Car tax refund UK: reclaim via DVLA after sale, SORN or write-off. Steps, timelines, refund amounts, and support from CaseCraft.ai start now.

If you sell your car, transfer it to a new keeper or declare it off-road, you may be entitled to a refund of the vehicle tax you have already paid. Car tax, officially called Vehicle Excise Duty, is collected by the Driver and Vehicle Licensing Agency (DVLA) on behalf of the Treasury. The DVLA issues refunds automatically when you tell them about a sale, transfer or Statutory Off Road Notification (SORN), but it is up to you to start the process and provide the right information.

This guide explains what car tax is, who pays it, when you can reclaim it, and how to navigate the process smoothly in 2025 with CaseCraft.AI.

What Is Car Tax and Who Needs to Pay It?

Vehicle Excise Duty (VED), commonly known as car tax, is a charge levied on most vehicles used or kept on public roads in the United Kingdom. The amount you pay is based on factors such as the vehicle’s age, emissions and list price. Unlike council road tolls, VED revenues go into general government funds and help finance transport and other public services. Every vehicle keeper must tax their car whenever they become the registered owner; this applies whether you buy a new or used vehicle, inherit one or import a vehicle.

The Role of DVLA in Vehicle Tax

The Driver and Vehicle Licensing Agency is the government body responsible for administering VED. The DVLA maintains a central database of registered vehicles and owners; it collects payments, issues tax reminders and enforces penalties for untaxed vehicles. When you cancel your vehicle tax because the car has been sold, taken off the road or scrapped, the DVLA processes a DVLA car tax refund, it cancels any Direct Debit, and calculates how much tax you are owed. The agency then issues a refund cheque to the name and address listed on the vehicle’s log book (V5C). Contacting the DVLA promptly is essential because they calculate refunds from the date they receive your notification, not from the date you sold or stopped using the vehicle.

Vehicles that Are Exempt from Car Tax

Some vehicles are exempt from paying VED. Vehicles used by disabled people, disabled passenger vehicles and certain mobility scooters do not pay tax. Historic vehicles built before 1 January 1985 and steam‑powered vehicles also enjoy exemptions. Agricultural and horticultural machines such as tractors, light agricultural vehicles, and limited‑use vehicles used for short journeys between plots are exempt too. Electric vehicles powered by external electricity or hydrogen fuel cells were previously exempt, but from 1 April 2025, owners of electric cars, vans, motorcycles and tricycles must start paying vehicle tax; only heavy goods vehicles weighing over 3,500 kg remain exempt. Hybrids still pay tax under the normal rates. If your exemption ends or circumstances change, check whether you qualify for a car tax refund in the UK and notify DVLA promptly. Even if a vehicle is exempt, the keeper still has to register it as taxed or declare it off-road (SORN) so the DVLA knows the vehicle exists.

When Can You Reclaim Car Tax?

You can reclaim vehicle tax when you no longer need to pay VED for a vehicle you own. There are specific scenarios in which refunds are allowed, and each situation requires notifying the DVLA. Acting quickly matters because the agency will only refund full months of unused tax from the date it receives your information, not from the date the event occurred. Below are the most common situations where a refund applies.

Selling or Transferring Your Car

When you sell a vehicle, your liability for VED ends immediately. However, the DVLA does not automatically know you have sold it; you must inform the agency through the “Tell DVLA you’ve sold your vehicle” service. Provide the vehicle’s registration number, the 11‑digit reference from your V5C log book and the date of sale. Once the DVLA processes this notification, the vehicle tax is cancelled, and any refund for the full months remaining will be triggered. Remember that you cannot transfer unused tax to a new owner — they must tax the vehicle afresh.

Declaring Your Car Off-Road (SORN)

If you decide not to use your vehicle on public roads, you must declare a Statutory Off Road Notification. SORN status means the vehicle is kept in a garage or on private land and is not driven or parked on a public road. Once the DVLA processes your SORN application, your vehicle tax ends, and you will automatically receive a refund for any full months remaining. Applying for SORN can be done online, by phone or by post; you will need the registration number and the 11‑digit V5C reference.

Vehicle Written Off or Scrapped

If your car is written off in an accident or dismantled at an authorised treatment facility, you are entitled to reclaim unused tax. In most cases, your insurer will handle notifying the DVLA when a write‑off occurs, but it is wise to check and ensure the paperwork has been sent. For scrapped vehicles, complete the relevant section of your V5C log book and send it to the DVLA. Once processed, a refund for any full months left on the tax will be issued.

Change in Tax Class

If you become eligible for a disability exemption or another lower tax class, you must tell the DVLA so they can amend your records. The agency will cancel your existing vehicle tax and refund the unused portion once the change is processed. Make sure you provide proof of eligibility (such as a Blue Badge) with your application. Refunds are calculated in whole months, so prompt notification ensures you do not lose entitlement.

Vehicle Stolen or Exported

If your car is stolen, report the theft to the police and then notify the DVLA by post with the crime reference number. For vehicles exported out of the UK permanently, complete the relevant section of the V5C and send it to the DVLA in Swansea. In both cases, the DVLA will cancel car tax and issue a refund of any full months left.

How to Reclaim Car Tax: Step‑by‑Step Process

Reclaiming car tax is straightforward if you follow the correct steps. Use the process below to make sure your refund is calculated correctly and arrives without delay.

Step 1 – Notify DVLA of Sale, Transfer or SORN

The first step is to tell the DVLA why you are cancelling your vehicle tax. You can do this online, by phone or by post, depending on your circumstances. For sales or transfers, use the DVLA’s online “sell a vehicle” service; for SORN declarations, use the SORN service; and for write‑offs, exports or stolen vehicles, complete the relevant section of your V5C and post it. Have the vehicle registration number, 11‑digit V5C reference and the date of sale or SORN ready. Notifying the DVLA promptly is essential because refunds are calculated from the date they receive your notice.

Step 2 – DVLA Cancels the Tax From the Date of Notification

Once the DVLA receives your notification, they cancel the vehicle tax and any associated Direct Debit. The cancellation takes effect from the date the DVLA receives the information, not the date you sold or stopped using the vehicle. Because refunds are based on full unused months, even a short delay could cost you an entire month of tax. Keep a record of when you notified the DVLA and any correspondence you receive.

Step 3 – Refund Sent Automatically by Cheque

After cancelling the tax, the DVLA automatically calculates the refund and issues a cheque to the registered keeper’s address. If you pay by Direct Debit, payments stop immediately, and there is no need to cancel them separately. Most refunds are processed within six to eight weeks, although online notifications are often faster. If you have not received a cheque after eight weeks, contact the DVLA to check on its status.

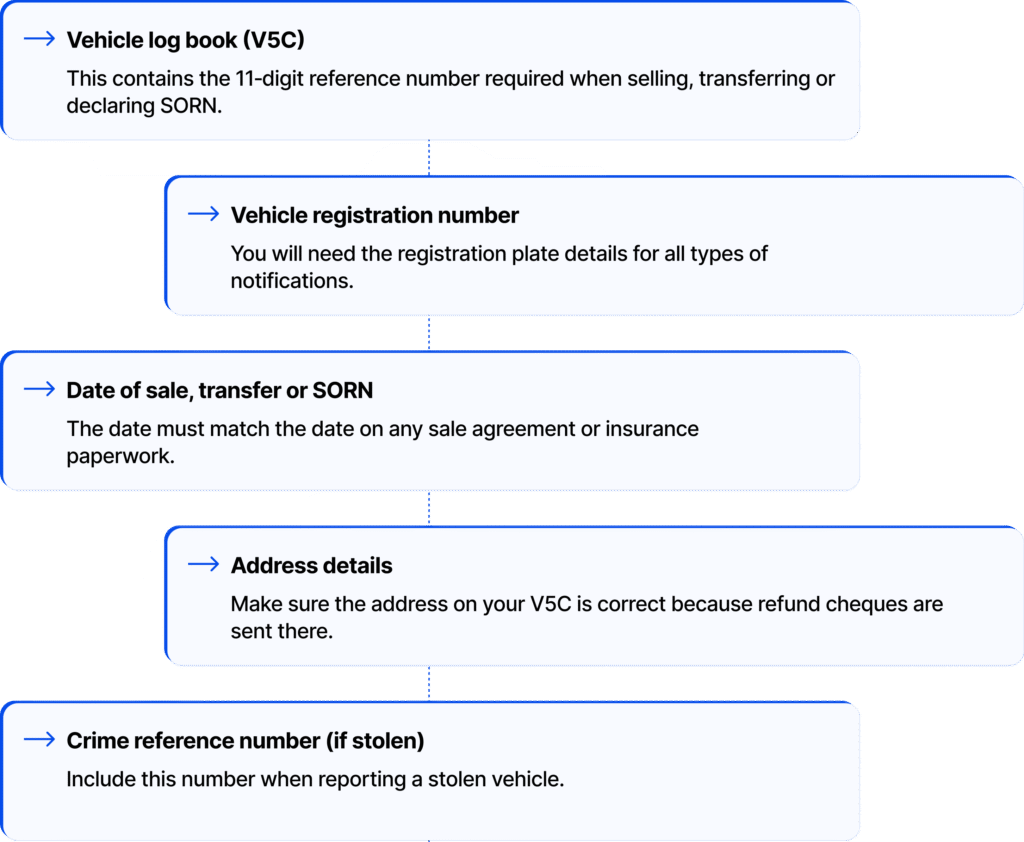

Documents and Details Required

When notifying the DVLA, gather the following information to avoid delays:

How Long Does a Car Tax Refund Take?

Average DVLA Processing Time

Car tax refunds are not instantaneous. The DVLA advises that most refunds arrive within six to eight weeks after they receive your notification. Online applications are usually processed faster than postal ones, sometimes within three to five working days. Postal applications take longer because staff must manually update records and dispatch cheques. You can track the progress of your notification through your confirmation email or by contacting the DVLA.

What to Do If Your Refund Is Delayed

If more than eight weeks have passed and you have not received your refund, contact the DVLA’s refund section. Provide your vehicle registration number, the date you notified them and the address on your V5C. The agency will check whether the cheque has been issued and, if necessary, send a replacement. If your cheque arrives in the wrong name, return it and tell the DVLA the correct name so they can issue a replacement.

How Much Car Tax Can You Reclaim?

Monthly Calculation of Unused Tax

The DVLA calculates refunds based on full months of unused tax from the date it receives your notification. Partial months are never refunded; if you sell your car on the second day of the month but only tell the DVLA later, you lose that month’s tax. Likewise, if you declare SORN in the final week of a month, the refund will start from the first day of the following month. Your DVLA refund cheque will reflect only those whole months, so understanding this rule helps maximise your refund.

Example Refunds by Month Remaining

Consider a car taxed at £195 per year (the standard annual rate for many petrol or diesel cars registered after 2017). The DVLA charges £195 for a 12‑month payment, which works out at £16.25 per month. The table below shows how much you might get back, depending on how many full months of tax remain on your vehicle.

These values are examples to illustrate how the calculation works. Your actual refund will depend on the tax band for your vehicle and the number of whole months left when the DVLA processes your notification. Higher‑emission vehicles pay more per year, so each refunded month is worth more; low‑emission vehicles pay less, so refunds are smaller.

Common Mistakes to Avoid When Reclaiming Car Tax

Successfully reclaiming car tax is mostly about timing and accuracy. Avoid these common errors to make sure you receive the refund you deserve:

- Failing to notify the DVLA promptly: The biggest mistake is waiting until weeks after selling or scrapping your vehicle. The DVLA counts refunds from the date they receive your notification, not the date of the event.

- Providing incorrect or outdated address details: Refund cheques are sent to the address on your V5C. If you have moved, update your log book before cancelling your tax.

- Assuming partial months are refundable: The DVLA only refunds whole unused months. Cancel early in the month to maximise your refund.

- Not cancelling your Direct Debit: While the DVLA automatically stops Direct Debit payments when they cancel car tax, it’s prudent to check your bank statements to ensure payments have stopped.

- Ignoring delays: If eight weeks pass without receiving your cheque, contact the DVLA’s refund section to avoid lost payments.

- Misunderstanding exemptions: Electric vehicles become liable for VED from 1 April 2025; don’t assume you are exempt unless your vehicle falls under one of the specific categories.

Car Tax Refund UK: Next Steps with CaseCraft.AI

Reclaiming car tax in the UK is a matter of understanding the rules, acting quickly and providing accurate information. When you sell, scrap or SORN your vehicle, notify the DVLA immediately so that refunds are calculated from the correct date. Remember that refunds only cover whole months and are issued by cheque to the address on your log book. If you do not receive your refund within eight weeks, contact the DVLA to chase it up.

Even though reclaiming car tax is usually straightforward, there are times when refunds are delayed or refused. In those cases, the small claims court can provide a legal remedy. The small claims track generally covers claims valued up to £10,000, making it a suitable route for disputes with the DVLA. CaseCraft.AI’s platform is built to guide you through the small claims process with confidence. It helps you gather evidence, complete court forms, and manage deadlines without expensive legal fees. Whether you’re reclaiming a refund that hasn’t arrived or pursuing other small claims, our AI‑powered tools make the process transparent and user‑friendly.

Ready to reclaim what you’re owed? Start your small claim with CaseCraft.AI today and take control of the process. Our secure, intuitive platform helps you prepare, file and track your claim, so you can focus on getting back the money you deserve.

FAQ About Car Tax Refunds

How do I reclaim car tax in the UK?

To reclaim vehicle tax, tell the DVLA why you are cancelling your vehicle tax by using the appropriate online service or sending the relevant section of your V5C by post. Have your registration number, 11-digit V5C reference and date of sale or SORN ready. Once processed, the DVLA cancels the tax and sends you a refund cheque for any full months remaining. If you declare your vehicle off the road, this is known as a SORN refund, and it is calculated from the date DVLA receives your notification.

How long does a DVLA car tax refund take?

Most refunds arrive within six to eight weeks after the DVLA receives your notification. Online applications are often processed faster than postal applications. If you have not received your cheque after eight weeks, contact the DVLA to investigate.

Do I get a refund if I sell my car?

Yes. When you sell or transfer ownership, inform the DVLA immediately. The DVLA will cancel the tax and refund any full months remaining. Remember that tax cannot be transferred to the new owner, so prompt notification is the only way to recover unused months.

Can I get a car tax refund if my car is written off?

Yes. If your car is written off or scrapped, you can reclaim unused tax. In most cases, your insurer notifies the DVLA, but confirm that the V5C has been sent. When the DVLA processes the write‑off, the tax is cancelled and a refund cheque is issued for any full months remaining.