

- Monetary limit: The small claims track generally handles claims up to £10,000. Claims between £10,000 and £25,000 go to the fast track. Cases involving landlord‑tenant repairs are limited to £1,000.

- Limitation period: You must file the claim within six years of the cause of action (or within six years of the last acknowledgement or part payment).

- Court fees: Issuing fees are based on claim value. Current fees for money claims are £35 for claims up to £300, £205 for claims up to £5,000, and £455 for claims up to £10,000. Hearing fees range from £25 to £335, depending on claim size. These fees are recoverable from the defendant if you win.

- Time to trial: The mean time for small claims to go to trial was 50.7 weeks in 2024. Using mediation and clear evidence can speed up the resolution.

- Documents required: You need your evidence file (bank transfers, messages, acknowledgements), the repayment timeline, interest calculations, and copies of all pre‑action letters.

Filing online is easier through the government’s portal or digital services. CaseCraft.AI guides users through eligibility checks, document uploads and filing, ensuring that claims meet legal requirements. The platform calculates court fees, compiles the claim form and tracks deadlines. This support reduces errors and expedites the process.

Evidence Needed for an Overdue Loan Repayment Claim

Evidence is the backbone of any loan repayment dispute in the UK. Without proof, courts may not believe that a loan existed or that it was meant to be repaid. The following types of evidence are commonly accepted:

- Bank transfer records: Proof that money was transferred to the borrower’s account with a reference indicating it was a loan.

- Messages and emails: Conversations where the borrower asks for the loan, agrees to the terms or promises repayment.

- Written agreements or IOUs: Signed documents showing the amount, terms and interest.

- Screenshots of acknowledgements or promises: Written acknowledgements reset the limitation period.

- Partial repayments: Bank statements showing payments made by the borrower, which confirm the loan and resets of the limitation.

- Witness statements: A neutral witness can testify that the loan was discussed and intended as a loan, not a gift.

Courts look at the overall context. A written agreement is compelling, but messages and payment records can suffice. To avoid disputes about whether money was a gift, keep all communication in writing and state clearly that it is a loan. Digital platforms like CaseCraft.AI allow you to upload and organise evidence, creating a secure timeline.

Common Reasons Loan Repayments Become Overdue

Understanding why loans go unpaid helps you tailor your approach.

- Financial difficulty: Borrowers may lose income or face unexpected expenses, making it hard to repay. Offering a payment plan may resolve the issue.

- Dispute about the amount: The borrower may dispute how much is owed or claim that the interest is unfair. Provide a clear statement of account and evidence of the agreed terms.

- Denial that a loan exists: The borrower might claim the money was a gift. This defence often arises when the evidence is weak. Keep written proof to counter this claim.

- Misunderstanding of repayment terms: Informal arrangements can lead to differing expectations. A written plan prevents misunderstandings.

- Debtor avoiding communication: Some borrowers avoid responding. Document all attempts to contact them. Courts view ignored letters unfavourably.

- Repayment timeline confusion: Without a clear timeline, borrowers may assume they have more time. Specify deadlines in reminders and letters.

How Мuch You Can Claim for an Overdue Loan?

Your claim comprises several components:

Principal loan amount: The outstanding balance of the loan.

Interest: Contractual interest (if agreed) or reasonable interest (up to 8 % per year). Business creditors may claim 8 % above the Bank of England base rate under the Late Payment Act.

Court fees: Issuing fees vary by claim value: £35 for claims up to £300, £205 for claims up to £5,000 and £455 for claims up to £10,000. Hearing fees range from £25 to £335. These fees are usually recoverable if you win.

You cannot claim compensation for inconvenience or stress in the small claims track; only direct financial loss is recoverable. Interest and fees should be calculated carefully and documented in your claim.

How CaseCraft.AI Helps Recover an Overdue Loan?

Recovering a loan not repaid in the UK requires patience, documentation and adherence to the debt pre‑action protocol. Start by assembling evidence and sending a polite loan repayment reminder. Ask for a loan acknowledgement letter to reset the limitation period and offer a fair repayment plan if appropriate. If the debt remains unpaid, calculate interest on the unpaid loan and issue a detailed Letter Before Action. Only proceed to small claims court when these steps fail, and ensure your claim is within the six‑year limitation period.

Digital assistants like CaseCraft.AI make the process less daunting by organising your documents, generating letters and guiding you through court filings. By following this roadmap, you respect the borrower’s rights, comply with legal procedures and maximise your chances of recovering your money.

Ready to act? Gather your evidence, send your reminder and explore the resources below to learn more. If repayment still doesn’t happen, consider using CaseCraft.AI to prepare and file your small claim with confidence.

Note: This material is provided for informational purposes only and should not be taken as legal advice. If you need advice for your specific circumstances, consult a qualified legal professional.

FAQ: Overdue Loan Repayment

What if someone refuses to repay a loan?

If the borrower refuses to repay despite reminders, gather evidence and send a Letter Before Action giving at least 14–30 days to respond. If they still refuse, you may file a claim in the county court for the outstanding amount, interest and court fees. Ensure you act within six years of the breach, and have evidence that the money was a loan.

Is a verbal loan agreement legally binding in the UK?

Yes. Verbal agreements are binding if you can prove that money was lent and the borrower agreed to repay. Evidence may include bank transfers, messages discussing the loan and any acknowledgement. However, written agreements provide stronger proof and reduce disputes about whether the money was a gift.

Can I charge interest on an unpaid loan?

You can charge interest if it’s specified in the contract or under statutory provisions. Business loans may attract 8% plus the Bank of England base rate under the Late Payment Act. For private loans without an agreed interest, courts often award simple interest at up to 8% per year. Always explain how you calculate interest and include it in pre‑action letters.

How long should I wait before taking legal action?

You must give the borrower a reasonable period to pay after your initial reminder and again after the Letter Before Action. The debt protocol suggests 30 days for individuals. If the borrower ignores your final deadline, you may issue a claim. Act within six years of the loan or the last acknowledgement.

What evidence do I need to recover a loan?

Gather bank transfer records, messages discussing the loan and repayment, written agreements, acknowledgements, partial repayments and witness statements. Organise your evidence chronologically and keep copies of all reminders and letters. This shows the court that the loan exists, is unpaid and that you acted reasonably.

Can I sue a friend for not repaying a loan?

Yes. If your friend fails to repay, you can sue in the county court. Ensure you follow pre‑action steps, document evidence and issue a Letter Before Action. Claims under £10,000 are allocated to the small claims track. Keep in mind that suing may strain the relationship; consider mediation or a repayment plan first.