Paid for a service but didn’t receive it? Learn your UK consumer rights, how to request a refund, use chargeback or Section 75, and claim compensation through small claims court.

When you book a haircut, hire a builder or sign up for digital services, you expect the agreed work to be carried out. Yet, many consumers each year find they’ve handed over money for a service not provided. Rogue traders, failed businesses, or simple negligence can leave you feeling powerless. Thankfully, UK law offers strong protection. This in‑depth guide sets out your UK consumer rights and the practical steps to claim a refund or compensation. We also look at when to involve your bank, the Financial Ombudsman Service, Trading Standards, or even the small claims court, and how the specialist platform CaseCraft.AI can streamline your claim.

Disclaimer: The guidance below is for residents of England and Wales and is based on laws and official guidance effective as of September 2025. Regulations may differ in Scotland and Northern Ireland. Always check the latest rules or seek legal advice if unsure.

1. Know Your Consumer Rights in the UK

Before taking action, as a consumer, it’s essential to understand the legal foundation underpinning your claim. Under the Consumer Rights Act 2015, traders must provide services with reasonable care and skill, supply them for a reasonable price if not agreed in advance and complete the work within a reasonable time. Information they give you in writing or orally is binding. Where those standards aren’t met, for example, if the service is not provided at all or is done poorly, you’re entitled to demand repeat performance or a price reduction.

If you paid for a service you never received, or the business failed to deliver by the agreed date, you’re generally entitled to a full refund. For distance contracts (purchases made online or by phone), you also have a 14‑day cooling‑off period under the Consumer Contracts Regulations 2013, during which you can cancel for any reason. Importantly, you can usually make a small claim up to six years after paying for the service in England and Wales, provided you act within reasonable time limits set by the court. These rights apply whether you’re dealing with a hairdresser, a builder or a digital subscription and irrespective of the provider’s terms.

Why Knowing Your Rights Matters

Understanding your statutory rights gives you confidence when dealing with a recalcitrant trader. When you complain, refer specifically to the Consumer Rights Act 2015. Citizens Advice suggests using language such as: “The Consumer Rights Act 2015 says services must be provided with reasonable care and skill. In my opinion, this was not done. I am asking you to fix the problem or give me a price reduction”. Quoting the legislation shows you know your rights and often encourages a quicker resolution.

2. Contact the Service Provider First

Your first port of call should always be the provider. Being polite yet firm often resolves the issue without escalation.

- Gather evidence. Collect receipts, invoices or payment confirmations, copies of contracts or terms and conditions, any correspondence between you and the business, photographs showing that the service wasn’t provided and records of informal attempts to resolve the issue. Witness statements from friends or neighbours can also help.

- Explain the problem and your rights. Outline what you paid for, when the service was supposed to be delivered and how the provider has failed. Reference the Consumer Rights Act and state whether you want the work completed or a refund. Always set a clear deadline for their response (14 days is standard).

- Keep written records. Communicate in writing (email or letter) and save copies. If you speak on the phone, note the date, time and what was said. Written evidence strengthens your case if you later pursue legal action.

A trader can offer either to redo the service or to provide a discount. Under the Consumer Rights Act, you must usually give them one chance to put things right. However, you can go straight to a refund or discount if repeating the service is impossible, would take too long or would cause significant inconvenience.

3. Ask for a Refund Under UK Law

If the service not provided was never supplied or cannot reasonably be repeated, you’re entitled to a refund under UK consumer rights. The difference between a partial and a full refund depends on what you received:

- Full refund: When the service is not provided at all or is incomplete, including cancellation by the trader during the cooling-off period, or where they fail to supply services at the agreed time.

- Partial refund (price reduction): If some work has been done but it’s below standard, you can ask for the price to be reduced to reflect the lower value. You might also be entitled to compensation for any additional costs you’ve incurred because the service wasn’t delivered.

Put your refund request in writing. Include evidence and clearly state the amount you expect. If the business disputes your claim, remind them that failing to honour a consumer’s statutory rights can lead to further action and potential court costs.

4. Dispute the Payment with Your Bank or Card Issuer

Sometimes the provider ignores you or disappears. In these situations, your bank may help to get your money back or start a bank dispute via your card issuer if needed.

- Section 75 claim: Under Section 75 of the Consumer Credit Act, if you used a credit card to pay for goods or services costing over £100 and up to £30,000, your card issuer is jointly liable with the trader. This protection still applies if you only paid a deposit by card. Section 75 covers situations where the company fails to supply the service, misrepresents what it is supplying or goes out of business. To claim, write to your credit card company with details of the purchase, proof of payment, the steps you’ve taken with the provider and a statement such as: “I am making a claim under Section 75 of the Consumer Credit Act”.

- Chargeback: Payments made by debit card (and some credit cards) may be covered by a voluntary chargeback scheme. If the service isn’t delivered and the trader refuses to refund you, you can ask your card provider to reverse the transaction. You must usually make a claim within 120 days of the transaction or the service date. Contact your bank, explain that you’ve tried to get a refund from the business and provide evidence. Bear in mind that a chargeback is not a legal right but an agreement between banks and card schemes. If Section 75 doesn’t apply, a bank dispute via chargeback can still help.

Using secure payment methods can protect you. Paying by card rather than bank transfer gives you access to Section 75 or chargeback, while paying through PayPal may offer additional buyer protection.

5. Escalate the Complaint if the Issue Is Unresolved

If the trader refuses to cooperate or your bank cannot help, other avenues exist.

Citizens Advice and Trading Standards

Contact Citizens Advice consumer helpline on 0808 223 1133. Advisers can offer tailored guidance and forward your report to Trading Standards. Trading Standards investigates unfair trading and illegal business activity, but does not handle refunds. They use information from consumers to take businesses to court or stop them from operating. To report a rogue trader, contact Citizens Advice; they will decide whether to alert Trading Standards.

Financial Ombudsman Service (FOS)

The Financial Ombudsman Service resolves disputes between consumers and financial service providers, such as banks or insurers. According to the House of Commons Library, you must first complain to the provider and give them up to eight weeks to respond. If you’re unhappy with their final response or they fail to reply, you can refer the matter to the FOS. The service is free for individuals and some small businesses. The FOS will assess your case and, if necessary, an ombudsman will issue a final binding decision. Complaints must usually be made within six months of receiving the firm’s final response.

Alternative Dispute Resolution (ADR)

Many industries offer ADR schemes, independent services that resolve disputes without a court. For example, travel agents often belong to the Travel Industry ADR Scheme and telecoms providers to the Communications Ombudsman. Check your provider’s terms; they must tell you if they belong to an ADR scheme. Using ADR can be quicker and cheaper than court and is becoming increasingly encouraged. In May 2024, the UK introduced mandatory free mediation for most money claims up to £10,000. Parties must attend a one‑hour telephone session through the court‑appointed mediator; failing to engage could lead to costs or the claim being struck out.

6. Small Claims Court – Last Resort Option

If all else fails, the small claims court allows you to seek compensation without a solicitor. Small claims are for simple disputes and generally for amounts up to £10,000 (with a £1,000 limit for personal injury cases). You can make a claim for poor service, a refund that hasn’t been paid or a service not provided. You have up to six years from the date of payment to start proceedings. Before filing, ensure you have strong evidence: contracts, receipts, correspondence and photographs.

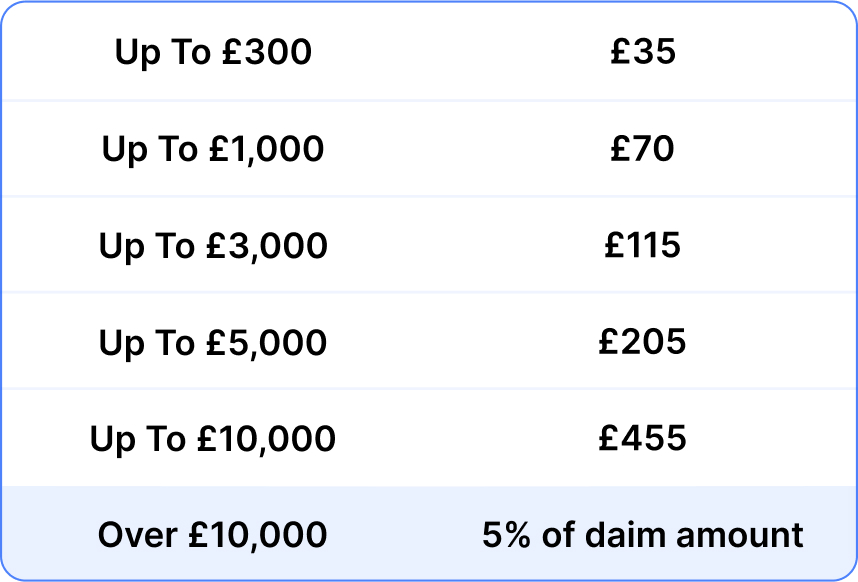

Court Fees and Procedure

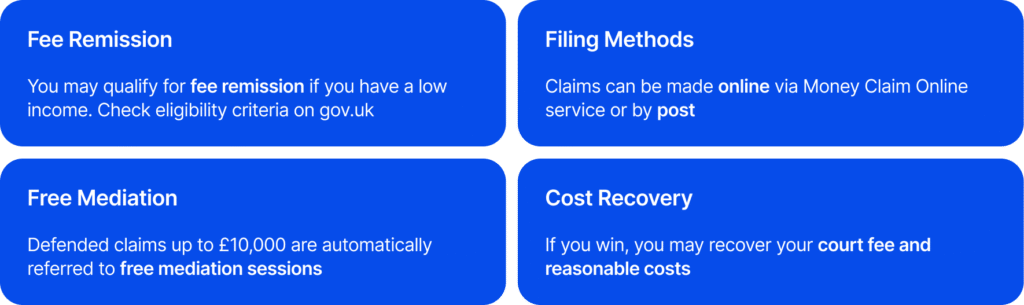

You pay a court fee when lodging your claim. According to HM Courts & Tribunals Service, the fee scales with the amount claimed: £35 if claiming up to £300, £70 for claims up to £1,000, £115 for claims up to £3,000, £205 up to £5,000 and £455 up to £10,000. Claims over £10,000 attract a 5% fee. You may qualify for fee remission if you have a low income. Claims can be made online via the government’s Money Claim Online service or by post. After you file, the court will automatically refer defended claims up to £10,000 to a free mediation session. Many cases settle at this stage; if not, the case proceeds to a hearing. If you win, you may recover your court fee and any reasonable costs.

How CaseCraft.AI Can Help

Navigating forms, deadlines, and legal jargon can be daunting. CaseCraft.AI is an AI‑driven platform designed to simplify small claims in England and Wales. It automatically generates the correct legal forms and organises your evidence to strengthen your case. You can file your claim online in minutes and receive step‑by‑step guidance. Unlike many services, CaseCraft.AI charges only a £15 setup fee and 10% of any successful claim, nothing if you lose. The platform handles claims up to £10,000 in accordance with HMCTS requirements and can also prepare pre‑action complaint letters and settlement offers to help you resolve disputes without court. With bank‑grade encryption and backing from a regulated law firm, it offers a secure route for consumers unfamiliar with legal procedures.

7. Prevent Future Issues When Buying Services

While you can’t eliminate risk entirely, following some prudent steps will greatly reduce the chances of a service not being provided.

- Research providers thoroughly. Look for a physical address, read online reviews and ask friends or family for recommendations. An absence of a web presence or refusal to provide references is a red flag. Trading Standards’ Buy With Confidence scheme lists approved traders who have been vetted for legitimacy and quality.

- Get written quotes and contracts. Rogue traders often refuse to give a written quote. Insist on an itemised, signed agreement detailing the work to be done, the cost and the timeline. Keep all emails and letters; they’re vital evidence if things go wrong.

- Avoid large upfront payments. Requests for big deposits are a hallmark of scams. A small deposit may be reasonable, but only pay the full price after the work is completed to your satisfaction.

- Check credentials and membership of trade bodies. Ask to see ID or proof of qualifications. Many professions have regulatory bodies (e.g., Gas Safe Register, NICEIC for electricians). If a trader claims to be accredited, verify it.

- Use secure payment methods. Paying by credit card gives you Section 75 protection, while debit cards offer chargeback. Avoid bank transfers and never pay cash to someone you’ve just met on your doorstep.

Red Flags to Watch Out For When Booking a Service

Rogue traders use predictable tactics. Be cautious if you encounter any of these warning signs:

- Large upfront payments or cash‑only demands: Legitimate providers shouldn’t ask for the full amount before starting the job.

- No written quote or contract: Without paperwork, you have no proof of what was agreed.

- No physical address, ID or online presence: A lack of transparency makes it hard to pursue a complaint.

- High‑pressure sales tactics: Offers that ‘expire today’ or warnings of urgent work are common scam techniques.

- Requests for sensitive information: Never give out your bank details or personal documents to unsolicited callers.

If a trader knocks on your door uninvited, don’t be afraid to close the door and refuse the offer. Report suspicious behaviour to the police or Citizens Advice.

Final Thoughts

Discovering that a service is not provided can be frustrating and financially damaging. Fortunately, UK law provides clear remedies, from repeat performance and price reductions to full refunds and compensation. The key is to act methodically: gather evidence, assert your consumer rights, use secure payment methods and follow the complaint escalation process. When diplomacy fails, the small claims court offers a user‑friendly last resort, with tools like CaseCraft.AI available to make the process far less daunting. By understanding the law and staying vigilant for red flags, you can protect yourself and recover what you’re owed.

FAQ: Service Not Provided

What counts as a “service not provided”?

A service not provided means you paid for work or access to something that was never delivered. It could be a tradesperson who didn’t turn up, a digital subscription that never went live or a flight that was cancelled without a refund. In UK law, failure to provide a service breaches the Consumer Rights Act and entitles you to remedies.

How long do I have to make a claim for non‑delivery of services?

In England and Wales, you can usually bring a claim within six years from the date you paid for the service. However, it’s best to act sooner rather than later because evidence can deteriorate, and time limits for chargeback or Section 75 claims are much shorter.

What if the company goes bust before the service is delivered?

If you paid by credit card (over £100), you can make a Section 75 claim because the card issuer is jointly liable. Debit card payments might be recoverable through a chargeback. If the business is regulated (e.g., a travel agent), check whether it belongs to a protection scheme. Otherwise, you may need to make a small claim against the owners or their insurers.

Do I need a solicitor for a small claim?

No. Small claims are designed to be used by individuals without legal representation. You can prepare and file the claim yourself and may even settle through mandatory mediation. Tools like CaseCraft.AI can guide you through the process and generate the required documents.