1. You must send a letter before action and give your landlord a chance to resolve the problem. If they don’t respond or refuse to pay, you can file a claim with the county court. Court fees range from £35 for claims under £300 to £455 for claims up to £10,000.

2. Evidence is critical. A written tenancy agreement, inventory, correspondence about repairs or deposits, receipts and photos will strengthen your case.

3. Not all disputes belong in small claims. Claims for repairs above £1,000 or requests for an injunction to force repairs should be taken through different routes. Always consider alternative dispute resolution before suing.

Introduction

Renting a home in England or Wales gives tenants significant protections under UK tenant rights law. When those rights are ignored, for example, when a tenant claims against the landlord arises due to an unreturned deposit, neglected repairs, or breach of tenancy agreement, small claims can provide an effective solution.

The tenant small claims UK process is designed to be accessible and affordable, allowing individuals to recover money owed without hiring a solicitor. The Ministry of Justice reports that the median time from claim to trial was 40.6 weeks in mid‑2025. Despite improvements, mistakes in paperwork or missing evidence still cause many tenants to lose cases.

Tenancy disputes often feel personal. Imagine a landlord withholding your £1,500 deposit for “wear and tear” or ignoring a leaking roof that spoils your belongings. Without legal guidance, it’s hard to know when to sue a landlord in the UK or what the chances of success are. Many renters walk away from claims worth thousands because the process seems intimidating.

First, we explain what the small claims court is and how it works. We then cover the main reasons tenants sue landlords: deposits, negligent repairs, unlawful deductions, breaches of contract and harassment. Next, we look at what compensation you can claim and what evidence you need. We finish with a practical guide to starting a claim, what happens after you win, scenarios where small claims aren’t suitable, and answers to frequently asked questions.

What Is the Small Claims Court?

The small claims court (the small claims track of the county court) deals with straightforward money disputes worth up to £10,000. It’s designed for self‑represented parties and offers lower fees and simplified procedures.

This track handles cases, such as disputes over unreturned deposits, minor housing repairs and unpaid invoices. Claims involving personal injury or housing disrepair where the cost of repairs is £1,000 or less go on the small claims track; for higher disrepair costs, different tracks apply.

Small claims cases are usually decided by a district judge in a brief hearing. Formal rules of evidence still apply, but proceedings are more flexible than in higher courts. Because legal costs aren’t normally awarded, the risk of paying the other side’s lawyer is limited. The process aims to encourage settlement before trial; as of May 2024, mediation is mandatory for many claims under £10,000.

Why Small Claims Are Attractive for Tenants

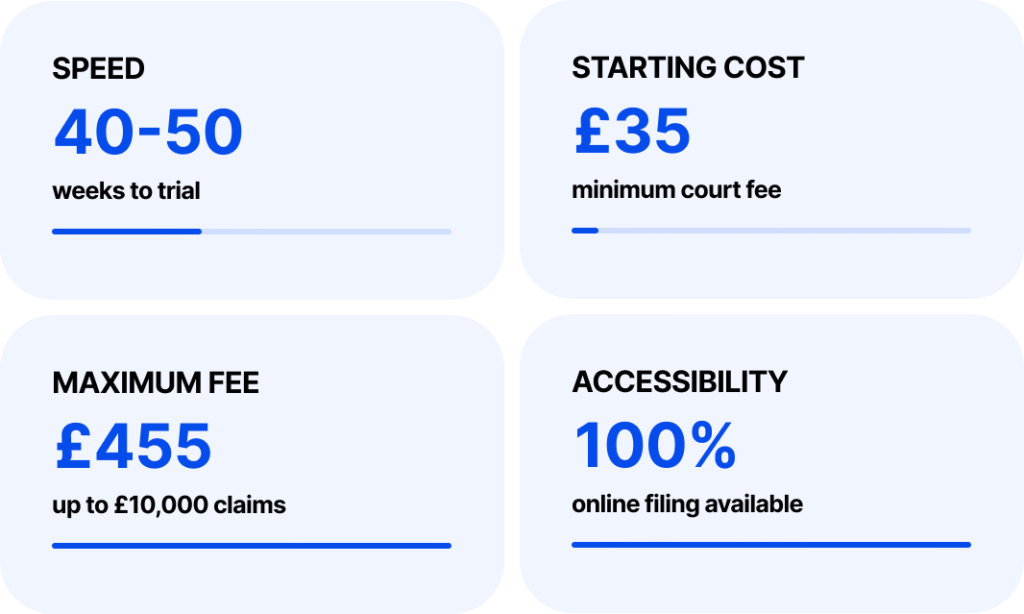

- Speed. While county courts can be slow, small claims cases now reach trial in around 40–50 weeks, much faster than other tracks.

- Low cost. Court fees start at £35 and cap at £455 for claims up to £10,000. You won’t usually pay your landlord’s costs if you lose.

- Accessibility. You don’t need a solicitor. Guides like this and platforms such as CaseCraft.AI help you navigate the paperwork, evidence and deadlines.

- Online filing. Claims can be filed electronically, and some hearings are held remotely. You only need to attend court in person if the judge feels it’s necessary.

Common Reasons Tenants Take Landlords to Small Claims Court

Disagreements with landlords vary widely, but most tenant claims against landlords fall into a few categories. Below, we explore each one, explaining the legal action against the landlord process, the legal basis for each type of claim, and what you can seek in compensation.

Unreturned or Unprotected Deposit

Landlords in England and Wales must protect tenants’ deposits in an authorised tenancy deposit scheme. If your landlord fails to protect your deposit or refuses to return it at the end of the tenancy, you can apply to the county court for compensation. GOV.UK advises that the court can order the landlord to repay the deposit or pay it into a scheme, and may order them to pay you up to three times the deposit. This penalty reflects the seriousness of non‑compliance.

In small claims, you can seek:

- Return of the deposit. The court will order your landlord to repay your money if they can’t prove that the deductions are justified.

- Penalty of 1–3× the deposit. The Housing Act 2004 allows judges discretion to award between one and three times the deposit where it hasn’t been protected.

Be sure to gather:

- Tenancy agreement breach and deposit receipt.

- Evidence of the deposit protection certificate (or absence thereof).

- Any correspondence requesting the return of the deposit.

Note: Section 213 claims for unprotected deposits must be done using the Part 8 procedure, which means they cannot be heard in Small Claims Court. These claims require different procedures and practically necessitate legal representation.

Negligent or Unrepaired Property Damage

Landlords must keep the property’s structure, plumbing, heating, gas, electrics, and sanitation in good repair. They also have a clear duty of care, landlord obligation, including annual gas checks, safe electrics, and working smoke alarms. If they fail to carry out repairs and you suffer a loss, for example, belongings damaged by a leak or health issues caused by mould, you may be entitled to compensation through small claims for property damage.

The small claims limit of £10,000 applies to most housing disputes. The small claims process can be used for repairs costing less than £1,000 and compensation up to £1,000. Claims solely for compensation (where you’ve already moved out or fixed the issue) can reach up to £10,000. Courts can award damages for:

- Cost of repairs or replacement of damaged items.

- Health and inconvenience. If disrepair caused ill health or made rooms unusable, the court may award a proportion of your rent for the affected period.

- Alternative accommodation. If you had to move out temporarily, you could claim those costs.

For a deeper look into how to build your case and calculate losses, read our full guide: Negligent Landlord Repairs: Claim for Losses Caused by Delayed Repairs.

Unlawful Deductions from Deposit

Not all deductions are lawful. Landlords can deduct for damage beyond fair wear and tear, cleaning if you left the property unusually dirty, or rent arrears. They cannot deduct for normal use or routine redecoration. When your deposit is not returned or deductions seem unfair, you can first challenge them through your tenancy deposit scheme’s free adjudication process. If you miss that deadline or disagree with the outcome, you can bring a tenant small claims UK action to recover the amount owed.

To succeed, assemble:

Check out the inventory and photographic evidence showing the property’s condition at move‑in and move‑out.

Receipts for cleaning or repairs you carried out.

Written correspondence challenging the deductions.

Breach of Tenancy Agreement

A tenancy agreement is a contract. Breaches can include failure to provide promised services (for example, including a cleaner in rent but never arranging one), overcharging for utilities, not refunding overpaid rent or failing to repair fixtures. You must show the term breached and the financial loss. Compensation can include the cost of the missing service or a portion of rent.

Unlawful Entry or Harassment

Landlords must give at least 24 hours’ written notice before entering your home (except in emergencies). Unlawful entry or harassment (changing locks, threatening eviction) may also constitute criminal offences. Serious cases are dealt with by local councils or the police, but you can use small claims to recover financial losses, such as the cost of new locks or stolen property. Evidence like witness statements, police reports, or photos will be vital.

What Tenants Can Claim in Small Claims Court

Understanding the types of losses you can recover helps you decide whether litigation is worthwhile. In most cases, you can claim:

- Deposit refunds and penalties when the deposit isn’t returned or protected.

- Repair costs and damages for negligent or delayed repairs, including replacement of belongings.

- Loss of amenity, for example, if a faulty boiler left you without heat and hot water, the court may award a portion of rent.

- Cleaning or replacement costs where deductions were unfair.

- Compensation for contract breach, such as the value of an agreed service not provided.

- Rent repayment orders for up to 12 months’ rent when the landlord commits specified offences.

You cannot usually claim for emotional distress unless the distress results in a quantifiable loss (e.g., medical bills). Courts focus on financial damages.

Small Claims Limit and Special Cases

The general cap for a tenant to take a landlord to court is £10,000. However, claims involving personal injury or housing compensation for disrepair have a £1,000 limit. There is no minimum claim amount; you can sue for as little as a few pounds. Keep in mind that court fees could exceed those for tiny claims, so consider alternative dispute resolution or deposit adjudication schemes for low‑value disputes.

Evidence Tenants Need to Succeed

Judges decide cases based on tenant evidence for small claims. Without proper documentation, even a valid complaint may fail. Here’s what you need:

Written Tenancy Agreement

A tenancy agreement is a legally binding contract, and a landlord’s breach of contract occurs when the landlord fails to meet the agreed-upon terms. Breaches can include failure to provide promised services (for example, including a cleaner in the rent but never arranging one), overcharging for utilities, not refunding overpaid rent, or failing to repair fixtures. You must show both the specific term breached and the financial loss suffered. Compensation can include the cost of the missing service or a proportion of rent for the affected period.

Inventory and Inspection Reports

Inventories taken at the start and end of your tenancy show the property’s condition. Photos of walls, carpets and fixtures help demonstrate whether damage is beyond normal wear and tear. Make sure the inventory is signed by both parties.

Correspondence and Notices

Keep copies of all emails, letters, or text messages requesting repairs or deposit returns. We emphasise the importance of maintaining clear proof of damage or loss, showing that you informed your landlord about repair problems and allowed a reasonable time for them to act. For deposits, keep any acknowledgements or correspondence from the tenancy deposit schemes as additional evidence.

Receipts and Photos

Gather receipts for cleaning, replacement items, alternative accommodation and professional reports (e.g., surveyors). Photos or videos of damage provide compelling evidence. For health issues, include medical records or prescriptions.

How to Start a Small Claim Against a Landlord

Even when you’re convinced your landlord owes you money, it’s important to understand your landlord’s obligations in the UK and the proper legal steps before issuing proceedings. Following these steps not only improves your chances of settlement but also shows the court that you acted reasonably and in good faith.

Step 1: Send a Letter Before Action

Write to your landlord setting out the problem, what you’re claiming and how much you seek. Explain that you will start a county court claim if they don’t respond within a specified period (usually 14 days). This is part of the pre‑action protocol for civil claims. Keep a copy of the letter and any responses.

Step 2: File a Claim

If the landlord doesn’t resolve the issue, you can file your claim online or via paper form. Claims under £10,000 can be filed digitally and attract lower fees. GOV.UK’s court fee table shows that claims up to £300 cost £35, those between £5,000 and £10,000 cost £455. If you are on a low income or benefits, you may apply for fee remission. Complete the claim form carefully; CaseCraft.AI can generate a court‑ready claim that meets HMCTS standards, ensuring the right forms and correct interest calculations.

Step 3: Serve the Claim and Wait for a Response

Once filed, the court will serve the claim on your landlord. They must respond within 14 days. They can admit the claim, ask for more time, or file a defence. If they ignore it, you can request a default judgment, which orders the landlord to pay without a hearing.

Step 4: Prepare for Hearing and Mediation

If the landlord disputes the claim, you may be offered mediation (now mandatory for many small claims). Mediation is free and often resolves cases quickly. If mediation fails, the court will list a hearing. Send copies of all evidence to the court and landlord ahead of time. On the day, summarise your case clearly and concisely. Small claims hearings are informal, typically lasting one to two hours, but you must respect court etiquette.

What Happens After Winning a Small Claim

If you win, the court will issue a judgment stating how much the landlord must pay and when. Sometimes landlords pay promptly, especially if they want to avoid a County Court Judgment (CCJ) on their credit record. If they don’t pay, you can enforce the judgment through:

- Warrant of control. Bailiffs can seize and sell goods to satisfy the debt.

- Attachment of earnings. The landlord’s employer pays part of their wages to you.

- Third‑party debt order. Freezes money in the landlord’s bank account.

- Charging order. Secures the debt against the landlord’s property.

Enforcement has extra fees, but these are usually recoverable from the landlord. Keep in mind that some landlords might be insolvent or have no assets, so consider the likelihood of recovery before investing time.

When a Tenant Shouldn’t Use Small Claims Court

Small claims are not suitable for every housing dispute. Avoid the small claims route if:

- You want the landlord to carry out repairs, and the estimated cost exceeds £1,000. Instead, involve environmental health or seek injunctions.

- Your claim involves complex legal issues such as substantial personal injury, structural defects or discrimination. These require specialist legal advice.

- The landlord’s breach is ongoing, and you need an immediate remedy (e.g., stopping harassment or dangerous conditions). Contact your local council or the police.

- The amount claimed is very small; court fees might exceed the sum. Consider mediation or a deposit scheme’s adjudication instead.

For serious or persistent breaches, tenants can also report the landlord to the local authority or seek a rent repayment order.

Disclaimer: This article is for general information only and does not constitute legal advice. Always seek professional guidance for your specific situation.

FAQ: Tenants Taking Landlords to Small Claims Court

When can a tenant take a landlord to small claims court?

You can take a landlord to small claims court when you suffer a financial loss arising from their actions or omissions. Typical cases include unreturned or unprotected deposits, negligent repairs costing less than £1,000, unlawful deductions from deposits, breaches of tenancy agreements and minor harassment. Claims must be under £10,000, and usually relate to money rather than asking the court to force repairs.

How much can a tenant claim in small claims court?

The maximum claim for most tenant small claims UK cases is £10,000. For a personal injury or housing disrepair claim, the limit is £1,000. There is no minimum amount, but court fees start at £35, so very small claims might not be cost‑effective.

Do I need a solicitor to sue my landlord?

No. The small claims track is designed for self‑representation. CaseCraft.AI can help you prepare the claim, draft the letter before action and organise evidence. Legal costs aren’t usually recoverable, so hiring a solicitor only makes sense for complex or high‑value disputes.

What evidence do I need to win a tenant claim?

Essential evidence includes the tenancy agreement, inventory and photos, correspondence asking for repairs or return of the deposit, and receipts for costs incurred. You must show that you told the landlord about repair issues and gave them a reasonable time to fix them.