1. Confusion about rules – many sole traders and consumers don’t know whether to follow the Pre-Action Protocol for Debt Claims or the general practice direction. The debt protocol applies when a business pursues an individual debtor and requires a letter of claim with specific enclosures. Otherwise, the general pre-action conduct rules apply, and shorter response periods may be reasonable.

2. Missing information in the letter – a robust letter before action (also known as a letter before claim or letter of claim) must set out the facts, the amount due with interest calculations, and enclose supporting documents. Failing to include key details weakens your position and can affect costs later.

3. Ignoring deadlines and mediation – debtors have 30 days to respond under the debt protocol and around 14 days under the general practice direction. From May 2024, money claims up to £10,000 are automatically referred to a free one-hour mediation session; skipping this step can result in sanctions.

Introduction

A letter before action is a formal warning that the creditor will start legal proceedings if an overdue debt isn’t paid. It gives the debtor one last chance to settle or propose a resolution and, in England and Wales, demonstrates compliance with the civil courts’ pre‑action requirements.

This article explains what a letter before action (sometimes called a letter before claim or letter of claim) is, when you need one for small debt claims, which rules apply, and what must be included. Throughout, we focus on small claims, money disputes under £10,000, where the courts expect parties to attempt settlement, follow the correct protocol, and attend compulsory mediation.

From Paper to Digital

Since July 28, 2025, most money claims must be filed online. Paper claims are no longer accepted except in specific circumstances. The mediation requirements discussed in this article apply to eligible claims filed online through HMCTS systems. Additionally, the mandatory mediation program is currently operating as a pilot scheme until May 21, 2026.

What is a Letter Before Action Is and What is It Also Called?

A letter before action is a concise, formal notice delivered by the creditor to the debtor before issuing a claim. Its purpose is to set out the facts, state the amount owed, and invite the debtor to pay or respond. The terminology varies: businesses recovering unpaid invoices may call it a letter of claim, letter before claim, or pre‑action letter; consumers chasing refunds sometimes refer to a final demand letter; and lawyers may talk about court letters. Whatever the label, the letter is a final, documented attempt to resolve the dispute without court proceedings.

Why Terminology Matters?

- Letter before action/letter before claim: Commonly used in small claims to describe a demand letter sent before starting litigation.

- Letter of claim: The official term used in the Pre‑Action Protocol for Debt Claims when a business claims against an individual debtor.

- Pre‑action protocol letter: A general description for letters sent under any court protocol. For example, there are specific protocols for construction disputes, professional negligence, and personal injury.

- Court letter: A colloquial term for a letter threatening court proceedings.

Using consistent terminology in your correspondence helps avoid confusion. In your letter, refer to it as a “letter before action” and, if the debt protocol applies, note that it is a “letter of claim” under the Pre‑Action Protocol for Debt Claims.

When Do You Need One for a Small Debt Claim?

Before issuing a small claim, you must give the debtor reasonable notice. Typical triggers include unpaid invoices, failed payment plans, returned goods not refunded, or disputed charges. If you’re a business chasing payment from an individual, including sole traders, the Pre‑Action Protocol for Debt Claims applies. It aims to encourage early communication, disclose documents, and avoid disproportionate costs.

In all other cases (e.g., consumer claims against companies, business‑to‑business debts where the debtor isn’t a sole trader), the general Practice Direction on Pre‑Action Conduct applies.

Small Claims Track Context

The small claims track of the County Court normally deals with claims worth up to £10,000. It is designed to be accessible without lawyers, with simplified procedures and limited cost recovery. If your claim exceeds £10,000, it will usually be allocated to the fast track or intermediate track, where different rules and costs apply.

For small claims, the courts now require parties to attempt mediation. Since 22 May 2024, all money claims under £10,000 issued on paper are automatically referred to a free one‑hour mediation session.

Failure to mediate can result in orders delaying the claim or sanctions. Thus, a letter before action is not just a courtesy; it sets the tone for cooperation and helps you later demonstrate that you tried to settle.

Which Pre‑Action Rules Apply? (Quick Decision Guide)

The decision about which rules to follow depends on who the parties are. The table below summarises the two main paths.

| Scenario | Applicable protocol | Response window | Key enclosures |

| Business creditor vs individual debtor (including sole trader) | Pre‑Action Protocol for Debt Claims | 30 days to reply; creditor must allow extra time if debtor seeks advice or requests documents | Information Sheet, Reply Form, Financial Statement (Annexes 1 & 2) |

| All other combinations (e.g., consumer vs business, business vs company, consumer vs consumer) | Practice Direction – Pre‑Action Conduct and Protocols | “Reasonable time” – often 14 days in straightforward cases | No prescribed forms; letter must state basis of claim, facts, remedy sought, and how the amount is calculated |

If you are unsure which category applies, consider whether your claim is about a business debt owed by an individual. If yes, follow the debt protocol; if not, follow the general practice direction. Erring on the side of caution and including more information is better than less; courts take compliance into account when awarding costs.

What the Letter Must Include?

Your letter must be clear, factual and complete. The debt protocol sets out specific requirements:

- Parties’ details: Names, addresses, and reference numbers. If you’re a company, include your registered number and trading name.

- Background and basis of the claim: Describe the contract or arrangement, what goods or services were provided, dates of invoices, and any attempts to resolve the issue.

- Amount due and calculation: Break down the principal sum, interest and charges. Under UK law, statutory interest on late commercial payments is 8% plus the Bank of England base rate. For example, a £1,000 invoice paid 60 days late would accrue £1,000 × 8% ÷ 365 × 60 = approximately £13.15 in statutory interest. If you agreed on a different rate in the contract, specify it.

- Documents relied upon: Enclose copies of the contract, invoices, statements of account, and relevant correspondence. For debt protocol cases, you must also enclose the Information Sheet, Reply Form and Financial Statement (found in Annexe 1 and Annexe 2 of the protocol).

- What you want: State whether you seek immediate payment or a repayment plan. Specify a deadline for payment (e.g., 30 days for protocol letters, 14 days for general letters) and invite the debtor to propose a resolution.

- Dispute resolution invitation: Encourage the debtor to contact you to discuss the matter or propose alternative dispute resolution (ADR), such as mediation. Under the debt protocol, the creditor should discuss repayment proposals and consider the debtor’s financial position.

- Consequences of non‑payment: Explain that if you do not receive payment or a satisfactory response by the deadline, you intend to commence proceedings. Mention that the court may impose cost penalties if the debtor fails to respond without good reason.

Following this structure helps demonstrate good faith. Aggressive tone, vague demands, or unrealistic deadlines can undermine your position and may be criticised by the court.

Example: Calculating Interest and Charges

Assume you supplied graphic design services for £2,000, due on 1 March 2025, and nothing was paid by 1 April 2025; your contract allows statutory interest, and you sent your letter before action on 1 July 2025. For late commercial payments, the statutory interest rate is 8% + the Bank of England base rate. The current Bank Rate is 3.75% (as published by the Bank of England), so the total annual statutory rate is 11.75% (8% + 3.75%). Interest for 122 days (1 March to 1 July) is: £2,000 × 0.1175 × 122/365 ≈ £78.55. If you also charge the fixed late payment fee (£70 for debts between £1,000 and £9,999.99), your letter would state: Principal: £2,000; Interest: £78.55; Fixed fee: £70; Total: £2,148.55.

Always check the current Bank of England base rate and explain your calculations in detail.

Deadlines and Response Windows (14 days vs 30 days)

The debt protocol gives the debtor 30 days to reply from the date of the letter. If the debtor returns the Reply Form requesting documents or debt advice, the creditor should allow a reasonable extension, typically an extra 30 days, before starting a claim. A creditor who ignores these timings risks the court staying the proceedings or penalising them in costs.

Under the general pre‑action conduct practice direction, there is no fixed period. The defendant should respond within a “reasonable time”. In straightforward debt cases, a response period of 14 days is usually considered reasonable. For complex disputes (e.g., involving counterclaims or expert evidence), a longer period, up to three months, may be appropriate.

Timelines and Mediation

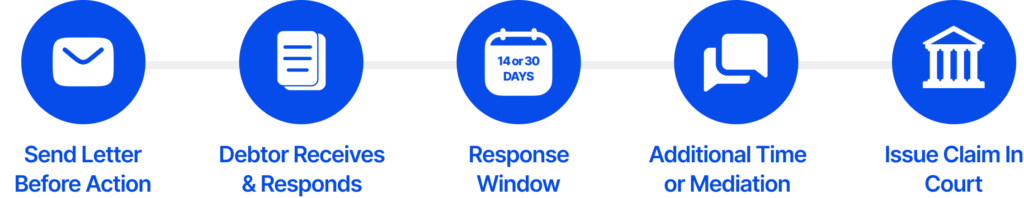

The graphic below shows the typical timeline for small debt claims, from sending the letter before action to issuing the claim:

- Send a letter before action. Post it the same or the next day after dating it, and, if possible, email it too.

- Debtor receives and responds. They have 30 days (debt protocol) or 14 days (general practice) to reply. If they ask for documents or advice, extend the deadline accordingly.

- Response window. During this period, you can negotiate, agree on a payment plan, or consider ADR. Keep records of communications and proposals.

- Additional time or mediation. If the debtor responds, allow further time to exchange information or schedule mediation. Since May 2024, small claims under £10,000 must be mediated before trial.

- Issue a claim in court. If the debtor ignores your letter or negotiations fail, you may issue a claim. Claims worth up to £10,000 normally proceed on the small claims track.

How to Send It and How to Prove You Sent It?

Send your letter by first‑class post and, if you have the debtor’s email address, by email. The debt protocol specifies that the letter should be clearly dated and posted on the day it is dated or the following day. Emailing as well ensures quicker delivery and creates a digital record. Always:

Keep copies. Retain a signed copy of the letter and any enclosures. Save a PDF of your email.

Proof of posting. Get a certificate of posting from the post office or use recorded delivery for evidence.

Envelope and addressing. Use the debtor’s last known address. For corporate debtors, send it to the registered office and any trading address.

If you are using the online letter generator at CaseCraft.AI, the system creates a PDF letter, attaches the necessary forms, and logs the send date. You still need to print and post it, but the platform helps ensure compliance and stores an audit trail. This is particularly useful for freelancers and small businesses who cannot afford solicitors but need to follow the rules.

Letter Before Action Template (UK) + Example

A template helps ensure you cover all essential elements. Below is a simplified version; you can download a fully formatted copy using the link beneath the example.

Template Structure

Heading: “Letter Before Action” with the date and your reference number.

Parties: Identify the creditor and debtor, including trading names.

Background: Summarise the agreement, goods or services provided, and invoice details.

Amount due: Break down principal, interest, and any fees.

Enclosures: List attached documents (contract, invoices, information sheet, reply form, financial statement).

What you want: Specify the payment deadline and invite proposals

Invitation to ADR: Express willingness to discuss and mediate.

Consequences: Warn that proceedings will start if you receive no response.

Sample Extract

Parties: Creditor: ABC Graphic Design Ltd (Company No. 123456), 1 Market Street, Cardiff. Debtor: John Smith, trading as Smith’s Coffee, 4 High Street, Newport.

Background: On 1 February 2025, we entered into an agreement for us to design promotional materials for your café. We delivered the final artwork on 10 March 2025 and invoiced you on the same date. The invoice, £800, was due on 10 April 2025. Despite reminders on 30 April and 15 May, payment remains outstanding.

Amount due: Principal £800; statutory interest at 8% + Bank of England base rate (13% total) from 10 April to 1 July (82 days) = £800 × 13% × 82/365 ≈ £23.36; fixed late payment fee £40. Total: £863.36.

Template Variants

The structure above works for most debt recovery situations. However:

- For business‑to‑business debts, you can omit the Information Sheet and Reply Form but should still invite discussion and attach invoices.

- For consumer claims (e.g., faulty goods), emphasise the nature of the complaint and specify the Consumer Rights Act breach.

- For tenancy or deposit disputes, cite the tenancy deposit scheme rules and attach the tenancy agreement. Remember that small claims cover deposits up to £10,000 and can include rent arrears or property damage.

What Happens After You Send It?

After sending your letter, several outcomes are possible:

- Full payment. The debtor pays the amount demanded by the deadline. You should send a receipt and close the matter.

- Negotiation. The debtor may propose a payment plan or dispute part of the claim. Under the debt protocol, the parties should try to reach an agreement and consider ADR.

- Dispute. The debtor may contest liability or amount. They should explain their reasons and provide supporting evidence. You must assess their arguments and, if unresolved, prepare for litigation. The CaseCraft.AI platform can help organise evidence, prepare witness statements, and guide you through mediation.

- No response. If you receive no reply, you may issue a claim once the response period expires. Under the debt protocol, this is after 30 days (or longer if documents were requested); under the general practice direction, 14 days is usually sufficient. When you issue a claim, the court will send the debtor a “response pack”, and they have 14 days to acknowledge and 28 days to file a defence.

Issuing the Claim and Court Fees

When issuing a claim, you must pay a fee. For 2025–2026 the issue fees are £35 for claims up to £300, £50 for claims up to £500, £70 for claims up to £1,000, £80 for claims up to £1,500, £115 for claims up to £3,000, £205 for claims up to £5,000, and £455 for claims up to £10,000. Hearing fees range from £27 to £346, depending on the claim amount. If you win, the court may order the debtor to reimburse your issue fee, but you usually cannot recover legal costs on the small claims track.

Default Judgment and Mediation Outcomes

If the defendant doesn’t respond to the claim, you can apply for a default judgment. However, since May 2024, the court will only enter judgment after the parties have had an opportunity to mediate. Mediation remains confidential, and voluntary agreements reached there are enforceable contracts. If mediation fails, the court will set a hearing date. You should prepare by gathering evidence, complying with disclosure deadlines, and possibly attending a virtual hearing.

Common Mistakes that Weaken Your Position

Even a well‑intentioned claimant can harm their case by making avoidable errors. Avoid these pitfalls:

Vague or aggressive letters. Demanding payment without explaining the basis of the claim or using threatening language undermines your credibility. Use neutral, factual language.

Unrealistic deadlines. Giving the debtor just a few days to pay is rarely reasonable. Courts expect creditors to allow at least 14 days (general practice) or 30 days (debt protocol).

Incorrect interest calculations. Overstating interest or adding charges not allowed by contract can be challenged. Use statutory rates correctly and itemise the calculation.

Failing to send the required forms. Omitting the Information Sheet, Reply Form or Financial Statement when the debt protocol applies is a breach. Courts may order you to re‑issue the letter, delaying the claim.

Ignoring mediation. Refusing to mediate can lead to sanctions.

Poor record‑keeping. Not retaining copies of letters, proof of posting, and evidence weakens your case. Keep an audit trail from the start.

Skipping the letter altogether. Going straight to court without giving notice may result in the claim being struck out or costs penalties.

Next Steps

Writing a clear, well‑structured letter before action is an essential step in recovering small debts in England and Wales. It demonstrates that you’ve acted reasonably, complied with pre‑action rules, and encouraged settlement. To summarise:

- Identify which protocol applies, debt claims (business vs individual) or the general practice direction.

- Include all necessary details: parties, facts, amount owed, supporting documents and forms, and invitation to resolve.

- Allow the debtor sufficient time to respond (30 days for debt protocol, 14 days otherwise) and be prepared to discuss repayment or ADR.

- Keep records and proof of sending, and use tools like CaseCraft.AI to generate compliant letters, manage evidence and track deadlines.

- If there is no satisfactory response, issue a claim and participate in compulsory mediation before the court hearing.

By following these steps and using the template provided, you can pursue small debts efficiently and professionally while respecting the court’s expectations. Remember that clear communication is more likely to resolve disputes without the need for a hearing, saving time, money and stress.

Note: This content is provided for general information purposes only and does not constitute legal advice; laws and court procedures change, every case depends on its own facts, and you should consider getting advice from a qualified legal professional before taking any action based on the information in this article.

FAQ

What is a letter before action?

A letter before action (or letter before claim) is a formal notice sent to a debtor warning that court proceedings will be issued if the debt isn’t paid. It sets out the facts, the amount owed, and gives the debtor a final chance to resolve the issue. It’s a key requirement under pre‑action protocols in England and Wales.

Is a letter before claim the same as a letter of claim?

Yes. The terms “letter before action”, “letter before claim” and “letter of claim” are often used interchangeably. The Pre‑Action Protocol for Debt Claims uses the term “Letter of Claim”. Regardless of terminology, the letter’s contents and purpose remain the same.

How long should I give them to respond?

If the debt protocol applies (business vs individual debtor), give 30 days. Otherwise, 14 days is usually reasonable. Extend the period if the debtor requests documents or needs time to seek advice.

What if there’s no response to the letter before action?

If the debtor doesn’t respond within the deadline, you may start a court claim. You should wait for the full response period (30 or 14 days). When you issue the claim, the court will still require mediation for claims under £10,000.

Can I use a letter before action template in small claims?

Yes. Templates help ensure you comply with the rules. Our downloadable template includes the required forms for the debt protocol and prompts you to fill in the factual details. Remember to adapt it to your situation.

Do I need a solicitor’s letter before action?

Not necessarily. In small claims, parties often act in person. You can draft and send the letter yourself as long as it meets the protocol requirements. However, legal advice may be helpful in complex cases or where large sums are involved. Platforms like CaseCraft.AI automate letter drafting and evidence preparation at a lower cost than solicitors.