Unpaid B2B Contracts: Claim Unpaid Commercial Invoices in the UK

Learn your rights under UK law and how our small claims service helps recover unpaid commercial debts quickly and affordably.

When to Use Small Claims Court for Unpaid B2B Contracts

Small claims court offers a cost‑effective route for debts under £10,000. It is suitable when:

- The value is £10,000 or less – including interest and compensation. If your claim exceeds this limit, you must use the fast track or multi‑track.

- Evidence is straightforward – you have clear contracts, invoices and communications. Complex multi‑party disputes may require a higher track.

- You seek monetary relief – small claims courts can award money, but not injunctions or specific performance.

You want to recover interest and costs – you can claim the principal debt, statutory or contractual interest, the fixed late‑payment charge and the court fee. Court fees range from £70 for claims between £500 and £1,000 to £455 for claims between £5,000 and £10,000.

Remember that costs recovery is limited; you cannot usually recover solicitor’s fees in small claims. If the debt is close to £10,000, calculate whether interest and charges will push the claim above the threshold; if so, you may need to use the fast track (consider legal help B2B claim to assess track allocation and costs).

After obtaining a judgment, if the debtor still doesn’t pay, you may need to enforce the judgment. Enforcement methods include a warrant of control, attachment of earnings, garnishee order or charging order. Choose an enforcement order method only if the debtor has assets or income to satisfy the judgment.

Steps to Take Before Legal Action

Going to court should be a last resort. Courts expect parties to attempt to resolve disputes first. Before initiating a small claims business dispute, follow these steps:

Check the contract and payment terms

Verify what was agreed regarding price, deliverables, payment deadlines, late payment charges and dispute resolution. If your terms include statutory interest or a specific late payment clause, calculate the interest accordingly.

Send a polite reminder

Once the due date has passed, contact the debtor by email or letter. Include the invoice number, amount owed, original deadline and payment methods. CaseCraft.AI’s guide recommends giving the client clear payment instructions and your contact details.

Issue a “letter before claim”

Also called a letter before action. This formal demand states that you intend to start legal proceedings if the debt is not paid. It should detail the amount owed, interest, deadline for payment and a warning that you will sue.

Preserve evidence

Keep the contract, invoices, reminders, emails, delivery notes, and any written or recorded communications. Evidence of service delivery, time sheets, acceptance certificates and messages acknowledging the debt are vital.

Common Scenarios of Unpaid Commercial Invoices

Claims for unpaid invoices in the business world are rarely malicious; more often, they involve confusion, cash‑flow issues or avoidance. Typical business contract dispute scenarios include:

SME supplies services, client delays payment – A design agency completes a project for a retail company. Despite reminders, the client ignores the due date. The agency sends a final demand and eventually claims interest under the Late Payment Act.

Contractor receives partial payment – A freelance developer delivers software for a start‑up. The start‑up pays half the agreed amount and disputes the rest, citing minor bugs that were never part of the specification.

Delivery accepted but invoice ignored – A wholesaler delivers goods to a business customer, who uses them but never pays. There is clear evidence of delivery, so the supplier pursues a commercial debt claim.

Dispute over timing or quality used as an excuse – A contractor finishes work late due to client‑caused delays. The client refuses to pay, alleging poor workmanship. If the contract allowed a reasonable extension, the defence may fail, and the debt can still be pursued.

In all of these cases, documenting communications, delivery receipts, and contractual terms strengthens your claim.

Preventing Future Unpaid B2B Disputes

The best way to handle unpaid services is to prevent them. Practical measures include:

- Use written contracts – always document the scope of work, deliverables, price and payment schedule. Include a clause allowing you to charge statutory interest and claim recovery costs under the Late Payment of Commercial Debts (Interest) Act 1998.

- Set clear payment terms – specify when payments are due and the consequences of late payment. Align invoices to the contract, and state that payments become late 30 days after issue if no period is agreed.

- Request deposits – for larger projects, ask for part payment up front. Deposits reduce the risk of complete non‑payment and signal a client’s ability to pay.

- Conduct credit checks – with the client’s consent, review their creditworthiness through reputable agencies before providing services.

- Monitor accounts receivable – have a process for sending reminders as deadlines approach. Many businesses use accounting software to flag overdue invoices and send automated reminders.

- Follow up quickly – addressing delays early increases the chance of payment. Keeping communications professional yet firm helps maintain a good relationship while protecting your interests.

Your Legal Rights Under UK Law

Statutory Interest and Recovery Costs

The Late Payment of Commercial Debts (Interest) Act 1998 gives UK businesses several tools to deter and recover late payments. If another business is late paying for goods or services, you can claim statutory interest, which is 8% above the Bank of England base rate. The government guidance illustrates how this accrues: a £1,000 debt at a 0.5 % base rate would yield about 23 pence per day of interest. You can charge the contractual interest rate if it’s higher, but you cannot claim statutory interest if you have agreed on a different rate.

Once statutory interest starts running, the Act entitles the supplier to fixed compensation for debt‑collection costs. Section 5A specifies a £40 fee for debts under £1,000, £70 for debts between £1,000 and £10,000 and £100 for debts over £10,000. If your reasonable recovery costs exceed the fixed sum, you can claim the difference. These rights apply automatically to commercial contracts, so you don’t need to include them in your terms.

Small Claims Track Under the Civil Procedure Rules

The Civil Procedure Rules allocate money claims to different tracks. Rule 27 makes the small claims track the normal track for any claim with a financial value not exceeding £10,000. Claims between £10,000 and £25,000 go to the fast track, and higher or more complex cases go to the multi‑track. Small claims hearings are informal and designed so parties can represent themselves; only limited costs are recoverable. The Limitation Act 1980 allows you up to six years from the due date to start a claim.

Difference Between B2B and B2C Debt Recovery in the UK

Business‑to‑business (B2B) debts arise from commercial contracts and are governed by the Late Payment Act, the Companies Act 2006 and general contract law. Business‑to‑consumer (B2C) claims are subject to consumer protection statutes. In B2B claims, the courts expect both parties to understand contractual obligations and keep records; interest and compensation are automatic. For consumer disputes, remedies such as the Consumer Rights Act and separate compensation claims and rules apply. As a result, unpaid commercial invoices are usually heard on the small claims track, while consumer claims may involve additional consumer rights.

What Counts as an Unpaid B2B Contract or Invoice?

When a business sells goods or services to another business, the parties normally agree on payment terms. A B2B contract or commercial invoice is considered unpaid when:

- Goods or services delivered, no payment received – you provided goods or completed a project, but the client has not paid by the due date.

- Partial or late payment – the client pays only part of the invoice or delays payment beyond the agreed terms. Under UK law, an invoice is considered late 30 days after it is issued or after delivery if no date is agreed.

- Breach of contract – the other party refuses to pay without good reason, claims defects that are not supported by evidence or unilaterally alters payment terms.

- Fabricated disputes – the debtor raises minor quality or timing issues as a pretext to withhold payment. In many unpaid commercial debt claims, the supplier has fulfilled obligations but must still pursue payment.

Clear contracts with price, delivery milestones and payment terms help prove that a debt is owed. Keeping emails, signed contracts, and proof of delivery makes it easier to demonstrate a breach of contract later.

How CaseCraft.AI Helps with Unpaid B2B Claims

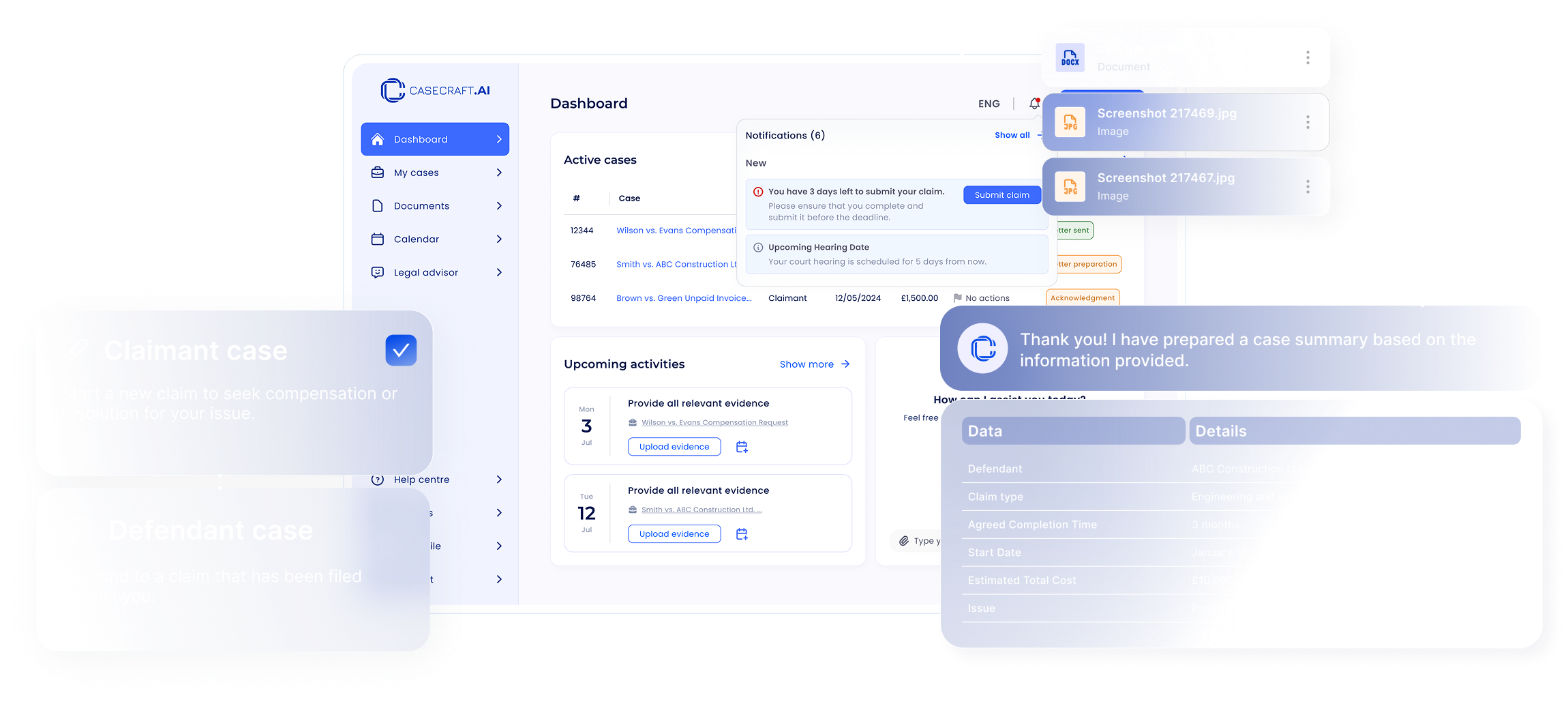

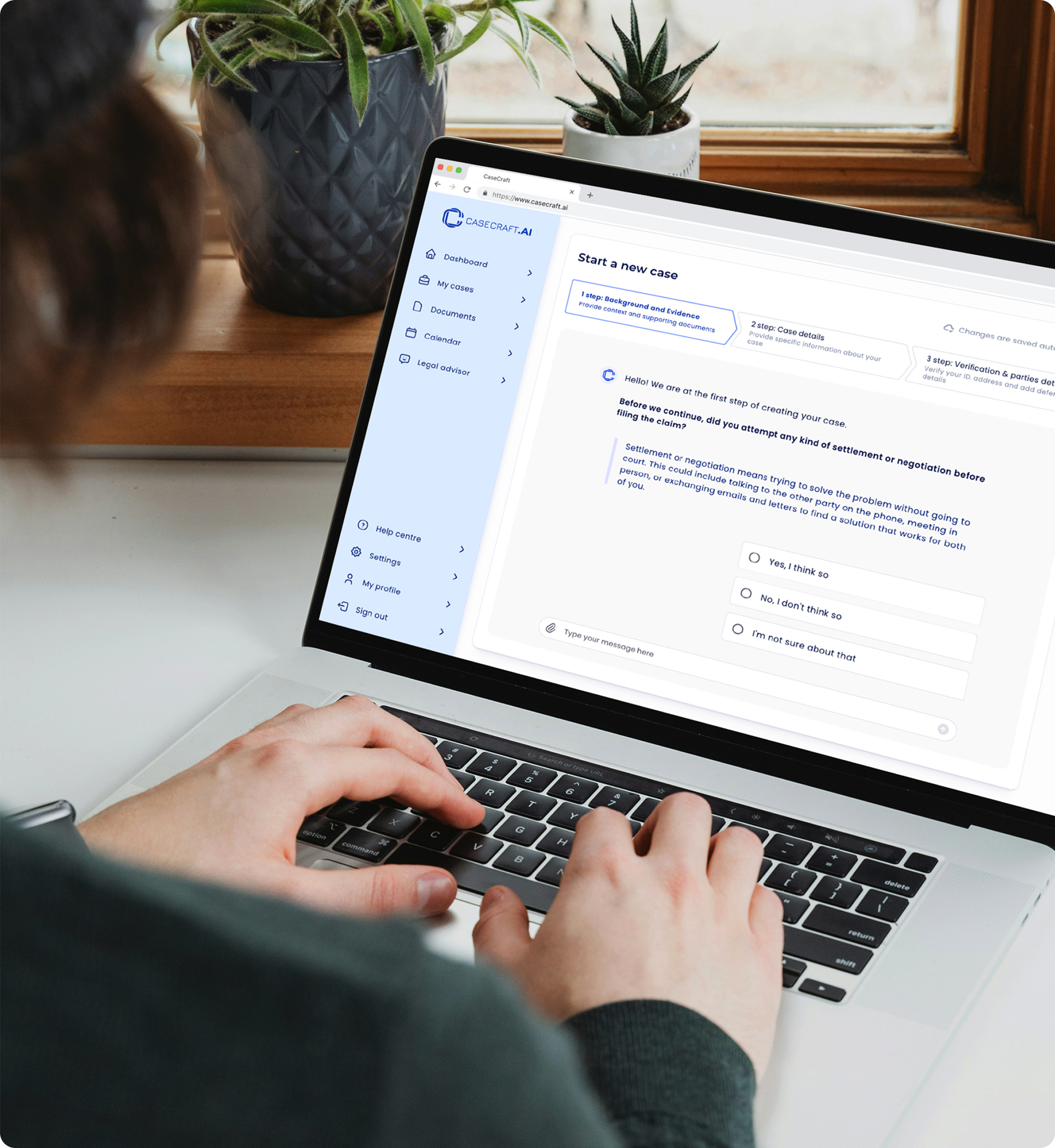

Filing a claim can be time‑consuming and intimidating. CaseCraft.AI is an AI‑powered platform designed to guide claimants through each step. According to the company’s website, CaseCraft.AI:

- Uses auto‑generated legal forms to save hours of work and organise your evidence.

- Enables fast filing in minutes; most users complete the process online in under 15 minutes.

- Provides step‑by‑step AI guidance that helps you prepare evidence, track deadlines and even explore settlement options before court.

- Charges success‑based pricing: a £15 setup fee and 10% only if your claim succeeds. No hidden hourly rates make the service cost-effective for SMEs and freelancers involved in SME disputes.

- It is available fully online and always open, so you can file or respond to claims at your convenience.

- Offers privacy and security: the platform uses bank‑grade encryption and UK‑based servers; it never sells or shares your information, and you remain in full control of your case files.

CaseCraft.AI’s workflow mirrors legal best practice. You answer a questionnaire to share the details of your case, upload evidence, and the platform converts this into a court‑ready claim that meets HMCTS standards. After submission, you can file and track your claim within the platform and receive reminders of key deadlines.

Recover Unpaid Commercial Invoices via Small Claims

Unpaid commercial invoices hurt cash flow and strain relationships. UK law offers robust remedies: the Late Payment of Commercial Debts (Interest) Act 1998 allows you to charge substantial interest and recover costs, while the Civil Procedure Rules provide a simple small‑claims procedure for debts up to £10,000. Taking measured pre‑action steps, checking contracts, sending reminders and a letter before claim, demonstrates reasonableness and often prompts payment.

When legal action is necessary, a modern platform like CaseCraft.AI can transform the process by generating court‑ready documents, guiding you through filing and tracking your claim online, and charging transparent, success‑based fees. With preparation and the right tools, businesses can confidently pursue unpaid B2B contracts UK disputes, protect their cash flow and maintain professional relationships.

Disclaimer (England & Wales): This page is general information, not legal advice. Small-claims rules, fees and limits can change; always check the current gov.uk guidance or get independent legal advice for your situation.

Friendly Asked Questions

What counts as an unpaid B2B contract or invoice?

Any business-to-business sum due under a contract for goods or services that has passed its agreed payment date (or, if none is agreed, the statutory “late” point under UK law).

When is a B2B payment officially “late”?

If there’s a payment date, it should usually be within 30 days for public authorities and 60 days for business transactions; longer terms must still be fair. If no date is agreed, payment becomes late 30 days after delivery/receipt of goods or services or 30 days after the invoice, whichever is later.

What can my business legally add to a late B2B invoice?

You can add statutory interest (8% above the Bank of England base rate) and a fixed debt-recovery fee per invoice (typically £40/£70/£100 depending on the debt size), plus reasonable additional recovery costs if your fixed fee doesn’t cover them.

What’s the small claims limit for business debts?

In England & Wales, money claims up to £10,000 are normally allocated to the small claims track under the Civil Procedure Rules (CPR).

Case Study: Claim for Breach of Contract

A client paid £5,000 for a one-month agreement to use commercial premises but was denied access after just five days. The provider refused to refund the unused period.

The claim was filed for fundamental breach of contract and unjust enrichment. When the defendant failed to respond, the court issued a default judgment, granting full recovery including fees and interest.

CaseCraft.AI supports all common types of small money claims

From unpaid invoices to poor service or contract disputes — most small claims share the same goal: getting back what you’re owed.

CaseCraft.AI helps you handle them all quickly and affordably, without legal complexity.

Don’t Wait – Get

Started Today!

Take the first step toward a faster, easier small

claims process with CaseCraft.AI.