1. Costs and fees – court fees for a small claim range from about £35 for claims under £300 to £455 for claims up to £10,000, with additional hearing fees. Debt collectors often charge commissions, plus fixed fees for sending letters. Decide whether you want a modest fixed cost or a percentage of the debt.

2. Time and success – small claims cases can take 4–9 months to conclude, and enforcement is still your responsibility. Commercial debt collection agencies typically act within days, but they are less suitable when liability is contested.

3. Relationship impact – court action may damage business relationships, whereas professional debt collectors often use negotiation and payment plans to preserve goodwill. Choose the method that aligns with your need for speed, cost management and customer relationships.

Introduction

When someone owes you money, you usually face a simple choice: pursue a small claim through the court or hire a debt collection agency. Each route has distinct costs, timelines and implications for your relationship with the debtor. Small claims actions provide a legally enforceable judgment but require paperwork, court appearances and your own effort to enforce the order. Debt collectors handle communication, negotiation and credit reporting on your behalf for a commission.

Your decision hinges on factors such as dispute status, claim size, cost tolerance and whether you want to maintain a business relationship. CaseCraft.AI can guide you through drafting pre‑action letters and compiling evidence so you pay a modest court fee rather than a large contingency fee.

When to Use Small Claims vs Debt Collectors?

Choosing between small claims vs debt collectors depends on the size of the debt, the dispute status and how quickly you need a resolution. Use the guidance below to decide which path fits your situation.

When Small Claims Make Sense?

- Within the court limit – In England and Wales, the small claims court limit is £10,000; Scotland uses a £5,000 simple procedure, and Northern Ireland uses £3,000. Staying under these limits keeps the case on the simpler track.

- Disputed liability – If the debtor disputes the invoice or the quality of work, only a court can give a binding judgment. A small claim allows you to present evidence and obtain a court order.

- Known debtor details – You must have the correct name and address of the defendant. Without these details, it will be difficult to file and enforce the claim.

- Willingness to invest time – Filing forms, attending hearings and handling small claims enforcement (bailiffs, attachment of earnings, third‑party debt orders and charging orders) requires time and patience.

- Follow the debt recovery process – The small claims route is part of the wider debt recovery process, which includes sending a Letter Before Action, filing the claim and enforcing the judgment. This structured process helps ensure compliance with court rules.

When Debt Collectors Are Appropriate?

- Undisputed debts – A debt collection agency is more suitable when the debtor acknowledges the debt but ignores reminders. Agencies can act quickly, send letters and make phone calls to collect the money.

- Speed and convenience – Agencies can begin work immediately. They handle all communications, track payments and often use credit reporting to encourage compliance.

- Customer relationships matter – For small businesses reliant on repeat customers, an empathetic collector can preserve goodwill while securing payment. Court action may sever future business.

- Large or multiple debts – Companies with many delinquent accounts may outsource to scale recovery efforts quickly.

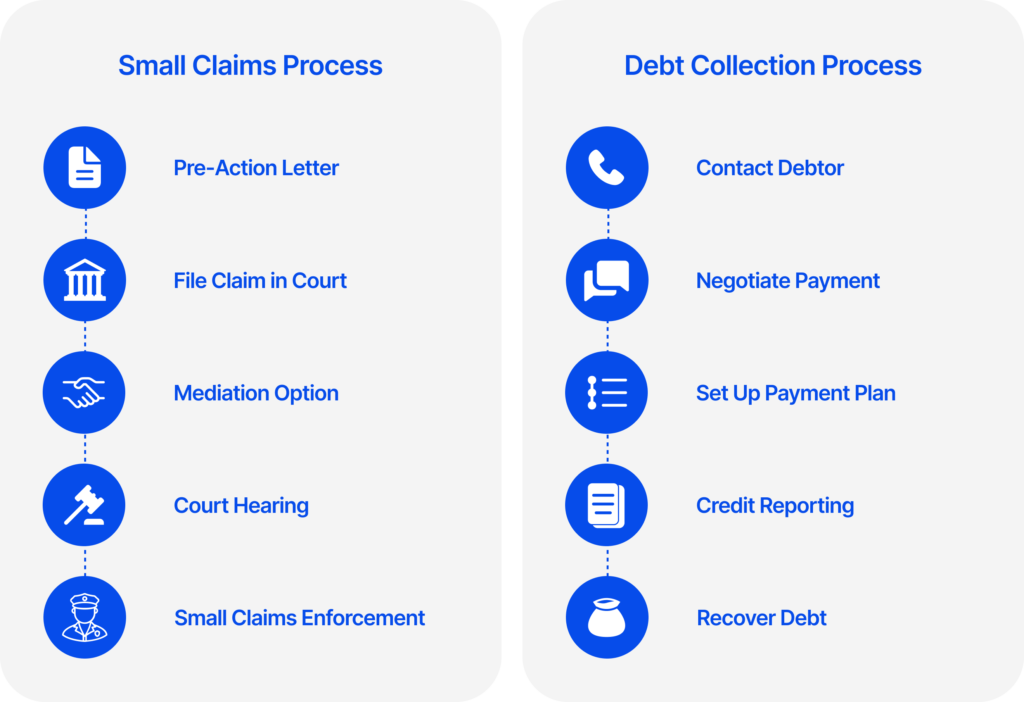

How Small Claims Work?

The small claims process in the UK follows a structured sequence. It begins with trying to resolve the dispute informally and ends, if necessary, with enforcement. Each step is important for meeting legal requirements and demonstrating that you acted reasonably.

1. Try to Resolve the Dispute First

Send a written complaint or final demand letter summarising the issue, the amount owed, supporting evidence and a deadline for payment (usually 14 days). This demonstrates reasonable pre‑action conduct and may encourage a settlement without court involvement.

2. Issue a Letter Before Action

Before filing a claim, you must send a formal pre‑action letter. It includes the debtor’s name, address, the amount owed, legal basis for the debt and an evidence summary. CaseCraft.AI automates compliant Letters Before Action, ensuring that your letter meets court standards.

3. Prepare the Claim

Gather documents such as contracts, invoices, messages, photographs and any other evidence. Organise them into a pre‑action evidence bundle. CaseCraft.AI helps you structure documents and calculate deadlines so nothing is missed.

4. File the Claim

File online via the government Civil Money Claims service. Note that all eligible claims must be filed online from 28th July 2025. Pay the issue fee (court fee) based on the value of the claim. For example, claims up to £300 cost around £35, claims between £3,000 and £5,000 cost £205, and claims between £5,000 and £10,000 cost £455. Hearing fees apply if the case goes to trial.

5. Response and Mediation

After you file, the defendant has 14 days to respond. They may admit the claim, dispute it, request more time or ignore it. The Small Claims Mediation Service may help parties reach a settlement before a hearing. Mediation typically takes 2–6 weeks and is free.

6. Hearing and Judgment

If the dispute is not settled, the court schedules an informal hearing. Both sides present evidence. The judge will usually provide a decision quickly. A judgment is an order to pay, but it does not guarantee immediate payment; you must enforce it.

7. Enforcement

If the debtor does not comply, you need to take enforcement action. Options include:

- Warrant of control – Court enforcement agents can collect the money owed or seize goods for auction.

- Attachment of earnings order – The court orders the debtor’s employer to deduct payments from wages.

- Third‑party debt order – The debtor’s bank or building society account is frozen, and funds are paid to you.

- Charging order – A charge is placed on the debtor’s property or other assets; payment occurs when the asset is sold.

Enforcement is your responsibility and may require further fees. CaseCraft.AI offers guidance on enforcement options.

How Debt Collectors Operate?

A debt collection agency is a commercial business hired to recover unpaid debts. They either collect on behalf of the original creditor or purchase the debt at a discount. Agencies must follow strict rules in the UK. Here’s how they work:

- Role of agencies – They act as intermediaries, contacting debtors via letters or phone calls to negotiate repayment. Some agencies may set up payment plans and report unpaid debts to credit reference agencies, which can affect credit scores.

- Contingency fees – Rather than charging up‑front, many agencies operate on a no‑collection‑no‑fee basis. Commission rates commonly range from 5% to 35% of the amount recovered. Fixed fees for sending demand letters vary, often between £15 and £250.

- Tools and strategies – Agencies use tracing services to locate debtors, send formal demands and negotiate directly. Some may report unpaid debts to credit bureaus or use data analytics to prioritise cases.

- Advantages – Hiring professionals saves time and effort; experienced collectors know how to secure payment while preserving customer relationships.

- Disadvantages – Commission may exceed court fees, especially for larger debts. Agencies cannot resolve disputed liability; they may issue legal threats, but cannot take court action unless they own the debt. You relinquish some control over communication with your customer.

- Legal considerations – Debt collectors must be authorised by the Financial Conduct Authority (FCA). They cannot harass, threaten or mislead debtors. They have no right to enter a home, seize goods or discuss the debt with third parties. Consumers can demand proof of debt and request that communication be in writing.

FCA authorisation is mandatory for firms collecting debts arising from consumer credit agreements, consumer hire agreements, and regulated peer-to-peer loans.

However, commercial business-to-business debt collection often falls outside FCA regulation. Regardless of regulatory status, reputable agencies should follow professional standards, including providing clear documentation, avoiding harassment, and treating debtors fairly.

Comparing Small Claims and Debt Collectors

Use the comparisons below to evaluate small claims vs debt collection strategies. Consider costs, speed, enforcement and the nature of the debt.

Cost

- Small claims – You pay a fixed issue fee and (if required) a hearing fee. Example: a £5,000 claim incurs a £205 issue fee and a £346 hearing fee. Costs may be recoverable if you win.

- Debt collectors – Commission of 5–35% of the recovered amount, plus fixed charges for letters (around £15–£250). If they fail to collect, you pay nothing under no‑collection‑no‑fee agreements.

Enforcement and Success

- Small claims – A judgment provides legal authority but does not guarantee payment. Enforcement methods (warrant of control, attachment of earnings, third‑party debt order, charging order) require additional applications and fees. Success depends on the debtor’s assets.

- Debt collectors – They rely on negotiation and credit reporting.

Customer Relationships

- Small claims – Court action may damage relationships; it signals a formal dispute.

- Debt collectors – Agencies often use professional and empathetic communication to preserve goodwill.

Which Option Works Better? Use Cases and Scenarios

Consider these scenarios to decide between small claims and debt collection.

- Scenario 1 – Disputed invoice – Your client disputes the quality of services and refuses to pay an £8,000 invoice. A court claim is appropriate. File under the small claims track, pay a £455 issue fee and provide evidence. The judge decides liability, and if you win, you can pursue small claims enforcement via a warrant of control.

- Scenario 2 – Unresponsive debtor – A tenant owes £2,000 in rent but has acknowledged the debt. Hiring a debt collection agency vs small claims court may be faster and cheaper. An agency charging 15% commission would take £300 if successful, compared with a court fee of £115 and a potential six‑month wait.

- Scenario 3 – Relationship matters – A long‑term customer owes £1,500. You value the relationship and want to avoid litigation. A collector can negotiate a payment plan and maintain goodwill. If the debtor contests liability, you can later switch to a small claim.

- Scenario 4 – Multiple debts – Your company has ten overdue invoices ranging from £500 to £5,000. Filing individual claims would involve multiple court fees and time. Outsourcing to a business debt collection agency scales recovery efforts; commission may be higher overall, but the administrative burden decreases.

Costs and Fees Explained

Understanding costs is essential when comparing small claims vs debt collectors.

Small Claims Fees

| Claim amount | Issue fee (paid when you file) | Hearing fee (if your case goes to court) |

| Up to £300 | £35 | £27 |

| £300 – £500 | £50 | £59 |

| £500 – £1,000 | £70 | £85 |

| £1,000 – £1,500 | £80 | £123 |

| £1,500 – £3,000 | £115 | £181 |

| £3,000 – £5,000 | £205 | £346 |

| £5,000 – £10,000 | £455 | £346 |

Debt Collection Fees

| Cost type | Typical range | What this means in real terms |

| Commission on money recovered | 5% – 35% | You lose this share of what you recover |

| Demand/tracing/admin fees | £15 – £250 per action | Charged even before recovery |

| International Recovery Commission | Up to 40% | High-risk overseas recovery |

Example

| Debt value | Commission rate | Commission cost | Typical letter/admin fees | Total cost |

| £4,000 | 20% | £800 | £50 – £250 | £850 – £1,050 |

Timeline Comparison

Small claims timeline

Pre‑action letter – Allow 14 days for the debtor to respond.

Filing the claim – After the deadline, file your claim; you will receive an acknowledgement within a few days.

Response period – The defendant has 14 days to reply. If they file a defence, the court schedules mediation.

Mediation – Typically takes 2–6 weeks. If mediation fails, the case proceeds to a hearing.

Hearing and judgment – Usually within 3–9 months from filing.

Enforcement – Enforcement adds extra time; warrants of control or other orders may take several months.

Debt collection timeline

Account handover – Provide the agency with details and documentation. This can occur immediately.

Initial contact – Agencies typically send demand letters and make phone calls within a few days.

Negotiation – Payment plans or settlements may be arranged within weeks.

Escalation – If payment is not achieved, the agency may recommend court action or transfer the debt to a solicitor. Success rates depend on the debtor’s willingness to cooperate.

Mistakes to Avoid

- Suing the wrong entity – Verify the legal name and registered address of the debtor. Suing the wrong company or individual will delay recovery and may incur further costs.

- Skipping the pre‑action letter – Courts expect claimants to send a formal Letter Before Action and attempt mediation before issuing a claim. Failing to do so may result in cost penalties.

- Poor evidence preparation – Collect contracts, invoices, correspondence and photographs. Lack of evidence weakens your claim.

- Overclaiming – Do not inflate the claim amount. Judges can reject or reduce claims and may order you to pay the defendant’s costs.

- Ignoring limitation periods – Under the Limitation Act 1980, most debts in England, Wales and Northern Ireland become statute-barred after six years. This means they cannot be enforced via court, though the debt still exists. Scotland’s limitation is five years.

- Believing the court will enforce payment – Winning a judgment does not guarantee payment. You must choose and apply enforcement methods.

- Hiring unregulated collectors – Agencies must be authorised by the FCA. Unregulated collectors may use aggressive tactics and risk complaints and reputational damage.

- Damaging relationships – Court action can sour business relationships. Consider negotiation or a commercial debt collection approach when preserving goodwill is a priority.

Why Use CaseCraft.AI?

CaseCraft.AI is a digital assistant that streamlines every stage of the small claims process. It is particularly useful when you decide to pursue a small claim rather than using business-to-business debt recovery services. Benefits include:

- Automated letters – The platform produces compliant Letters Before Action and final demand letters, reducing drafting errors.

- Defendant identification – It helps you identify the correct defendant, including legal status and registered address, avoiding the mistake of suing the wrong entity.

- Evidence organisation – CaseCraft.AI organises your documents into professional bundles ready for court.

- Fee calculators and deadlines – It calculates court fees and tracks response deadlines, ensuring you remain within timelines.

- Step‑by‑step guidance – The interface guides you through forms and filings without needing a solicitor. That saves you solicitor fees while improving accuracy.

- Post‑judgment support – The platform provides guidance on enforcement options so you can recover the money you are owed.

- Fair pricing – CaseCraft.AI charges a fixed £15 set‑up fee and a 10 % success fee only if your claim succeeds.

If you are considering the small claims route, you can take a look at how CaseCraft.AI works and get started.

Note: This page is for general information only and does not provide legal advice. If you need advice on your specific circumstances, you should speak with a qualified legal professional.

FAQ

Are debt collectors more effective than small claims?

It depends on the type of debt. Debt collectors are often effective when a debt is not disputed, and the person simply has not responded to reminders. Small claims court is usually the better option when there is a dispute, when liability is denied, or when you need a formal court judgment to resolve the matter. Note that if you owe £5,000 or more to a creditor, they can present a bankruptcy petition against you.

What are the filing fees for small claims court?

Court fees depend on the value of your claim. For example, claims under £300 cost around £35 to issue. Claims between £3,000 and £5,000 cost £205. Claims between £5,000 and £10,000 cost £455. A separate hearing fee may apply if your case goes to court.

How long does each process take?

If a small claim is not disputed, it may be resolved in a few weeks. Contested cases often take several months from start to finish. Debt collection agencies can usually begin contacting the debtor immediately and may resolve straightforward, undisputed debts within weeks.

Can I recover my court costs or collection fees?

If you win a small claim, the court may order the other party to repay your court fees. With debt collectors, their commission is normally taken out of what they recover, so you receive the remaining amount rather than the full sum owed.

Do I need a solicitor for small claims?

Most people represent themselves in the small claims court. The process is designed to be accessible without a solicitor, although legal advice can be useful for complex cases. CaseCraft.AI can help with preparing documents and keeping track of deadlines.

Will pursuing a small claim damage my business relationships?

Court action can affect relationships, especially where you have ongoing dealings with the other party. Debt collectors often use more informal and tactful communication, which can help preserve goodwill in some situations.