Learn what evidence counts in a UK money claim: contracts, screenshots, invoices, emails, and proof of payment. Step-by-step 2025 guide.

In the UK, small claims cases are decided on the balance of probabilities, so clear documentation is everything: written contracts (or a verbal agreement backed by emails, texts or WhatsApp), invoices and receipts, proof of payment via bank statements, dated photos/screenshots, and short, signed witness statements. Group evidence by type, label it, and put it in strict chronology with a one-line note on relevance. CaseCraft.AI helps you capture, organise and file this evidence in line with court directions.

Introduction

When you pursue a money claim in the UK, your chances of success hinge on what you can prove, not how passionately you feel about being wronged. Judges don’t guess; they weigh evidence. As a claimant, you must show that on the balance of probabilities (more likely than not) the other person owes you money. That means you need solid proof: contracts, receipts, messages, bank statements and more. Without organised documentation, your story may fall flat, and in 2025, the courts expect litigants to be well‑prepared.

Evidence is any document, record, or communication that proves the existence of a debt or agreement between you and the defendant. It includes formal contracts, informal emails, invoices, bank statements, photographs, witness statements and more.

In this guide, we’ll explain what counts as evidence in a money claim, how to organise it effectively, and how the court evaluates it. Whether you’re chasing an unpaid invoice, enforcing a loan to a friend or recovering wages, we’ll show you what proof you need, how to avoid common mistakes and when to seek help. And because CaseCraft.AI specialises exclusively in small claims, we’ll highlight how its platform streamlines evidence gathering and filing so you can focus on your case.

Why Evidence Matters in a Money Claim

In civil law, the burden of proof rests on the claimant. Unlike criminal cases where the prosecution must prove guilt beyond a reasonable doubt, money claims are decided on the balance of probabilities; the judge asks whether it’s more likely than not that your version of events is true. That means even a small amount of credible evidence can tip the scales in your favour.

Civil vs Criminal Standard

Civil disputes (including small claims) ask the judge to decide whose story is more persuasive. Evidence doesn’t have to be perfect or eliminate all doubt; it just needs to show that your claim is more plausible than the defendant’s. However, flimsy or irrelevant evidence, gossip, hearsay or emotional appeals carry little weight. By contrast, credible documents, clear communications, and well‑organised proof can secure an award or encourage the other side to settle early.

CaseCraft.AI has built its entire service around helping you meet this standard. Its platform auto‑generates legal forms, organises your materials into categories and ensures you meet court deadlines. Instead of spending weeks figuring out the rules, you can assemble your case in minutes.

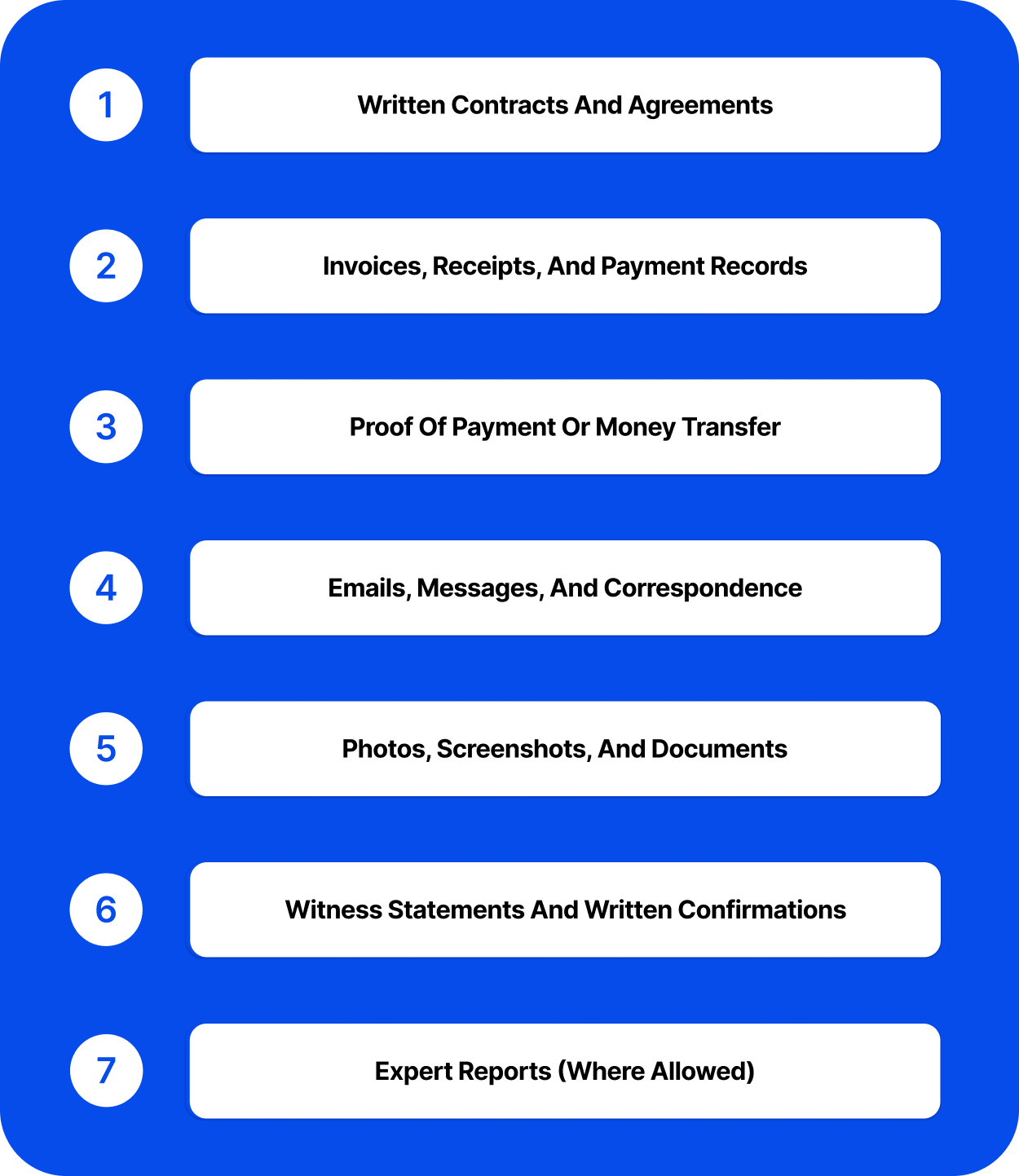

Types of Evidence Accepted in UK Money Claims

Not all proof is equal. Below are the categories of evidence that UK small claims courts accept. Each plays a role in demonstrating the existence of an agreement, the work done or goods supplied, and the amount owed.

Written Contracts and Agreements

Written contracts are the gold standard of proof. They set out terms, responsibilities, and payment obligations in black and white. Examples include:

- Service agreements and purchase orders showing what was promised and at what price. A signed order form or email confirming an order is strong evidence of a money claim in the UK.

- Employment or freelance contracts, which can support claims for unpaid wages or invoices.

- Loan agreements or IOUs, even a simple document stating who borrowed what and when, can help you prove your case.

If you only have a verbal agreement, don’t despair. In England and Wales, oral contracts are generally enforceable, but they are hard to prove. Support the agreement with emails, texts, bank records and witness testimony. These supplementary records tip the balance in your favour. It’s still wise to put all new agreements in writing; otherwise, you risk confusion about terms.

Invoices, Receipts, and Payment Records

Invoices and receipts confirm that work was done or goods were delivered, while payment records prove that money was or wasn’t transferred. Collect:

- Invoices or bills showing what was charged and when payment was due. If you’re pursuing an unpaid invoice, this is your primary evidence.

- Receipts and delivery notes demonstrating that goods were provided.

- Payment confirmations from platforms such as PayPal, Stripe or bank transfer. These show partial or full payment and help calculate what remains outstanding.

Keep unedited copies with visible dates and amounts; altered documents may be challenged. If you’ve used CaseCraft.AI, the platform prompts you to attach these items to your claim, ensuring all money claim online documents are included.

Proof of Payment or Money Transfer

Showing how money moved bolsters your case. Banks and payment apps offer detailed logs; use them. Acceptable items include:

- Bank statements or CSV exports showing transfers to or from the defendant. In the UK small claims courts, bank statements are acceptable proof. Highlight the relevant lines and provide the full page for context.

- Screenshots of online transactions — ensure they are dated, unedited, and show account names and amounts. These can serve as proof of debt in small claims court in the UK.

- Proof of cash payments, such as receipts or a written note signed by both parties.

Emails, Messages, and Correspondence

Digital communications can be persuasive, especially when they show agreement or confirm work. Collect:

- Emails that set out terms, confirm delivery, or chase payment.

- Texts, WhatsApp and social media messages that evidence discussions about the transaction. Courts accept screenshots of messages, but you must identify the sender, recipient and date.

- Letters or memos from the other party acknowledging the debt or promising payment.

Tip: Back up your messages early. If the defendant deletes their account or you change phones, you may lose key evidence. CaseCraft.AI’s case organiser helps you upload and store digital files securely so nothing goes missing.

Photos, Screenshots, and Documents

Sometimes objects speak louder than words. Visual proof can show poor workmanship, damaged goods or compliance with a contract:

- Photographs and videos of defective items, property damage or unfinished work. Label the images with dates and descriptions. If the item is small or portable, keep it in case the judge wants to see the original.

- Screenshots of websites, advertising, or digital interactions that show what was promised. Ensure timestamps and URLs are visible.

- Other documents, such as diaries, logs or notes that show meetings, tasks completed or goods delivered.

Witness Statements and Written Confirmations

Independent witnesses can strengthen your story. In small claims courts, written witness statements aren’t always mandatory, but they can be very useful. A statement should:

- Identify the witness and their relationship to the dispute.

- Explain what they observed: dates, times, actions or conversations.

- Include a statement of truth and signature, showing they understand their duty to tell the truth.

Courts may require witness statements depending on the nature of the dispute and the amount at stake. Even if not required, prepare at least one if there’s someone who can corroborate your account. CaseCraft.AI prompts you to collect witness contact details and can auto‑generate statement templates.

Expert Reports (Where Allowed)

Although not common in low‑value claims, expert reports may be needed for technical matters such as property surveys or professional valuations. The court must give permission before you obtain an expert report, and you may need to share the report with the defendant in advance. In many small claims, photos and receipts suffice; however, if the issue is complex, speak to a legal adviser before commissioning an expert.

How to Organise and Present Evidence Effectively

Evidence is only as good as its presentation. Judges appreciate clarity and efficiency. Poorly organised bundles waste time and may weaken your case. Follow these steps to organise your materials.

Group Documents by Category

Create digital folders for each type of evidence: Contracts, Invoices, Emails, Bank Statements, and Photos. Label each file clearly. The court may ask for both digital uploads and paper copies. CaseCraft.AI automatically groups and labels your materials when you upload them.

Arrange Items Chronologically

Order your documents by date to tell a coherent story. For each category, place the earliest evidence first and progress through to the most recent. This helps the judge follow the timeline and see how the dispute escalated. For example:

- Contract signed (Jan 2025)

- Goods delivered (Feb 2025)

- Invoice issued (Mar 2025)

- Payment chased (April 2025)

- Final letter before claim (May 2025)

Include a Short Summary for Each Evidence Item

Create a cover sheet or index with brief notes. For instance: “Invoice #112 – issued 3 March 2025 for £750 services rendered; unpaid as of 10 May 2025.” This summary helps the judge (and the defendant) understand why the document matters.

Avoid Common Evidence Mistakes

- Altered or incomplete documents. Courts may reject evidence if it appears tampered with or lacks context.

- Missing sender or recipient details. Show who sent the email or message and when.

- Unreadable or low‑quality files. Photographs and scans should be clear. If you compress files to meet upload limits, ensure they remain legible.

- Excessive duplicates. Quality beats quantity. Select the most relevant materials.

Submitting Evidence Online

Most small claims are filed online, and the court will instruct you to upload documents via its portal or email. When using an online service like CaseCraft.AI, the platform converts your files into court‑accepted formats (PDF or JPEG) and notifies you of file size limits. Always keep a backup of your uploads in case of technical problems.

CaseCraft.AI Tip: During the preparation stage, you can generate a court‑compliant evidence bundle automatically. The service prompts you to add supporting documents, groups them correctly and warns if anything is missing.

What Evidence Not to Use

While courts are flexible, some materials should be avoided. The following are commonly excluded or given little weight:

- Irrelevant documents. Only include items that prove the debt or dispute. Extraneous material wastes time.

- Illegally obtained recordings. Secret recordings without consent may be inadmissible and could breach data protection laws.

- Hearsay without notice. Statements from people who will not attend or sign a statement must be disclosed early.

- Evidence not shared with the other side. Withholding documents breaches disclosure rules and can lead to exclusion.

- Opinions disguised as fact. Courts care about what happened, not speculation.

For a comprehensive list of what not to do in small claims court, see our guide on what you cannot do in small claims court.

How Judges Evaluate Evidence

Small claims judges look for clarity, authenticity, relevance and consistency. They prefer documents over oral assertions and will compare your materials against the defendant’s. Here’s what they consider:

- Relevance. Does the evidence directly relate to the claim? Irrelevant details are ignored.

- Authenticity. Is the document genuine and unaltered? The judge may compare the original with photocopies. In digital evidence, metadata such as timestamps can support authenticity.

- Clarity and presentation. Is the information easy to read and follow? Well‑indexed bundles make a strong impression.

- Consistency with other proof. Does your evidence tell the same story across emails, invoices and bank statements? Inconsistencies (e.g., invoice shows £400 but claim is for £500) may reduce your award.

Courts also recognise that people sometimes forget details. A written witness statement can preserve memory. Judges may decide not to order witness statements for very simple disputes, but being prepared never hurts.

FAQ: About Money Claim Evidence

What documents do I need for a money claim?

Gather any document that proves the existence of a contract or debt: signed agreements, invoices, receipts, bank statements, emails and texts showing orders or promises, and letters before action. Photos of defective products and witness statements may also help.

Can screenshots count as evidence?

Yes. Courts accept screenshots of emails, texts and online payments as long as they are relevant and unedited. Make sure they show the sender, recipient, date and amount. Use clear, full‑length captures rather than cropped excerpts.

Are WhatsApp messages accepted in the UK small claims court?

Yes. Messages from WhatsApp, SMS or other messaging platforms can be used if they show agreement or payment discussions. Present them chronologically and identify the participants and dates. Always back up your chats early.

Do I need witnesses for a money claim?

Not always. Many simple claims rely on documents alone. However, if someone else witnessed the agreement or delivery, ask them to provide a written statement. Witness statements should follow the court’s format and include a statement of truth.

Can I submit photos as proof?

Absolutely. Photos and videos of defective goods or poor workmanship can be persuasive. Include a caption and date for each image and, if relevant, bring the original item to the hearing.

How do I submit my evidence online?

Online systems require you to upload PDFs or JPEGs. Ensure each file is labelled and within size limits. CaseCraft.AI’s platform converts and submits your documents in court‑approved formats and tracks submission deadlines so you don’t miss them.