Learn your rights on misleading advertising in the UK. Report false adverts, gather evidence, and claim compensation via small claims.

Consumer law in the United Kingdom tries to prevent businesses from wooing customers with half‑truths or deliberately burying important information. In practice, however, false advertising in the UK still happens. A recent overhaul of the advertising rules through the Digital Markets, Competition and Consumers Act 2024 (DMCC Act) means that UK traders face stiffer penalties for misleading claims and “drip pricing” (failing to show mandatory fees up front). Yet consumers still need to know how to recognise misleading adverts, document their losses and pursue compensation through small claims courts. This guide draws on official sources and the CaseCraft.ai platform to explain when marketing crosses the line, what your rights are and how to bring a claim against a trader.

What Counts as Misleading Advertising Under UK Law

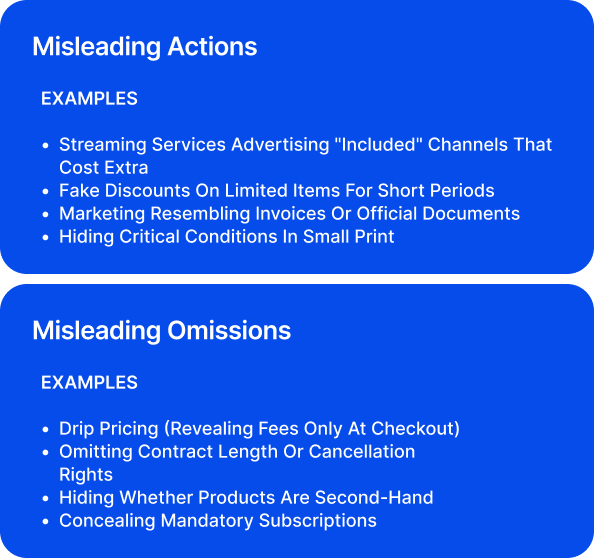

Under the Consumer Protection from Unfair Trading Regulations 2008 (CPRs) (now replaced by Part 4 of the DMCC Act), a business commits a prohibited “unfair commercial practice” if it misleads consumers or hides information that might affect their purchasing decision. The updated legislation keeps the core definitions, splitting misconduct into misleading actions and misleading omissions:

- Misleading actions occur when a trader provides false or misleading information (for example, exaggerating the benefits of a product without evidence), uses deceptive services (such as hiding critical conditions in small print), creates confusion with a competitor’s products or fails to follow a code of conduct to which it claims to adhere. Examples in the DMCC guidance include a streaming service advertising that certain channels are included in a “premium” package when they actually cost extra, or a retailer promoting “discounts” that only apply to a handful of items for a short time. Marketing that resembles invoices or uses an official‑looking logo can also mislead.

- Misleading omissions happen when traders omit material information or conceal mandatory charges. Material information is anything an average consumer needs to make an informed decision, such as the full price, contract length, cancellation rights or whether a product is second‑hand. Drip‑pricing, where a trader quotes a low headline price and only reveals compulsory fees at the checkout, is a typical example. The rules also prohibit omitting information required by law, such as statutory cancellation rights or the existence of hidden subscriptions.

The Advertising Standards Authority (ASA) enforces the non‑broadcast advertising code and receives thousands of complaints each year. In 2024‑25, the ASA reported that around 70% of complaints concern misleading advertising. Section 3 of the CAP Code, now updated to align with the DMCC Act, states that marketing communications must not materially mislead and that businesses must provide substantiation for objective claims. The ASA tests whether a misleading advert could cause an “average consumer” to take a different decision and will consider the overall impression, any images used and whether material information is omitted. Ads showing unrealistic results (for example, claiming eye drops change the colour of your eyes) and fabricated five‑star ratings have been banned.

Your Rights as a Consumer

Statutory Protections

The Consumer Rights Act 2015 requires traders to deliver services with reasonable care and skill. Spoken or written descriptions are binding; if a service fails to meet what was promised, the consumer can ask the trader to redo the work or offer a price reduction up to 100%. If a price or completion date is not agreed upon, the law implies that it must be reasonable. For online or distance‑selling contracts, the Consumer Contracts Regulations 2013 give a 14‑day cooling‑off period for services unless the consumer has asked for immediate performance, and require traders to provide key information (description, total price, extra charges, cancellation rights and trader details) before a sale. If a trader fails to provide that information, cancellation rights may extend up to 12 months.

Redress Under the DMCC Act

If a trader’s misleading action or omission causes you to enter a contract or to pay more than you would otherwise, you may have the right to “unwind” the contract within 90 days and get a full refund. The Business Companion guide explains that a consumer complaint in the UK can be unwound within 90 days of a prohibited practice, returning goods or rejecting services for a refund. If unwinding is impractical (for example, you have consumed the service), you can claim a discount proportionate to the loss; for contracts below £5,000, the law specifies fixed reductions (25% to 100%), and for higher values, the discount is negotiated. You can also claim damages for distress or inconvenience caused by the unfair practice. To qualify, you must have entered into a contract with the trader, the trader must have engaged in a prohibited practice (misleading or aggressive), and the practice must have been significant to your decision.

Refunds and Partial Refunds for Misleading Sales

According to Citizens Advice, if you are misled or pressured into buying something, you can demand a full refund within 90 days. After 90 days, you may still get a partial refund if the service was partly used. Examples of misleading behaviour include providing wrong information about prices or discounts, failing to highlight hidden fees or telling consumers they must decide quickly even though stock is plentiful. Consumers should write to the seller explaining the misleading conduct, ask for a refund or compensation claim and keep evidence.

Collecting Evidence of Misleading Advertising

Proving that advertising misled you is essential if you want to recover your money. Courts and regulators expect contemporaneous evidence rather than recollections. Start building your case as soon as you suspect an advert is deceptive.

Take screenshots of web pages or social media posts showing the misleading claim or omission. Save brochures, flyers or email promotions that contain the false information. Keep copies of receipts, order confirmations and the terms and conditions you relied on, and highlight any unfair contract terms. Keep a record of any communications with the trader (emails, live chats, letters), and if you had telephone calls, write down the date, time and the name of the person you spoke to.

If the misleading advert resulted in financial loss, such as paying more for a subscription or buying a product that was misrepresented, gather proof of payment and any evidence of the actual loss (for example, bank statements or repair invoices). Courts may also accept witness statements or reviews from others who were misled by the same ad; the CMA guidance emphasises that systemic issues can trigger enforcement action.

Raise the Issue Directly with the Business

UK courts expect parties to try to resolve disputes before starting proceedings. Sending a formal complaint to the trader can often lead to a refund without litigation. Citizens Advice recommends writing a letter before a claim that sets out your name and address, summarises what happened, states how much money you want and by when you expect a response. Include copies of your evidence, explain how the advertising misled you, and quote relevant legislation (CPRs/DMCC Act, Consumer Rights Act). Set a deadline, usually 14 days, for the trader to reply. Mention that you are willing to try alternative dispute resolution, such as mediation, and warn that you will pursue court action if they do not resolve the complaint. Keep proof of postage or email delivery.

Many businesses will resolve complaints at this stage to avoid negative publicity or regulatory scrutiny. If the trader acknowledges the problem, record the offer and confirm any agreement in writing. If they dispute your claim, ask them to explain which facts they disagree with and why. You can then prepare to involve regulators or the courts.

Escalate the Complaint to Regulators

If the trader refuses to engage or the misleading practice seems widespread, you can involve external bodies.

Advertising Standards Authority (ASA)

The ASA complaint regulates non‑broadcast advertising in the UK. It checks every complaint received and investigates ads that may breach the CAP Code. You can complain to the ASA if you are a member of the public, a competitor or part of a group with an obvious interest. Use the ASA’s online form or call its helpline to lodge your complaint. Complaints should be limited to three issues, and you must provide details of where you saw the advert and what you believe is misleading. The ASA may ask for screenshots or recordings; it cannot accept complaints via general email. After assessment, the ASA will inform you if the case will be formally investigated and may refer non‑compliant advertisers to Trading Standards.

Competition and Markets Authority (CMA)

The CMA complaint has new powers under the DMCC Act to fine businesses directly for breaches of consumer law. It’s helpful for consumers, guidance explains that you should report problems to the CMA only if they affect more than one person or indicate systemic misconduct. The CMA uses reports to identify trends and launch investigations, but it cannot provide advice on individual disputes. When reporting, include a description of the unfair practice, supporting evidence, misleading advert, and details of other affected consumers. For personal advice, the CMA directs individuals to Citizens Advice.

Citizens Advice and Local Trading Standards

If you need guidance tailored to your situation, contact Citizens Advice. Its advisers can explain your rights, help draft complaint letters and refer cases to Trading Standards for enforcement. Local Trading Standards departments have powers to investigate unfair trading, prosecute offenders and seek court orders to stop misleading adverts. Providing them with comprehensive evidence increases the chance of action.

Claim Compensation Through Legal Routes

If the trader rejects your complaint and regulatory intervention does not resolve the issue, you can take legal action and claim compensation for misleading advertising through the courts. In many cases involving misleading advertising, claims fall within the small claims track of the county court. This is designed for simple disputes with a value up to £10,000. If your claim relates to a landlord’s failure to repair, the maximum you can recover in the small claims court is £1,000. Claims above £10,000 go to the fast track or multi‑track, which involve more complex procedures and potentially higher costs. To remain within the small claims limit, you should specify that you expect to recover no more than £10,000 in your claim form.

Pre‑action Requirements and Mediation

Before filing, you must follow the court’s pre‑action protocol by sending a letter before claim and allowing time for a response. In May 2024, compulsory mediation was introduced for many small claims under £10,000. Parties are automatically referred to a free, one‑hour mediation session through the Small Claims Mediation Service and are expected to attempt settlement. Although you are not required to reach an agreement, mediation can resolve disputes quickly and avoid hearing fees. If mediation fails, the case proceeds to a hearing or a paper‑based decision.

Filing Your Claim

You can start a small claim by completing a Civil Money Claims online form if you know the exact amount sought. The online system calculates court fees based on the claim value (for example, claims up to £300 cost £35; claims of £10,000–£200,000 cost 5% of the claim value). If you use the paper N1 form, attach copies of evidence and send them to the Civil National Business Centre. When completing the form, include a brief statement of the facts, specify the amount claimed and interest (8% per year under the County Courts Act 1984 if appropriate). Keep copies of all documents.

Timelines and Responses

After filing, the defendant has 14 days to reply or 28 days if they file an acknowledgement of service. If the defendant fails to respond, you can request judgment by default. If they dispute the claim, both parties complete a directions questionnaire specifying availability for a hearing. The court will then allocate the case to the small claims track and set a hearing date, which is usually held at the defendant’s nearest county court.

Preparing for Court

Present your evidence clearly and concisely. Organise your screenshots, adverts, correspondence and proof of loss. Bring copies for yourself, the defendant and the judge. Courts typically discourage legal representation in small claims, as rules are informal and costs are limited. However, you can seek legal advice to prepare your case. At the hearing, explain why the advertising misled you, how it affected your decision and what remedy you seek. The judge may ask questions and will decide whether the trader breached consumer law. If you win, the court may order a refund, damages and interest. If you lose, you may have to pay the trader’s limited costs, such as travel expenses.

Preventing Future Issues with Misleading Advertising

Being a vigilant consumer helps you avoid disputes. Here are practical steps to reduce the risk of being misled:

- Check reviews and credentials. Before buying or using a service, read independent reviews and verify the company’s registration number and address. Genuine businesses usually provide contact details and membership of professional bodies. The ASA and CMA emphasise that fake reviews are now illegal, so look for patterns or identical wording that might signal manipulated feedback.

- Use official sources. Purchase tickets, subscriptions and services directly from official websites or authorised retailers. Be cautious of ads on social media that link to unfamiliar domains. Cross‑check pricing on the trader’s main site and look for hidden fees. If the headline price looks too good to be true, it often is. The DMCC Act expressly prohibits failing to disclose mandatory charges.

- Read the small print. Read terms and conditions, cancellation policies and privacy statements. If an advert promises “100% guaranteed results” or “no hidden fees”, verify whether the fine print contradicts those claims. Under the CAP Code, exaggerations without evidence and omissions of material information are unlawful.

- Pay with methods that offer protection. Using credit cards or payment services that provide chargeback rights can help recover your money if the transaction turns out to be fraudulent or misleading.

- Keep a paper trail. Document your interactions even if everything seems legitimate. Keeping records helps if you need to complain or go to court later.

Common Examples of Misleading Advertising Disputes

Misleading adverts take many forms. Understanding typical scenarios can help you recognise problems early:

CaseCraft.ai: Bringing Fairness to Small Claims

CaseCraft.ai is a specialist platform designed to make small claims simple. It combines auto‑generated legal forms, fast filing and step‑by‑step AI guidance to help you build and submit a claim without wading through legal jargon. The service generates HMCTS‑compliant claim forms and organises your evidence. Most users complete their claim within minutes because the platform’s interface guides them through the necessary steps. Once you’ve entered details of the misleading advert and uploaded your evidence,

CaseCraft.ai turns your information into a court‑ready claim and allows you to file it directly. You can track deadlines and receive reminders via a secure dashboard. CaseCraft.ai uses bank‑grade encryption and UK‑based servers to protect your data. Pricing is transparent: there’s a £15 set‑up fee and a 10% success fee only if your claim succeeds. The platform caters for both claimants and defendants, so you can also use it to craft a robust defence.

Disclaimer: This content is for general information only and is not legal advice. Always seek professional guidance for your case.

FAQ: Misleading Advertising

What is considered misleading advertising in the UK?

Misleading advertising covers both misleading actions, where a trader gives false information or creates a deceptive impression, and misleading omissions, where they hide material information, such as mandatory fees. The DMCC Act and the ASA’s CAP Code prohibit these practices.

Can I get a refund if I was misled by an advert?

Yes. Under the Consumer Rights Act and the DMCC Act, you can unwind a contract within 90 days and get a full refund if a prohibited practice induced you to buy. After 90 days, you can claim a partial refund or compensation for the difference.

Do I need a lawyer to take a misleading advertising claim to court?

Small claims procedures are designed to be used without legal representation. You can file your claim online and attend a hearing yourself. Services like CaseCraft.AI generate claim forms and guide you through the process, though you may seek advice if you feel unsure.

How much can I claim in the small claims court?

In England and Wales, small claims are typically for less than £10,000. Landlord repair claims are capped at £1,000. Claims above these limits are allocated to different court tracks and involve greater costs.