Owe a withheld bonus or unpaid commission? Learn your UK employment rights and how to claim via grievance, ACAS or tribunal.

Employers often use bonuses and commission schemes to reward performance and incentivise staff. When these payments are withheld, the effect on morale and finances can be profound. Under UK law, your entitlement depends on the wording of your contract and how your employer administers the scheme. This guide explains how to assess your rights, resolve disputes and, where necessary, claim bonus UK through an employment tribunal or the small claims court limit (see our detailed guide). It reflects UK legislation and advice services as of September 2025 and is written in British English for a UK audience.

1. Understand Your Rights Under UK Employment Law

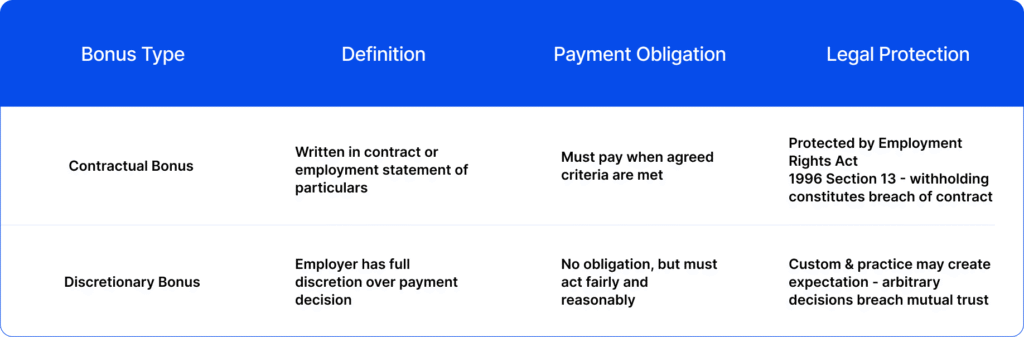

Bonuses and commissions are not treated uniformly by law. To decide whether you have a legal right to payment, start by identifying whether the bonus is contractual or discretionary.

- Contractual (guaranteed) bonus – A contractual bonus is set out in writing (for example, in the contract or written statement of employment particulars). Employers must pay it when the agreed criteria are met. Withholding a contractual bonus may amount to breach of contract or an unlawful deduction from wages. Section 13 of the Employment Rights Act 1996 gives workers the right not to suffer unauthorised deductions. Employers may only deduct from wages if a statutory provision or the contract authorises the deduction, or if the worker has consented in writing. If your bonus forms part of your wages, failing to pay it could be treated as a deduction.

- Discretionary bonus – Employers can decide whether to pay a discretionary bonus, but they must act fairly and reasonably. Even where a scheme is labelled discretionary, custom and practice (for example, regular year‑end payments) may give rise to an expectation. If the employer’s discretion is exercised arbitrarily or in bad faith, a breach of the implied term of mutual trust and confidence or indirect discrimination may arise. You should seek legal action in such cases.

The distinction between a bonus and commission is often blurred. Commission usually involves payment of a percentage of sales, whereas a bonus rewards wider performance. Both can be contractual or discretionary. Under UK law, you can claim commission for an unpaid bonus if the terms are contractual or if the employer exercises discretion unfairly, including where an employer dispute or a workplace dispute has arisen over entitlement or calculation.

2. Check Your Employment Contract and Bonus Scheme Terms

Read your employment contract, staff handbook and any bonus policy carefully. Look for:

- Nature of the bonus – Is it described as “guaranteed”, “contractual”, “performance‑related” or “discretionary”? Contractual schemes must specify the criteria and are binding. Discretionary schemes should still include clear performance measures. If the wording is unclear, a court may interpret the scheme as contractual.

- Eligibility and conditions – Note any targets, KPIs or sales thresholds you must meet. Check whether you need to be employed on a certain date (for example, at the end of the financial year) to receive the payment and whether leaving employment forfeits the right to a bonus.

- Payment schedule – Your contract may specify when bonuses or commission are calculated and paid. If the employer changes or cancels a contractual scheme without consent, they must follow the process for changing employment contracts.

- Clawback clauses – Some schemes allow employers to reclaim bonuses under certain circumstances (e.g., misconduct). These clauses must be clear and reasonable.

If you cannot determine whether the bonus is contractual, consider whether custom and practice apply. Regular payment of a discretionary bonus over several years may establish an implied contractual right. Seek specialist advice if needed.

3. Raise the Issue Informally with Your Employer

Resolving disputes amicably is faster and cheaper than litigation. If your bonus or commission hasn’t been paid:

- Gather evidence – Collect your payslips, contract, bonus scheme documents, emails or performance reviews to show that the payment was due. Evidence such as communications about targets, confirmation of results and calculations of commission is essential for any claim.

- Ask for an explanation – The government’s guidance on performance‑related pay encourages employees to ask their employer to explain in writing how they calculated the pay. A genuine mistake can often be corrected quickly.

- Meet your manager or HR – Arrange an informal meeting with your line manager or HR department. Politely explain why you believe the bonus or commission is due and present your evidence. Keep notes of the meeting and follow up with a written summary; ACAS advises confirming in writing what was discussed.

- Consider mediation – If the dispute cannot be resolved internally, a neutral mediator can help. Many employers offer internal mediation, or you can use a service accredited by the Civil Mediation Council.

Addressing the issue informally shows that you have attempted to resolve the problem, which tribunals often expect.

4. Submit a Formal Grievance

If informal discussions fail, you can lodge a formal grievance. Employers must have a grievance procedure. Follow it carefully; failure to do so may reduce any compensation awarded by a tribunal.

ACAS provides a template grievance letter. It should:

- Be addressed to your employer, HR manager or line manager.

- Describe the issue clearly: for example, “I am raising a grievance because the [2025] annual bonus specified in my contract has not been paid.”

- Provide evidence (e.g., contract clauses, performance results and communications).

- State what outcome you seek (e.g., immediate payment plus interest).

- Request a meeting to discuss the grievance and specify a companion if you wish.

Your employer should invite you to a meeting and give you a written decision. If you disagree with the outcome, you can appeal internally. Keep copies of all correspondence.

5. Escalate the Complaint to ACAS

Before you can bring an employment tribunal claim, in most cases, you must notify ACAS and undertake Early Conciliation. This government‑funded service aims to help employees and employers reach a legally binding agreement without court proceedings.

Important points:

- Try informal steps first – Early conciliation should not be your first option. ACAS encourages employees to raise issues informally or through grievance procedures before involving them; drafting a clear complaint letter can help frame the discussion.

- Deadlines – You must start early conciliation within three months minus one day from the date of the incident you are complaining about (six months for statutory redundancy or equal pay claims). Missing the deadline may forfeit your right to a tribunal claim.

- How it works – Complete the online ACAS form to notify them of your intention to make a claim. An ACAS conciliator will contact both parties to explore a settlement. Early conciliation lasts up to six weeks, although it can end sooner if an agreement is reached or either party declines to participate. During this period, the time limit for making a tribunal claim pauses and then extends by at least one month. Include your evidence and refer to your complaint letter to keep your position consistent.

- Outcomes – If a settlement is reached, it will be recorded in a COT3 agreement (a binding contract). If no settlement is reached, ACAS issues an early conciliation certificate. You need this certificate number to lodge a tribunal claim.

ACAS is impartial and cannot offer legal advice or represent you. You may still wish to consult a solicitor or Citizens Advice to discuss strategy.

6. Take the Case to an Employment Tribunal

If conciliation fails, you can file a claim with the Employment Tribunal. Key considerations include:

- Time limits – The tribunal must receive your claim within three months of the event (or termination of employment). Starting early conciliation pauses this deadline as explained above.

- Jurisdiction and value – Employment tribunals can hear claims for unlawful deduction of wages, breach of contract (if the employment has ended) and discrimination. For bonus disputes, the tribunal can award compensation up to £25,000. Claims above that value need to be made in the County Court or High Court.

- How to file – You can submit your claim online using the HM Courts & Tribunals Service’s portal or by post. Provide details of the claim, evidence and the ACAS certificate number. Court fees apply; fee remission is available for low‑income claimants.

- Process – After filing, the respondent has 28 days to reply. The tribunal may order a preliminary hearing. Many cases settle before the full hearing. If your claim succeeds, the tribunal can order your employer to pay the unpaid bonus or commission plus interest, and possibly compensate you for financial losses.

Employment tribunal procedures can be complex. It’s wise to consult a solicitor or representative, especially for high‑value claims.

7. Alternative Legal Routes: Small Claims Court

If your withheld bonus or unpaid commission is a fixed, contractually-owed sum and the employment has ended, the County Court small claims track can be a clean, fast route to recover what you’re due. In England and Wales, the small claims track generally handles claims up to £10,000; claims from £10,000–£25,000 usually go to the fast track; higher-value claims use the multi-track or Money Claim Online service. Small claims can cover unpaid wages or bonuses, and, crucially, contract claims in the civil courts carry a six-year limitation from when the money fell due, offering protection.

CaseCraft.AI is built for precisely this lane. You can start, prepare and file a small claim on the platform, upload evidence, track deadlines and keep your costs predictable. Pricing is simple: £15 processing fee + 10% success fee (only if you win). Before you file, make these steps count:

- Send a statutory demand: giving your former employer 21 days to pay, clear, dated, and with the sum and basis set out. This is a firm nudge and shows the court resolution.

- Weigh the economics: court fees scale with the claim; consider enforceability, if the employer looks insolvent or asset-light, recovery may be poor even with a judgment.

- Assemble evidence: pin down the exact figure, contract/bonus plan, emails confirming entitlement, sales reports/KPIs, payslips, and your calculation schedule. You can issue online or use Form N1 if filing on paper.

Unsure whether your case sits on the small claims track? CaseCraft.ai guides you through eligibility and filing, keeps all documents court-compliant, and lets you monitor progress end-to-end, which is useful when you want a focused, low-friction path to a withheld bonus or unpaid commission recovery. For the limit itself, see our internal guide: What is the Small Claims Court Limit?

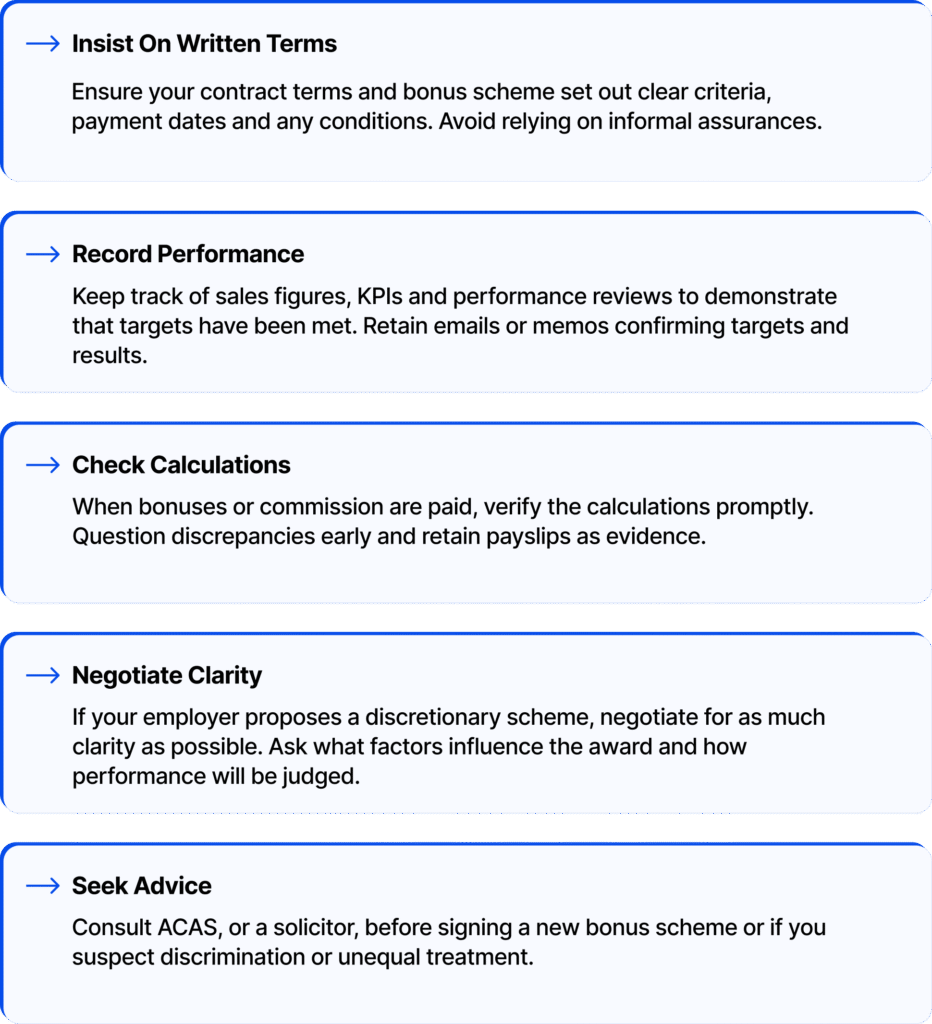

8. Prevent Future Disputes about Bonuses or Commission

To reduce the risk of bonus or commission disputes:

Common Disputes Around Bonuses and Commission

Bonus and commission disputes arise in various situations. Being aware of common issues helps employees and employers design fair schemes:

Disputed Performance Criteria and KPIs

Employees may argue that targets were unrealistic or manipulated, while employers contend that the criteria weren’t met. Clear, measurable targets and transparent calculations reduce misunderstandings.

Withholding Bonuses on Termination

Some employers refuse to pay bonuses if the employee has resigned or been dismissed. Whether this is lawful depends on the contract terms. Clauses requiring you to be “in employment on payment date” are common but may be unenforceable if they amount to a penalty or restrict your right to wages already earned.

Discretionary Bonuses and Unfair Exercise of Discretion

Even in discretionary schemes, employers must not act irrationally or capriciously. Failing to pay a discretionary bonus for discriminatory reasons (e.g., because of gender or pregnancy) may give rise to discrimination claims.

Disputes Over Commission Calculations

Commission disputes often stem from incorrect sales data, cancelled contracts or clawback clauses. Employers should provide transparent statements of how commission is calculated and allow employees to verify the figures.

Delayed Payments and Unpaid Wages

Delays in paying bonuses or commission can amount to an unlawful deduction from wages under the Employment Rights Act 1996. Employees should challenge delays promptly and, if necessary, bring a claim.

Note: This article provides general information and does not constitute legal advice. For tailored guidance, consult Citizens Advice, ACAS or a qualified solicitor.

FAQ: Claim Bonus or Commission You’re Owed in the UK

What counts as a withheld bonus under UK law?

A withheld bonus is any payment you were contractually entitled to that your employer fails to pay. Contractual bonuses form part of your wages; withholding them without contractual authority may be an unlawful deduction. Discretionary bonuses can also give rise to a claim if the employer exercises discretion unfairly, particularly where an employer dispute exists over entitlement or calculation.

Can I claim for unpaid commission through an employment tribunal?

Yes. Commission forms part of wages when the contract terms specify how it is calculated. Non‑payment can be an unlawful deduction. You must notify ACAS and, if conciliation fails, file your claim within three months of the date payment should have been made.

How do I raise a grievance about a withheld bonus?

Use your employer’s grievance procedure and ACAS’s template. State the details, provide evidence and explain the remedy you seek. If unresolved, you can progress to ACAS Early Conciliation and potentially the employment tribunal.

Is there a time limit for claiming unpaid bonuses or commission?

For employment tribunal claims, you generally have three months less one day from the non‑payment to start early conciliation. Civil court claims (small claims or county court) have a six‑year limitation period.

When should I use the small claims court instead of an employment tribunal?

If you have left your job and your claim is simply for a fixed sum owed under the contract, the small claims court may be appropriate. It handles claims up to £10,000. For ongoing employment relationships or claims involving discrimination or unfair dismissal, the employment tribunal is usually more suitable.

Can I claim interest on unpaid bonuses or commission?

Employment tribunals can award compensation, including interest on unlawful deductions. In small claims court, the judge may order statutory interest. Include a request for interest in your claim forms.