Compare fixed tariffs vs the 2025 Price Cap. See if fixing your energy bill now could save money as forecasts shift into 2026.

When your gas and electricity bills make up a big chunk of your monthly outgoings, it’s natural to ask whether you should lock into a fixed tariff or ride the regulator’s price cap. When Ofgem reviewed the price cap in July 2025, households across Great Britain finally saw a little relief. In the sections below, we’ll break down the main tariff options, from fixed deals to the price-capped standard variable tariff.

This guide is for people who pay domestic energy bills in Great Britain and want clear, up‑to‑date information about 2025. It explains how energy pricing works, what the latest price cap changes mean, how fixed deals compare, and what to do if you run into a dispute.

Use Our Tariff Comparison to Find the Top Fixes for You

Energy is sold through tariffs, each with its own unit rates, standing charges, contract length and exit fees. In 2025, the UK energy market is unusually competitive because wholesale costs have fallen from their 2022 peak, and suppliers are fighting for customers. Some fixed deals are now cheaper than the regulator’s cap, while others undercut it by discounting standing charges. The best way to find these offers is by using an impartial comparison tool that calculates costs based on your postcode and actual usage.

To get accurate quotes, you’ll need your annual consumption (in kilowatt hours), your payment method and postcode. The tool will show fixed tariffs, variable tariffs and specialist options like trackers or time‑of‑use tariffs. It’s worth checking regularly because deals can be pulled without notice, and the price cap changes every three months.

CaseCraft.AI tip: If you later believe your supplier has misbilled you or failed to honour a contracted rate, and your potential loss is under £10,000, you can use CaseCraft’s.AI‑powered platform to file a small claim. The service guides you through evidence gathering, deadlines and forms so you can focus on your case rather than paperwork.

How to Check If It’s Worth Fixing Your Energy

If You Are Not on a Fix, You Are Almost Certainly on a Price‑Capped Tariff, So That Is What You Need to Complain Against

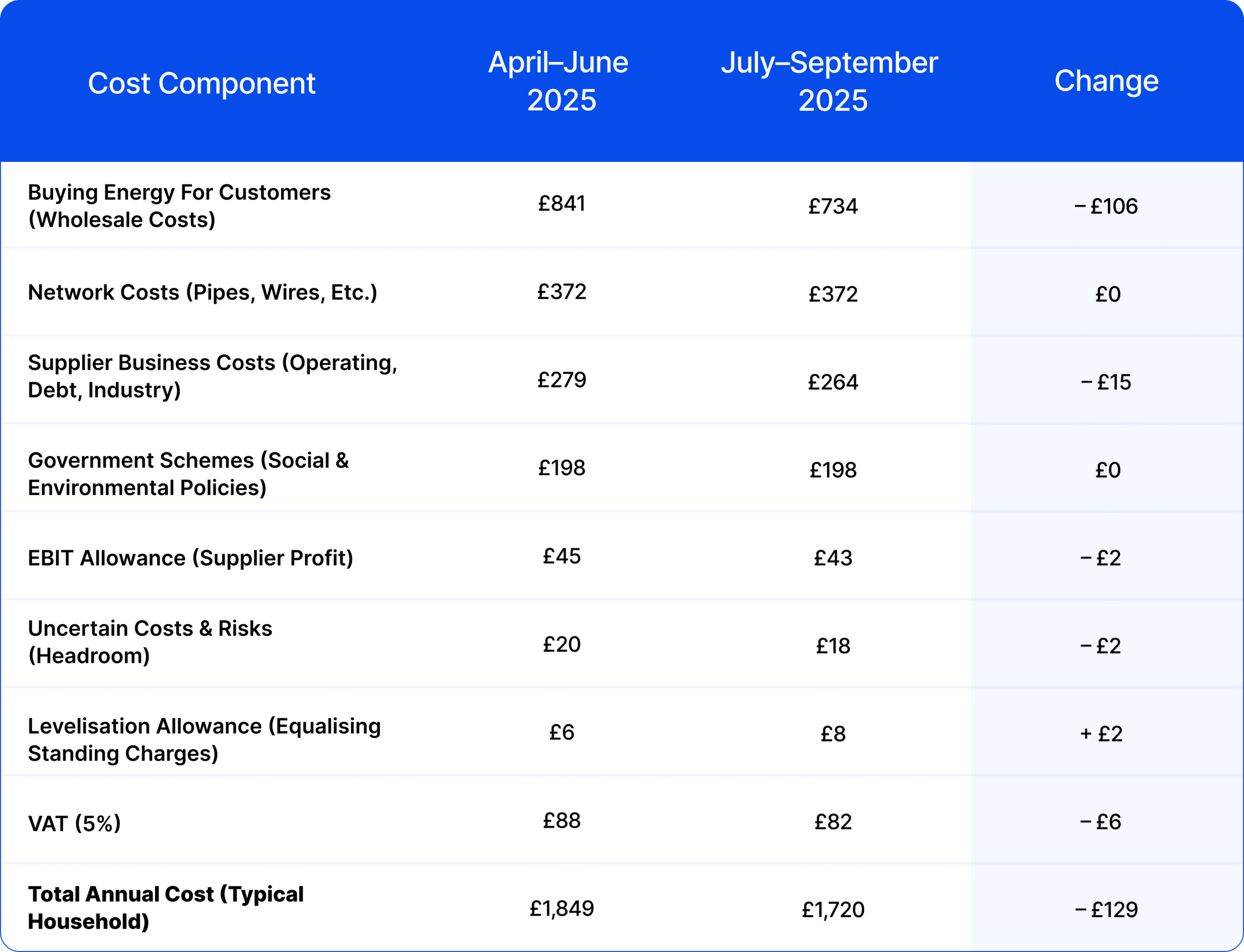

Most households are on a standard variable tariff, meaning their prices are controlled by the energy price cap. The cap is not a limit on your total bill; it restricts the maximum unit rate and standing charge suppliers can levy. A typical dual‑fuel household paying by Direct Debit saw its annual cap fall from £1,849 to £1,720 on 1 July 2025 to 30 September 2025. This 7% cut equates to roughly £11 per month and reflects a drop in wholesale costs.

Cost Breakdown for a Typical Dual-Fuel Household (Direct Debit, GB average)

Source: Ofgem, “Summary of changes to energy price cap, Cap period 14b (1 Jul–30 Sep 2025)”.

To decide whether to fix, you need to know how the cap is expected to move. Price‑cap forecasts from suppliers and independent analysts currently suggest that:

- Some forecasters expect it to rise by around 2% in the October–December quarter (to around £1,758), while others anticipate a small fall of about 1% to £1,698.

- Beyond December, the picture becomes hazier. Predictions for early 2026 range from a slight dip to £1,743 to rises above £1,820, and analyst confidence is low.

Because the cap moves every quarter, a fixed deal that looks expensive now could end up saving you money if rates rise. A rule of thumb is that if a fixed supply agreement is priced below or within about 3% of the current price‑cap rates, you’re likely to save over the next year. This assumes the published forecasts hold and there are no major shocks to wholesale markets.

Disclaimer: Always verify current energy prices and deals directly with suppliers before making any commitments. Market conditions can change rapidly, making this information potentially outdated.

Calculating Your Personal Break‑Even Point

- Check your annual consumption. It’s measured in kilowatt hours (kWh) on your latest bill. A typical household uses around 11,500 kWh of gas and 2,700 kWh of electricity a year.

- Compare the fixed tariff’s annual cost to the cap. Some 12‑month fixes currently undercut the cap by 10%–17%, while others are within a few per cent.

- Consider exit fees. Many fixed deals impose £50–£75 per fuel if you leave early. A “no‑risk” fix has no exit fees, allowing you to switch if prices fall.

- Weigh certainty versus flexibility. Fixes guarantee unit rates but not your total spend; the more energy you use, the higher your bill. Price‑capped tariffs follow the cap up and down, so you might benefit if prices fall further, but pay more if they rise.

- Assess the length. One‑year fixes offer clarity for the next 12 months. Eighteen‑month and two‑year deals are now priced similarly to one‑year fixes, but predictions beyond a year are unreliable.

Top Energy Deals

Best Standalone Energy Tariffs

The cheapest fixed offers in August 2025 are significantly below the price cap. For example, some 12‑month dual‑fuel fixes are about 17% cheaper than the cap. These deals are usually only available to dual‑fuel customers, require payment by Direct Debit and come with exit fees of around £75 per fuel.

Another 15‑month fix was roughly 12.6% cheaper. It caters to both dual‑fuel and electricity‑only households and doesn’t require a smart meter.

A 12‑month green supply agreement option was about 10.5 % cheaper, but it required a smart meter and also charged exit fees.

No‑Risk Fix

If you’re hesitant to commit, consider a no‑exit‑fee fix. This type of deal locks in rates for 12 months yet allows you to leave penalty‑free if tariffs fall. One such tariff in August 2025 was around 3.4% cheaper than the cap. It suits dual‑fuel, electricity‑only or gas‑only customers and doesn’t require a smart meter.

Cheap Electricity‑Only Fix

For households without mains gas or with electric heating, an electricity‑only fix can be attractive. A 12‑month fix in August 2025 was about 14.5% cheaper than the price cap. It required a monthly Direct Debit and had a £75 exit fee. Longer electricity‑only fixes were similarly rated but carried higher exit fees.

Fixing Is Not Your Only Choice to Save

Locking in a cheap fix is the simplest way to guarantee unit rates, but other options may suit your circumstances:

- Discounted price‑cap tariffs. Some suppliers offer variable tariffs that track the price cap but discount the unit rate or standing charge by around £50–£100 per year. You always pay less than the cap, though rates change every three months.

- Variable tariffs below the cap. A few standard variable tariffs are 3%–11% cheaper than the cap. They’re controlled by the cap, so you’re protected if rates rise, and there are no exit fees, but you benefit only while the supplier maintains the discount.

- Tracker tariffs. Rates on tracker follow wholesale prices daily or half‑hourly. These fixed deals have been cheaper than standard ones about three‑quarters of the time between January and July 2025. However, they can spike quickly when wholesale costs rise, so you must monitor your usage and be ready to switch back to a price‑capped tariff if costs climb.

- Time‑of‑use tariffs. Households with smart home technology can exploit cheaper off‑peak rates. Smart tariffs, such as half‑hourly trackers or electric‑vehicle plans, offer lower prices when demand is low, but higher rates at peak times. They work better if you can shift heavy usage to off‑peak periods, for example, charging a vehicle overnight.

Is It Worth Fixing for Longer?

Eighteen‑month and two‑year fixes became competitive in mid‑2025. They provide rate certainty beyond a year, which can be reassuring when household budgets are tight. However, no analyst predicts price‑cap rates more than about a year in advance. If you opt for a longer fix, you could pay more if wholesale prices fall or benefit if they surge. Longer deals also carry higher exit fees, so think carefully about your risk tolerance, financial cushion and whether you expect to move house.

What Are the Alternatives to Fixing?

Aside from the tariffs mentioned above, there are several non‑contractual ways to manage your energy spend:

- Stay on the price cap. About 70% of homes remain on price‑capped. Your rates change every three months and will track any fall in the cap without the need to switch suppliers.

- Switch to a discounted variable tariff. Some providers guarantee a discount off the cap for 12 months. For example, a tariff that knocks £100 off the cap for typical use (roughly 6% below) is available to smart‑meter customers, while another reduces standing charges by £50. Exit fees apply to some of these tariffs, so read the small print.

- Choose a standard variable tariff below the cap. A handful of suppliers offer standard variable tariffs around 11% cheaper than the cap. There are no exit fees, so you can switch again if prices rise.

- Consider tracker and smart tariffs if you have a flexible lifestyle or energy‑intensive appliances. As mentioned earlier, these can offer substantial savings but are volatile.

- Invest in energy efficiency. Improving insulation, upgrading to efficient appliances, installing smart thermostats and using energy at off‑peak times can reduce your consumption and lower bills.

What to Do If You Are Struggling to Pay Your Energy Bills

Soaring living costs mean many people find it hard to keep up with gas and electricity bills. If you’re in this situation:

- Contact your supplier early. Suppliers are required to help customers in financial difficulty. They may offer payment plans, rate reviews or hardship grants. For example, some major suppliers have assistance funds that provide bill credits, free electric blankets or help with standing charges.

- Check if you qualify for government support. Schemes like the Warm Home Discount, Winter Fuel Payment and Cold Weather Payment offer relief for pensioners, low‑income households and those on certain benefits. Local authorities also run household support funds and energy‑efficiency grants.

- Seek impartial advice. Charities such as Citizens Advice and National Energy Action can help you negotiate with suppliers, maximise benefits and access charitable funds.

- Improve your home’s efficiency. Small actions like turning down the thermostat by one degree, using draft excluders and switching off appliances can add up. Investments in loft insulation or double glazing may be available through government or supplier schemes.

Resolving Energy Disputes Within the Small‑Claims Limit

Energy billing disputes are among the most common consumer complaints. They may involve incorrect meter readings, failure to apply agreed discounts, or delays in refunding credit. For claims up to £10,000 or less, the current guideline limit for the small‑claims track in England and Wales, you can pursue the matter through the county court.

If you’ve been overcharged, pursue a complaint. Start by using your supplier’s complaints process. For unresolved disputes, CaseCraft.AI’s small‑claims platform can help you prepare and file a claim.

What Energy Tariff Prices Are You Being Offered?

When comparing offers, focus on more than the headline annual cost. Check the unit rate (price per kWh), the standing charge (daily fee you pay regardless of usage), the contract length, any exit fees, whether a smart meter is required and additional benefits (such as cashback or green energy). A tariff that looks cheap on paper may have high exit fees or restrictive conditions.

Remember that regional differences matter: unit rates and standing charges vary across Great Britain. A deal that’s competitive in one area may be less so elsewhere, which is why personalised quotes are essential.

Also consider your lifestyle. For example, if you have an electric vehicle or plan to install solar panels, a smart fixed deal that rewards off‑peak charging could be more cost‑effective even if its headline rate is similar to the cap. Conversely, if you use most energy during the day, a flat‑rate fix may be safer.Is it worth fixing your energy bill in 2025? Depends on your risk tolerance, what deals are available to you and your own expectations of future price changes. It is really important to know what you are agreeing to with your tariff. If it goes wrong, remember that you can take small-claims actions, and you can also use services like CaseCraft.AI to help you through the process. Above all, stay informed; the energy market is dynamic, and the right decision today may change as new data emerges.

FAQ: Should I Fix My Energy or Stay on the Price Cap?

Should I fix my energy tariff or stay on the price cap in 2025?

Fixing can save money if the deal is priced below or close to the current cap. Staying on the cap offers flexibility and tracks price cuts automatically. The right choice depends on forecasts, usage and your risk tolerance.

How do I know if a fixed deal is good value?

Compare its annual cost with the current price cap using your actual consumption. Fixes within roughly 3% of cap rates often offer good value. Consider exit fees, contract length and whether the tariff requires a smart meter.

Are tracker or time-of-use tariffs cheaper than fixed deals?

They can be, especially when wholesale prices are low. However, rates change frequently and can spike. They work best for households with smart meters and flexible usage patterns that can shift consumption to cheaper off-peak periods.

What can I do if my energy supplier overcharges or misbills me?